Investing is more than just a financial activity—it’s a gateway to achieving long-term financial goals, building wealth, and ensuring a secure future. While saving provides a foundation, investing takes your money to the next level by putting it to work and allowing it to grow.

Why Is Investing Important?

- Wealth Accumulation Through Growth

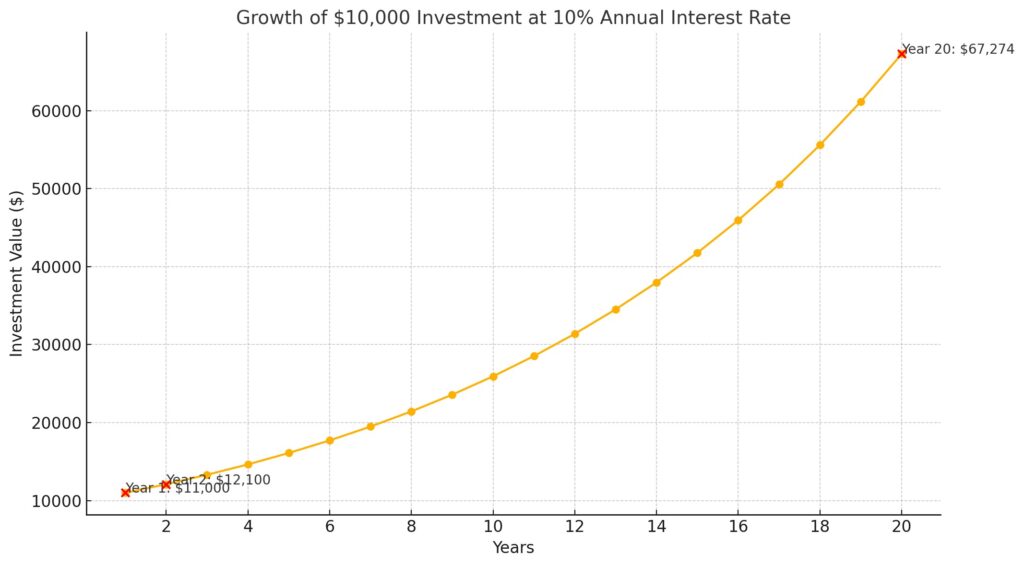

Investing allows your money to grow significantly over time, thanks to the magic of compounding. When you earn returns on your investments, those returns are reinvested, creating a snowball effect. For example:

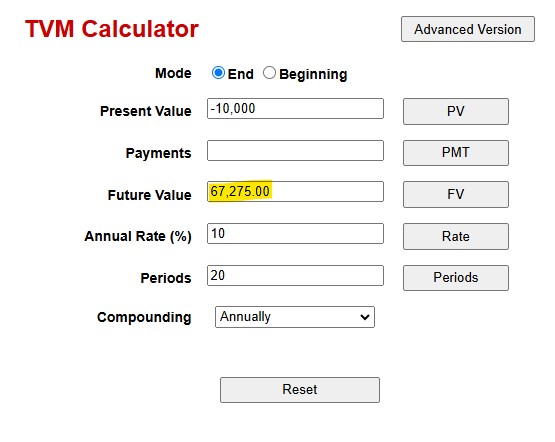

- If you invest $10,000 at an average annual return of 10%, it can grow to over $67,000 in 20 years.

This growth far exceeds what a regular savings account would offer.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

2. Protecting Against Inflation

Inflation gradually decreases the purchasing power of money. By investing in assets with higher returns than inflation, you preserve and increase your real wealth. For instance:

- If inflation averages 3% annually, a $100 item today will cost approximately $180 in 20 years. Investments in stocks or real estate can help your money keep pace with or surpass inflation.

3. Achieving Financial Goals

Investing is a strategic way to reach significant milestones like:

- Buying a home.

- Funding your child’s education through 529 college savings plan.

- Launching a business.

- Building generational wealth for your family.

4. Planning for Retirement

Retirement planning often requires more than just saving in a bank account.

- Investment vehicles like 401(k)s, IRAs, or even personal portfolios provide opportunities for market growth.

- Investing through HSA account ensures you have the funds to maintain your desired lifestyle and cover healthcare costs during retirement.

5. Diversifying Income Streams

Investments generate income through:

- Dividends from stocks.

- Interest from bonds.

- Real Estate Investment Trust (REIT) funds.

This reduces dependency on a single source of income, offering financial stability

Benefits of Investing Early

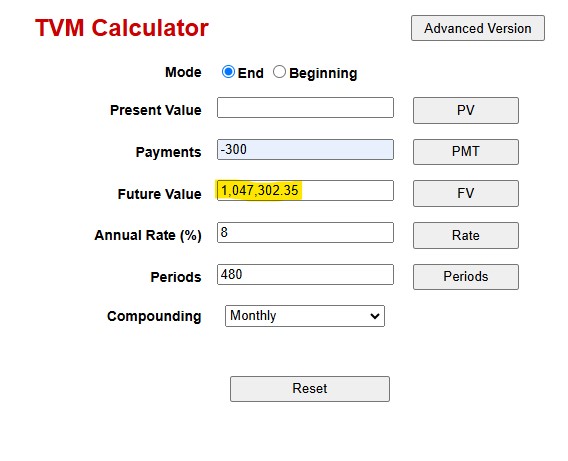

Starting early provides a massive advantage due to time and compounding returns. Consider two investors:

- Investor A starts at age 25, investing $300 monthly

- Investor B starts at age 35, investing $300 monthly

At age 65, assuming a 8% annual return:

- Investor A’s portfolio grows to over $1,000,000.

- Investor B’s portfolio grows to about $447,000.

Investor A can retire as a millionaire by taking benefits of investing early.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Common Investment Options

- Stocks

- High-risk, high-reward investments.

- Suitable for long-term goals due to potential for substantial growth.

- Bonds

- Lower risk compared to stocks.

- Provide regular income through interest payments.

- Mutual Funds and ETFs

- Offer diversification by pooling money to invest in multiple assets.

- Managed by professionals, making them beginner-friendly.

- Real Estate Investment Trusts (REIT)

- Provide rental income

- Retirement Accounts (401(k), IRA)

- Offer tax advantages to boost your savings for retirement.

- Employer-sponsored accounts often include matching contributions.

How to Start Investing

- Educate Yourself

Learn the basics of asset classes, risk management, and market behavior. Resources include:- Books like The Intelligent Investor by Benjamin Graham.

- Online courses/seminars or financial literacy blogs.

- Set Clear Goals

Define what you’re investing for—retirement, education, or wealth building—and tailor your strategy accordingly. - Determine Your Risk Tolerance

Understand your comfort level with risk. Stocks are riskier but offer higher returns, while bonds and savings accounts are safer but yield lower returns. - Start Small and Be Consistent

- Begin with what you can afford. Many brokerage firms allow you to start with as little as $1.

- Consistency matters more than large investments—set up automatic contributions.

- Diversify Your Portfolio

- Spread your investments across different asset classes to reduce risk.

- The saying, “Don’t put all your eggs in one basket,” applies strongly in investing.

- Consult a Financial Advisor

If you’re unsure where to start, seek professional advice to create a personalized investment plan.

Overcoming Common Misconceptions

- “I need a lot of money to start.”

Many brokerage firms allow you to begin investing with minimal amounts. - “Investing is too risky.”

Risk varies by asset class. Balancing high-risk investments (stocks) with safer options (bonds) can align with your comfort level. - “I don’t know enough.”

Financial literacy tools, seminar/courses, and advisors are available to help you gain confidence.

Key Takeaways

Investing is not just for the wealthy or financially savvy—it’s for anyone with a desire to grow their wealth and secure their future. Here’s why you should start now:

- Time is your greatest ally in investing.

- Small, consistent contributions lead to significant long-term gains.

- Diversifying and understanding your goals reduce risks and improve results.

Remember, investing is like planting a tree: the sooner you plant it, the sooner it bears fruit. Start today and take control of your financial future.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.