Introduction

Financial literacy and investing are often overlooked when raising children and young adults, yet they are some of the most powerful tools for building wealth over time. Starting to invest at an early age allows young individuals to take advantage of compound interest, market growth, and long-term wealth accumulation.

In today’s world, where inflation, increasing college costs, and economic uncertainties exist, having an investment strategy early in life can make a significant difference. Whether saving for college, a first home, or retirement, learning about investing at a young age is an important financial milestone.

This guide will explore the importance of teaching kids and young adults about investing, different investment vehicles available, and strategies to help them build a strong financial future.

Why Start Investing Early?

The biggest advantage of early investing is time. The earlier a child or young adult starts investing, the more time their money has to grow.

Power of Compound Interest

Investing early allows young investors to benefit from compound interest, which means earning returns not only on the initial investment but also on the accumulated earnings over time.

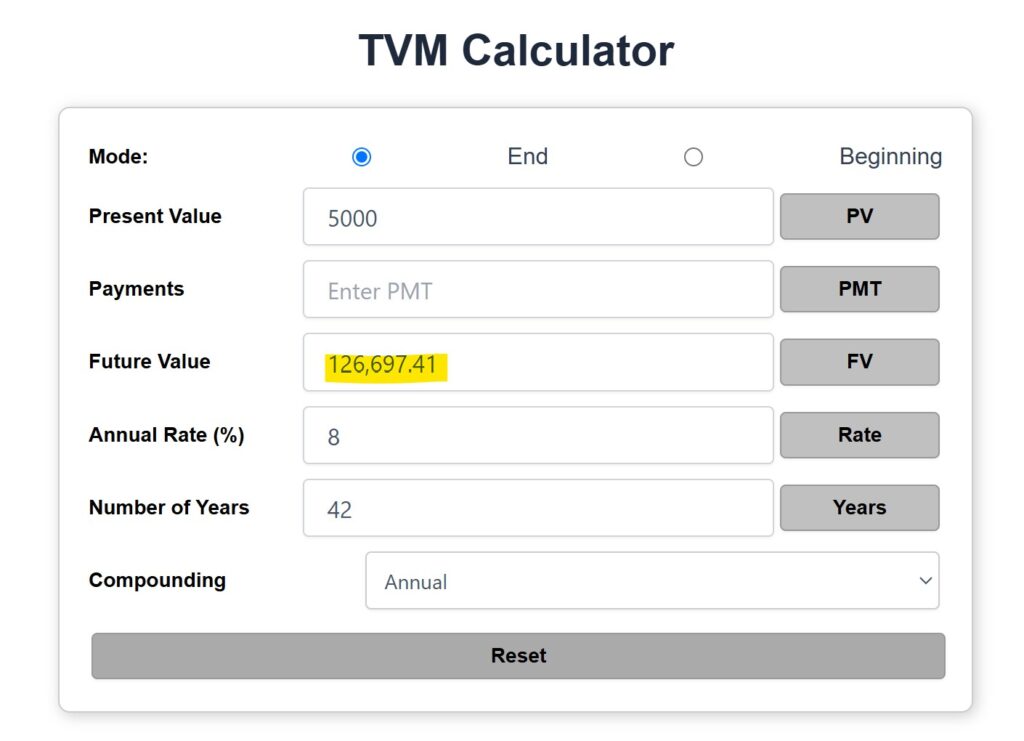

Example:

If an 18-year-old invests $5,000 in an index fund earning an average of 8% per year, by age 60, their investment could grow to $126,697 without adding another dollar.

https://buildwealthretirerich.com/tvm/

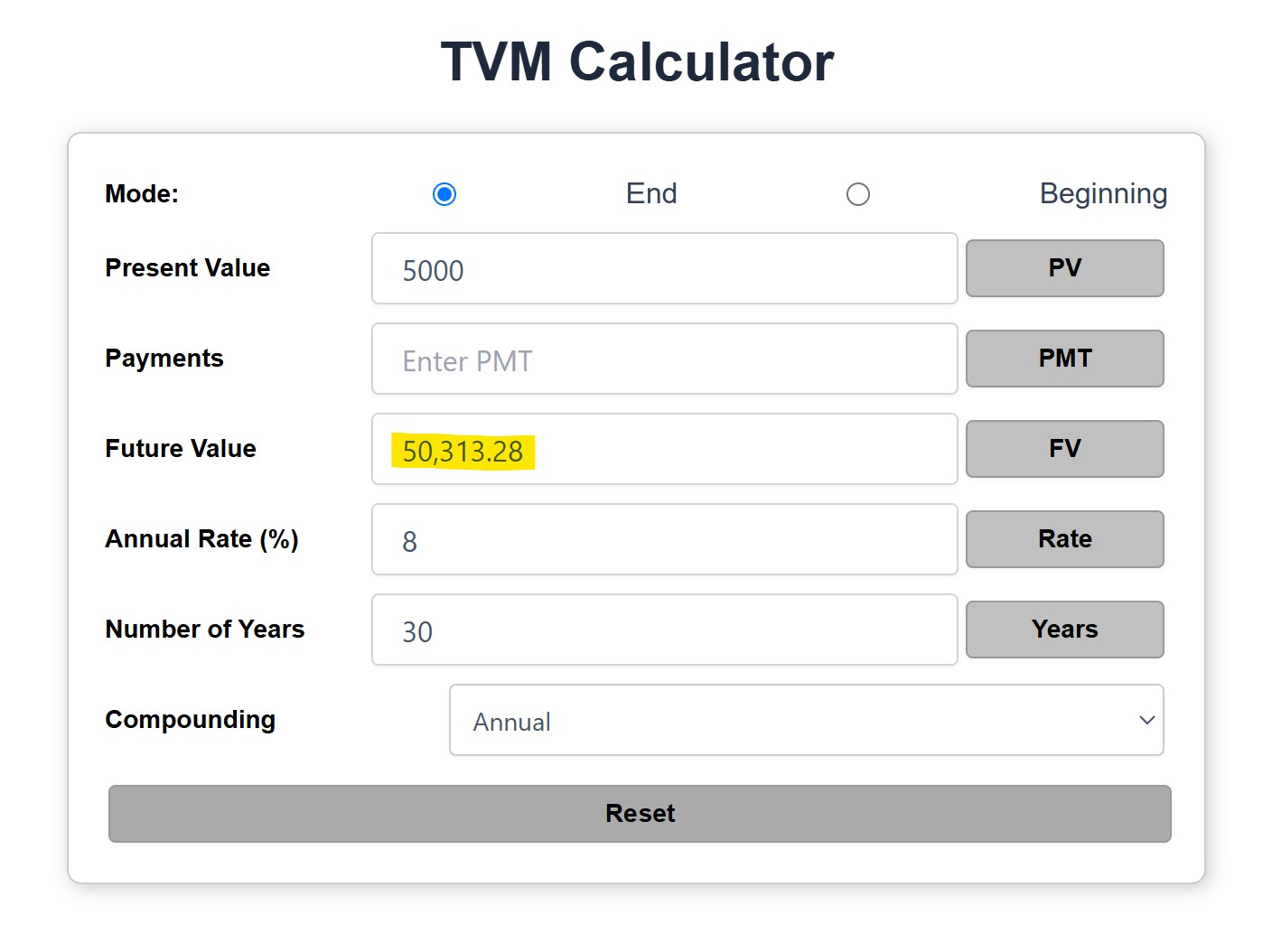

If they had waited until 30 to invest the same $5,000, their total by age 60 would be only $50,313.

https://buildwealthretirerich.com/tvm/

Time, not just money, is the most powerful factor in wealth accumulation.

Key Benefits of Starting Early:

- More Time for Growth: Longer investment horizons allow for higher potential gains.

- Lower Required Contributions: Investing small amounts over time can lead to significant wealth.

- Better Financial Habits: Learning about investing early helps young individuals develop responsible financial habits.

- Mitigating Market Volatility: Long-term investing smooths out short-term market fluctuations.

Step-by-Step Guide to Investing for Kids and Young Adults

Step 1: Teaching the Basics of Money and Investing

Before kids start investing, they need a solid understanding of money, saving, and spending.

- Explain the concept of earning money (through chores, allowances, part-time jobs).

- Teach them to budget (saving, spending, and investing percentages).

- Introduce investing as ‘making your money work for you’ by explaining how businesses grow and how investors earn money.

Ways to Introduce Investing Concepts to Kids:

- Use Storytelling: Explain how companies like Disney, Apple, and McDonald’s make money.

- Interactive Apps: Introduce investment simulation apps like Greenlight, Stockpile, and BusyKid.

- Hands-on Experience: Let them choose a stock in a company they love and track its progress.

Step 2: Setting Up the Right Investment Accounts

Different types of investment accounts are available for kids and young adults. Here’s a breakdown:

1. Custodial Accounts (UGMA/UTMA)

- A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account allows parents to invest on behalf of their children.

- Once the child reaches 18 or 21 (varies by state), they take control of the assets.

- Investments can include stocks, mutual funds, ETFs, and bonds.

2. 529 College Savings Plan

- Tax-advantaged savings plan designed to pay for education expenses.

- Investments grow tax-free, and withdrawals are tax-free when used for qualified education expenses.

- Some states offer tax deductions or credits for contributions.

3. Custodial Roth IRA

- Allows minors with earned income (from a job or business) to contribute up to $7,000 per year (2025 limit). You can check on the IRS website for the current year contributions limit. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

- Contributions grow tax-free, and withdrawals are tax-free in retirement.

- Best for long-term investing and retirement savings.

4. Brokerage Accounts for Kids

- Parents can open a custodial brokerage account and invest in stocks, ETFs, and mutual funds on behalf of their children.

- Allows flexibility in choosing dividend stocks, index funds, or growth stocks.

5. High-Yield Savings Accounts & CDs

- While not investments, high-yield savings accounts and Certificates of Deposit (CDs) are a safe way to introduce kids to earning interest.

- Useful for short-term savings goals (e.g., saving for a laptop, vacation, or new phone).

Best Investments for Kids and Young Adults

When selecting investments for young investors, consider low-cost, diversified, and growth-oriented options.

1. Index Funds & ETFs

- S&P 500 Index Fund – Tracks the top 500 companies in the U.S.

- Total Stock Market Index Fund – Provides broader diversification across thousands of companies.

- Dividend ETFs – Earn passive income from dividend-paying stocks.

2. Individual Stocks

- Invest in companies they know and use (Apple, Amazon, Disney, Tesla, McDonald’s).

- Teach kids how to research companies, analyze financials, and read earnings reports.

3. REITs (Real Estate Investment Trusts)

- Offer exposure to real estate without buying physical properties.

- Provide dividends and long-term capital appreciation.

4. Bonds

- Help balance risk and provide stable returns.

- U.S. Treasury Bonds & Municipal Bonds are great for low-risk investing.

Common Mistakes to Avoid When Investing for Kids

- Waiting Too Long to Start – The earlier, the better.

- Investing Without a Goal – Teach kids to set financial targets.

- Overlooking Fees – Choose low-cost funds and commission-free brokers.

- Emotional Investing – Teach patience and long-term thinking.

- Lack of Diversification – A mix of stocks, bonds, and index funds provides balance.

Conclusion: Building Wealth for the Next Generation

Teaching kids and young adults about investing is one of the best gifts parents can give. By starting early, leveraging compound interest, and using the right investment vehicles, young investors can build a strong financial foundation for their future.

Key Takeaways:

- Investing early allows kids to benefit from compound growth.

- Choosing the right accounts (Custodial Accounts, Roth IRAs, 529 Plans) is essential.

- Low-cost investments like index funds and ETFs are great for young investors.

- Parents can encourage smart financial habits through matching contributions and goal-setting.

Your Mantra for Success: “Start early. Invest smart. Build wealth.”

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.