Saving for retirement is essential, and Individual Retirement Accounts (IRAs) provide an excellent opportunity to grow your wealth while enjoying tax benefits. Whether you’re supplementing an employer-sponsored plan or starting your savings independently, IRAs are a vital tool in building a secure financial future.

What is an IRA?

An IRA is a personal retirement savings account designed to encourage long-term savings with tax advantages. IRAs offer flexibility, allowing you to choose from a variety of investments such as stocks, bonds, mutual funds, and ETFs.

For those with employer-sponsored retirement plans like 401(k)s, IRAs can provide additional benefits. After maximizing your employer match (if available), an IRA can help diversify your retirement savings and offer access to a broader range of investment options.

Three Main Types of IRAs

1. Traditional IRA

- Tax Benefits: Contributions are often tax-deductible, providing immediate tax savings.

- Withdrawals: Subject to income tax upon withdrawal in retirement.

- Required Minimum Distributions (RMDs): Mandatory withdrawals begin at age 73.

2. Roth IRA

- Tax Benefits: Contributions are made with after-tax dollars, but withdrawals are tax-free in retirement.

- No RMDs: Funds can remain in the account indefinitely, making them ideal for estate planning.

3. Rollover IRA

- Purpose: Allows you to transfer assets from an employer-sponsored retirement plan, such as a 401(k), into an IRA.

- Tax Benefits: Preserves the tax-deferred status of the funds, avoiding penalties or immediate taxes.

Example:

When Sarah changes jobs, she rolls over $100,000 from her 401(k) into a Rollover IRA, gaining access to a wider range of investment options while maintaining her tax benefits.

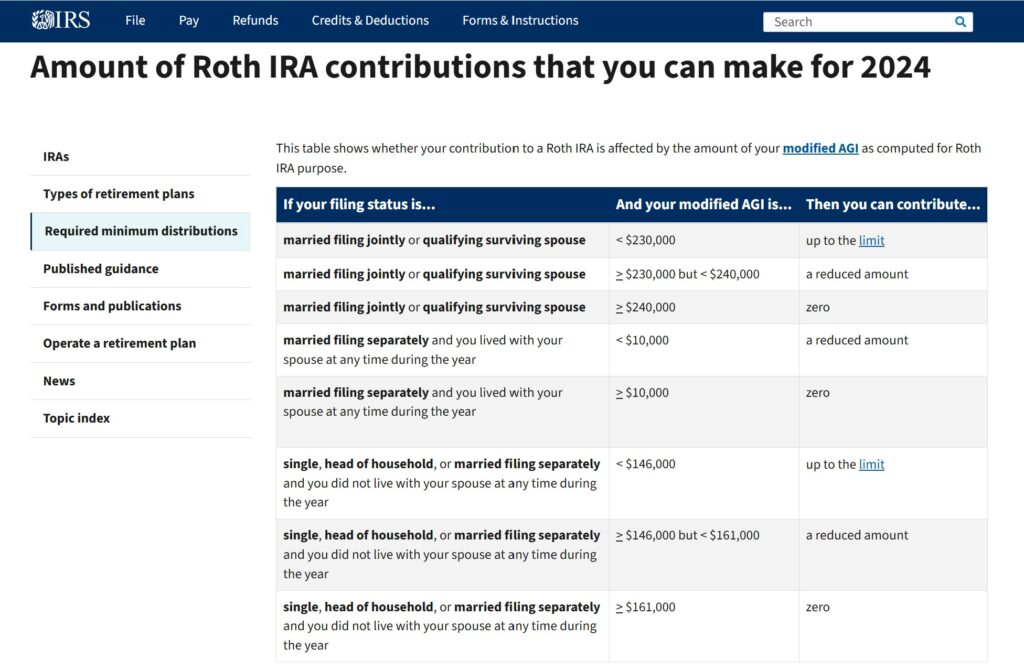

Income Limitations on IRAs

When contributing to an IRA, it’s important to be aware of the income limitations that may affect your eligibility, particularly for Roth IRAs and the deductibility of Traditional IRA contributions. For Roth IRAs, contributions are phased out if your Modified Adjusted Gross Income (MAGI) exceeds certain limits. For 2024, single filers with a MAGI above $146,000 and joint filers with a MAGI above $230,000 cannot contribute to a Roth IRA.

Traditional IRAs, on the other hand, do not have income restrictions for contributions, but if you or your spouse are covered by a workplace retirement plan, the deductibility of those contributions may be reduced or eliminated based on your MAGI. For example, single filers with a MAGI above $87,000 in 2024 lose the full deductibility of Traditional IRA contributions. Understanding these limits can help you strategically plan your retirement savings and optimize your tax benefits.

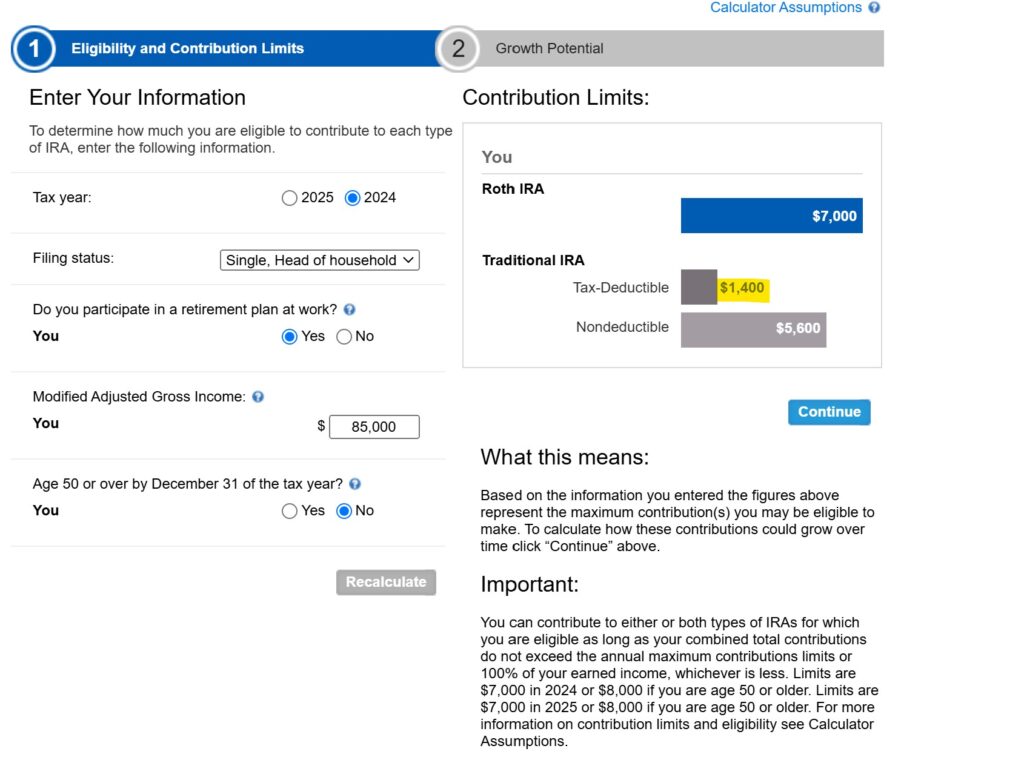

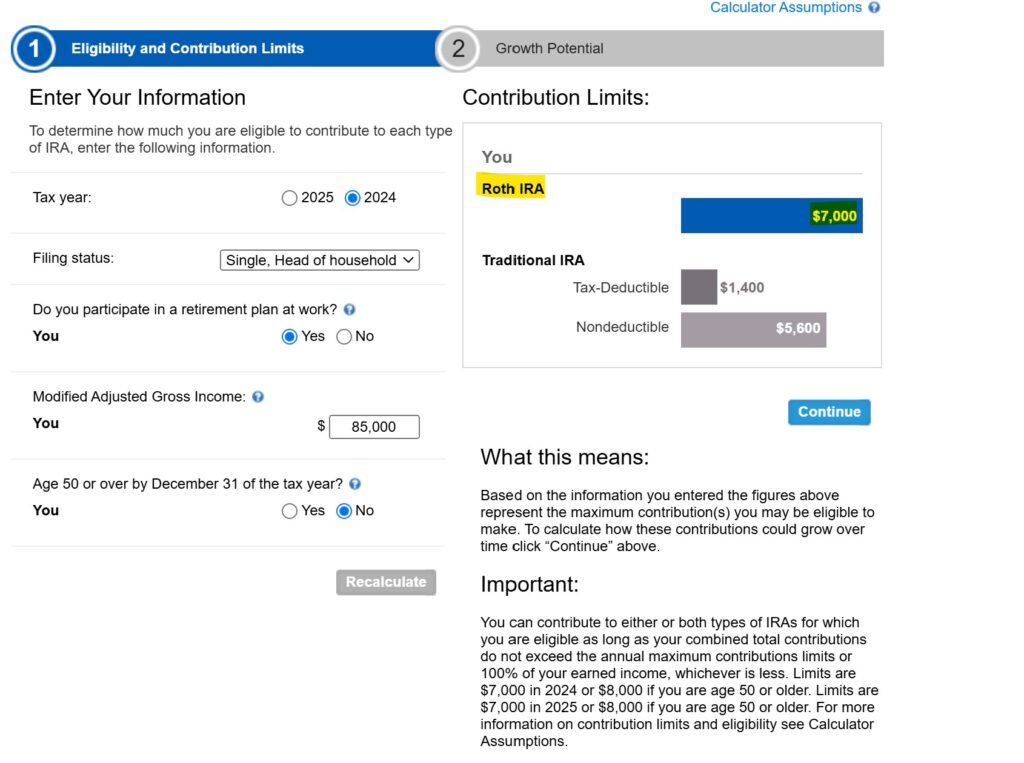

Example 1: Single Filer

- Income Level: $85,000

- Filing Status: Single

- Covered by a Workplace Retirement Plan: Yes

- 2024 IRA Contribution Limit: $7,000 (under 50)

Traditional IRA:

- Deduction Phase-Out Range: $77,000 to $87,000 (2024).

- Contribution: Allowed up to $7,000, but only a partial deduction can be taken since income is in the phase-out range.

- Deduction Calculation:

- MAGI = $85,000

$85,000 – $77,000 = $8,000 over the lower limit.

Phase-out percentage: $8,000 ÷ $10,000 = 80%.

Deductible contribution = $7,000 × (1 – 0.80) = $1,400

- MAGI = $85,000

Source: https://www.schwab.com/ira/ira-calculators/roth-vs-traditional

Roth IRA:

- Income Eligibility Phase-Out Range: $146,000 to $161,000 (2024).

- Contribution: Full $7,000 allowed since income is below $146,000.

source: https://www.schwab.com/ira/ira-calculators/roth-vs-traditional

Other Types of IRAs

In addition to the three main types, specialized IRAs cater to specific needs:

- SIMPLE IRA: Ideal for small businesses, allowing both employer and employee contributions.

- SEP-IRA: Designed for self-employed individuals or business owners, offering higher contribution limits.

- Inherited IRA: Used to manage funds received from a deceased individual’s IRA.

- Custodial IRA: Allows minors with earned income to begin saving for retirement.

- Spousal IRA: Enables contributions for a non-working spouse under a joint tax return.

Strategies to Maximize Your IRA

1. Automate Contributions with Dollar-Cost Averaging

Setting up a recurring investment plan ensures consistent contributions and takes advantage of dollar-cost averaging (DCA). DCA involves investing a fixed amount regularly, regardless of market conditions, allowing you to buy more shares when prices are low and fewer when prices are high.

2. Reinvest Dividends

Dividends can significantly boost your retirement savings when reinvested. By using the dividends to purchase additional shares, you compound your returns over time.

3. Choose Low-Cost Index Funds

Index funds are an excellent choice for IRAs due to their low fees, diversification, and historical performance.

Why Index Funds?

- Lower Expense Ratios: Keep more of your investment returns.

- Broad Diversification: Reduce risk by spreading investments across multiple sectors.

- Proven Growth: Track the performance of the market over the long term.

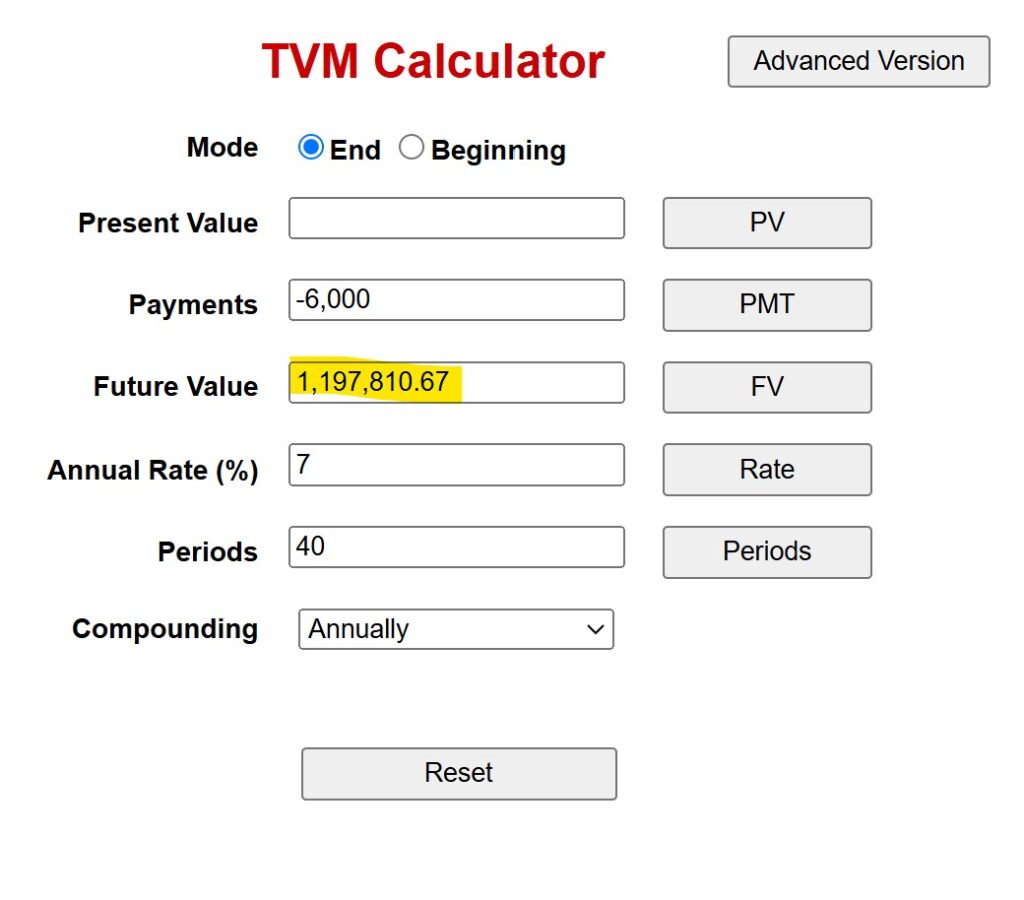

Benefits of Starting Early

Starting your IRA contributions early amplifies the power of compounding, where your returns generate additional returns over time.

Example:

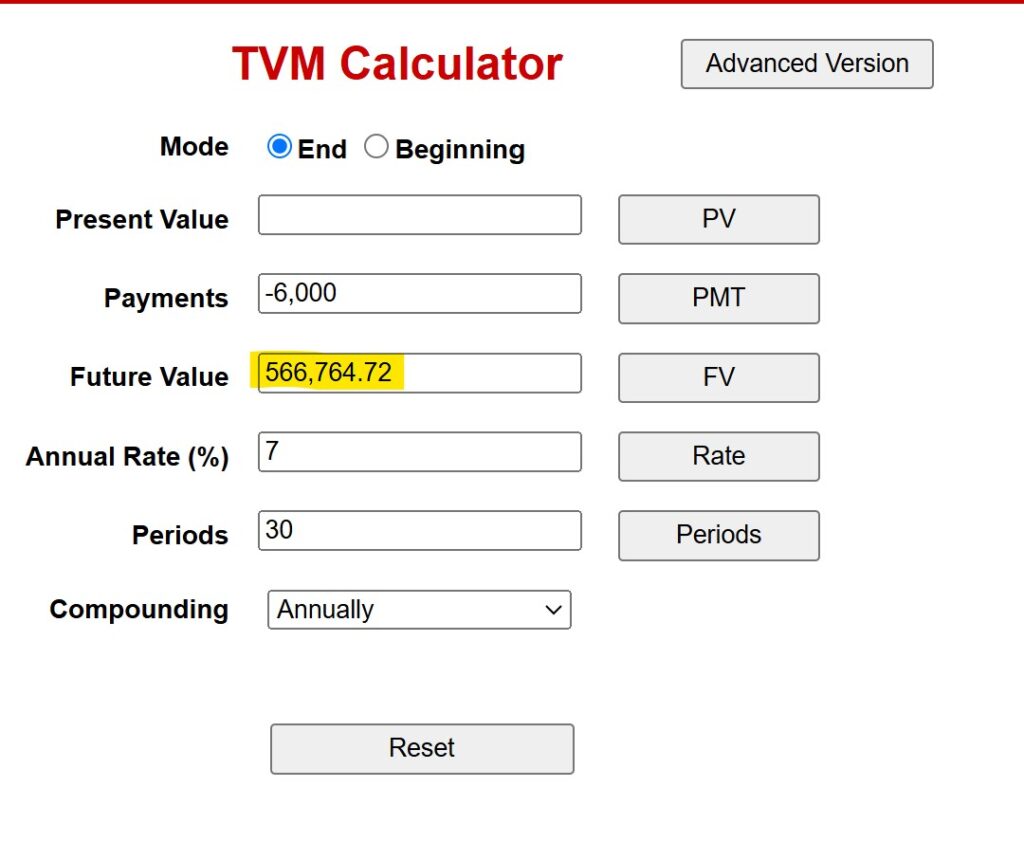

Anna begins contributing $6,000 annually to her IRA at age 25, while Ben starts at 35. By age 65, Anna’s account is worth almost $1.2 million, while Ben’s grows to about $566,000, assuming a 7% annual return.

Anna Portfolio in 40 years

TVM Calculator source: https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Ben Portfolio in 30 years

TVM Calculator source: https://www.fncalculator.com/financialcalculator?type=tvmCalculator

How to Get Started

- Choose the Right IRA: Evaluate your current income, tax preferences, and retirement goals.

- Open an Account: Many financial institutions offer easy online account setup.

- Select Investments: Build a diversified portfolio with low-cost funds or ETFs.

- Automate Contributions: Set up recurring transfers to ensure consistent savings.

- Monitor and Adjust: Review your investments periodically to ensure they align with your goals.

Conclusion

IRAs are a cornerstone of a well-rounded retirement strategy. By understanding the different types, leveraging recurring contributions, reinvesting dividends, and selecting low-cost investments, you can maximize your savings and achieve long-term financial success.

Start today to take control of your financial future and pave the way for a comfortable retirement. For more insights and actionable advice, visit https://buildwealthretirerich.com/wealth-talks/

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.