When making a car purchase decision, it’s tempting to upgrade to that sleek, high-end model. But before you take the plunge, consider this: what if you chose a modest car and invested the difference instead? Let’s look at how opting for a $25,000 car instead of a $50,000 one could transform your financial future, especially when we think long-term.

The $25,000 Trade-Off: Investing for the Future

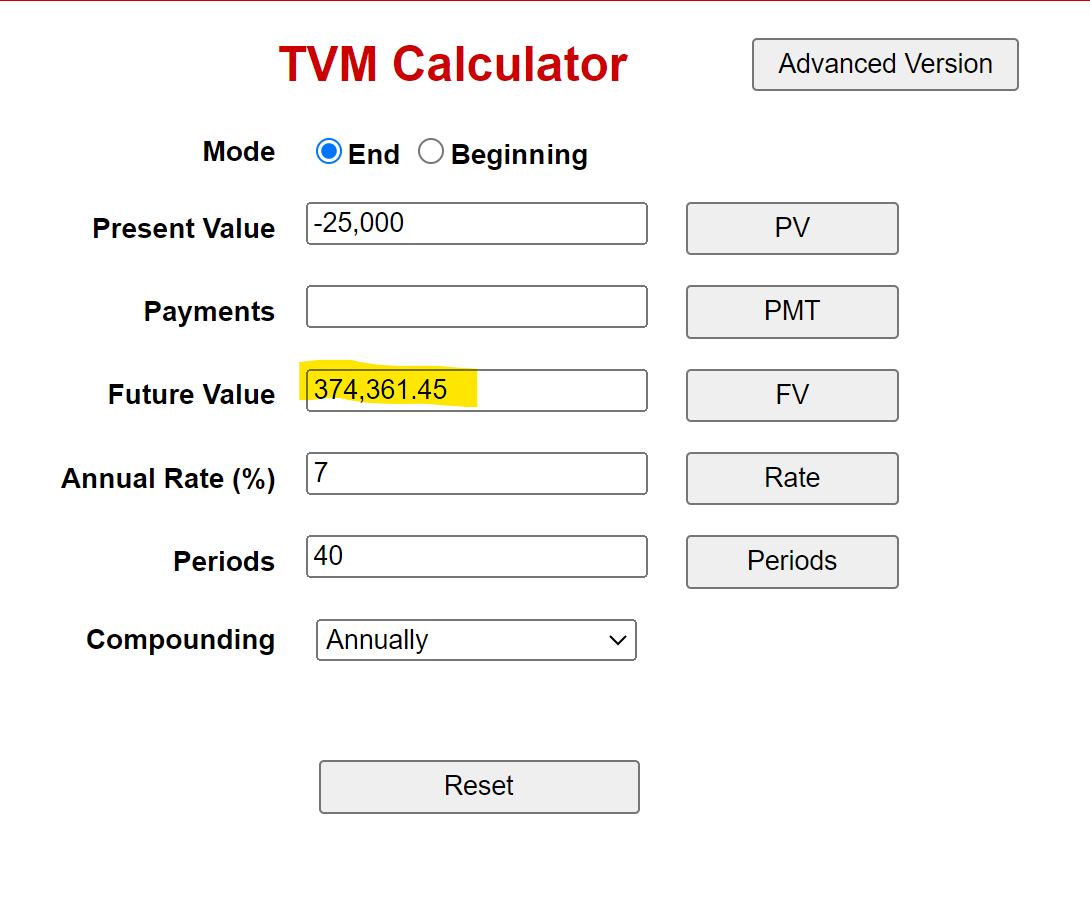

Imagine you buy a $25,000 car instead of a $50,000 one. You’ve saved $25,000 upfront. What happens if you invest this amount instead, letting it grow over 40 years in a diversified retirement portfolio with an average annual return of 7%?

By the end of 40 years, that initial $25,000 could grow to a staggering $374,361.

Breaking Down the Numbers: The Power of Compounding

- Initial Investment: $25,000

- Annual Rate of Return: 7%

- Investment Period: 40 years

Calculator reference: https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Using the power of compound interest, that $25,000 would grow steadily each year, eventually turning into $374,361.

This means the opportunity cost of choosing a $50,000 car today — just for a few years of driving pleasure — is nearly $375,000 that you could potentially use for a more secure and enjoyable retirement.

What Does an Extra $374,361 Mean in Retirement?

Let’s put that figure into perspective:

- Additional Retirement Income: With a 4% safe withdrawal rate, $374,361 could provide an additional $14,974 per year in retirement income.

- Early Retirement: If your goal is to retire early, this amount could shave off years of work.

- Legacy and Giving: The extra funds could be used to support causes you care about, set up educational funds for children or grandchildren, or simply create a financial cushion.

Don’t Forget the Hidden Costs of a High-End Car

Choosing a more expensive car doesn’t just mean a higher upfront cost. It also means:

- Higher Monthly Payments: This could add stress to your cash flow and reduce your ability to invest.

- Greater Depreciation: Luxury cars often depreciate faster, leading to a bigger financial loss.

- Costlier Insurance and Maintenance: These recurring expenses could add thousands of dollars over the life of the car.

The Bottom Line: Drive a Car or Drive Your Financial Future?

It’s not about depriving yourself of enjoying life, but about aligning your financial decisions with your long-term goals. Is the satisfaction of driving a high-end car today worth the potential $374,361 you’re giving up in the future?

Next time you’re in the dealership, think beyond the leather seats and premium features. Ask yourself, “Am I investing in my lifestyle, or in my future?” Because while a high-end car may turn heads now, a strong retirement portfolio will pay dividends for decades to come.

So, would you rather drive a luxury car today or enjoy an extra six-figure cushion in your retirement portfolio tomorrow? The choice is yours.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.