A minor reduction in your paycheck today can lead to a massive boost in your retirement wealth tomorrow. This blog explores how making the most of employer 401(k) contributions transforms modest sacrifices into extraordinary financial rewards. Keep reading to see how a $220 monthly adjustment turned into a $1.2 million retirement portfolio.

When it comes to retirement savings, many employees underestimate the power of employer contributions to their 401(k). It’s essentially free money, yet fear of reduced take-home pay often prevents people from taking full advantage of this benefit. Let’s break down a real-life scenario to illustrate why maximizing your 401(k) contributions is one of the smartest financial decisions you can make.

A Relatable Scenario: Balancing Living Expenses and Savings

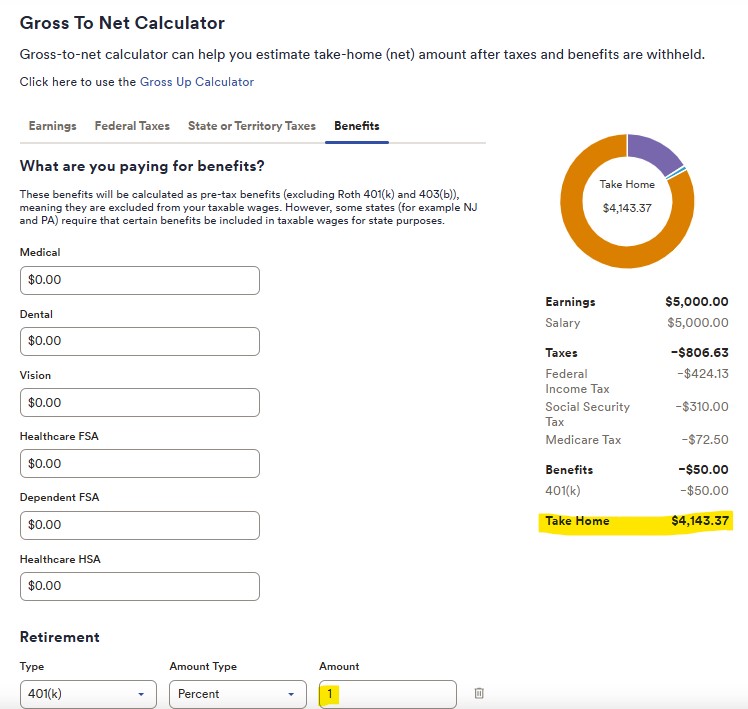

Meet James, a 22-year-old professional who recently moved to Texas for a job offering an annual gross salary of $60,000. James initially contributed only 1% of his salary to his 401(k) because he feared that a higher contribution would leave him with too little take-home pay to cover living expenses. After federal taxes, Social Security, and Medicare deductions, his monthly take-home pay came to $4,143.37, which allowed him to manage his rent, utilities, and discretionary spending comfortably.

Note: These calculations do not include deductions for health, vision, or dental insurance premiums, as James has not opted for these benefits in this scenario.

https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

James’ employer offered a 50% match on contributions up to 6% of his salary—a great benefit, but one he wasn’t taking full advantage of.

Crunching the Numbers: Small Changes, Big Gains

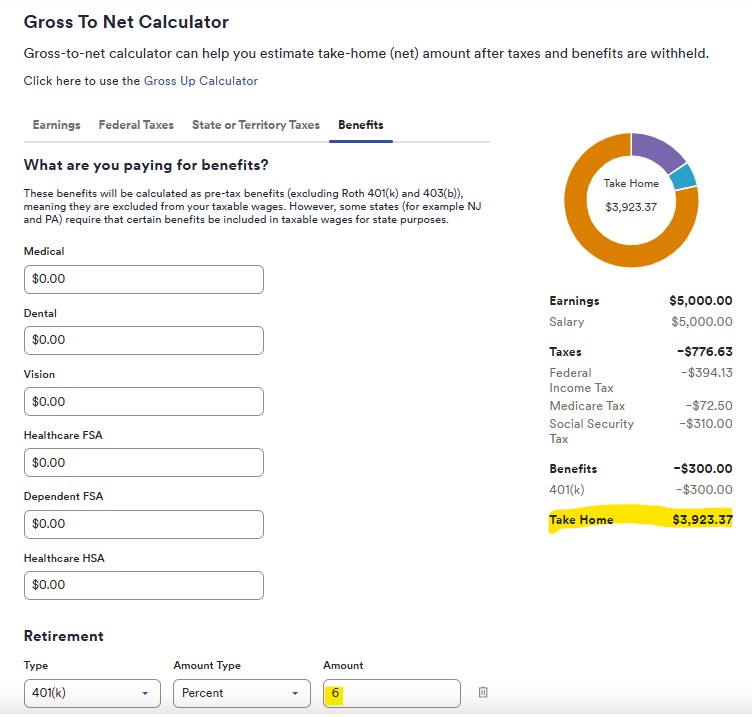

Curious about the impact of increasing his contributions, James ran some calculations. Here’s what he found:

- At 1% Contribution: His take-home pay remained $4,143.37.

- At 6% Contribution: His take-home pay dropped to $3,923.37—a monthly reduction of just $220.

https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

Encouraged by this relatively small difference, James decided to contribute 6% and unlock the full employer match.

The Long-Term Impact: The Power of Compounding

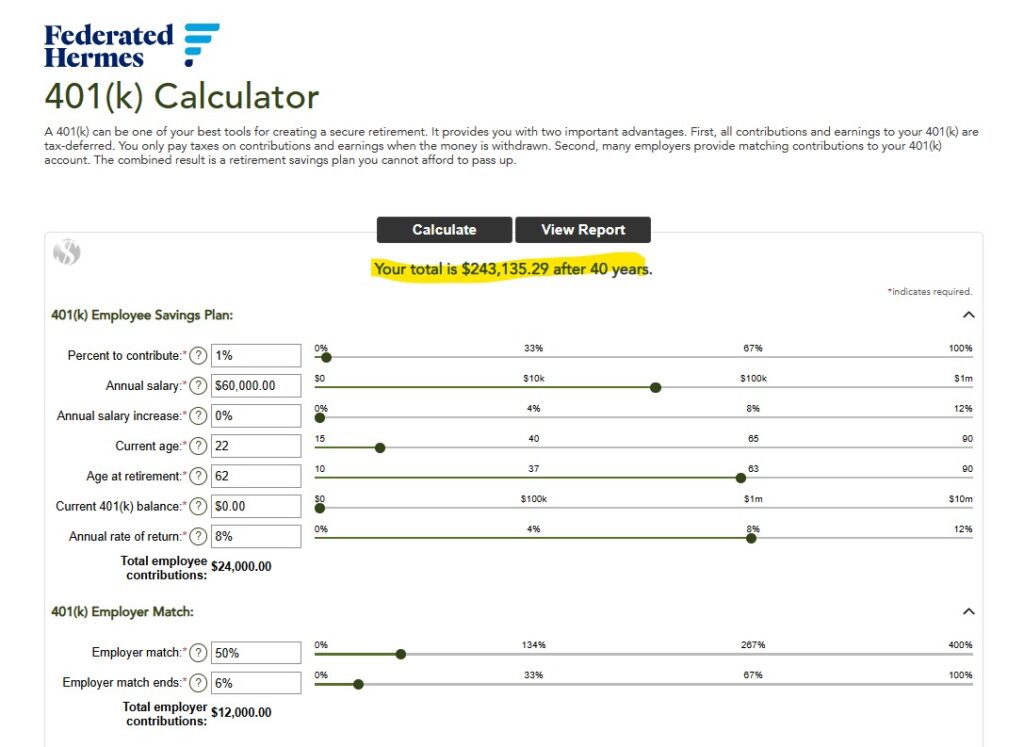

Using a 401(k) calculator with realistic assumptions—an 8% annual return over 40 years—James was able to compare his potential retirement savings under each scenario:

At 1% Contribution: His portfolio would grow to $243,135.29.

https://www.federatedhermes.com/us/calculators/Retire401k.html

At 6% Contribution with Full Employer Match: His portfolio would grow to $1,458,811.74.

https://www.federatedhermes.com/us/calculators/Retire401k.html

The difference? A staggering $1.2 million increase in retirement savings, all for a manageable $220 reduction in monthly take-home pay.

Breaking Down the Benefits

- Employer Match: James’ employer contributed 50% of his contributions up to 6% of his salary. This free money significantly amplified his total savings.

- Tax Savings: Contributions to a traditional 401(k) reduce taxable income, meaning James paid less in taxes today while saving for tomorrow.

- Compound Growth: Over decades, the combination of his contributions, employer match, and an 8% annual return exponentially increased his portfolio value.

Addressing Common Concerns

- “What if I Can’t Afford It?”

- James adjusted his budget, cutting back on discretionary expenses like dining out and subscriptions. Small changes made the $220 reduction manageable.

- “What Happens if I Switch Jobs?”

- While James’ employer match would be subject to a vesting schedule, the contributions he made were his to keep. Most plans allow rollovers into a new employer’s plan or an IRA, ensuring no savings are lost.

- “Is an 8% Return Realistic?”

- Historical data shows that long-term stock market returns often average around 7%-10%. Even accounting for inflation, 8% is a reasonable assumption for long-term growth.

The Missed Opportunity: Leaving Free Money on the Table

Without maximizing his contributions, James would have lost out on the employer match and the compounding growth it enables. For many employees, this could mean missing out on hundreds of thousands—or even millions—in retirement savings.

Your Action Plan: Steps to Secure Your Future

- Understand Your Employer’s Match Policy: Check how much your employer is willing to match and aim to contribute at least that amount.

- Use a 401(k) Calculator: Run scenarios to see how increasing contributions will impact both your take-home pay and long-term savings.

- Start Small, Then Build: If contributing the full match amount feels daunting, start with a smaller percentage and gradually increase it over time.

- Consult a Financial Advisor: Personalized advice can help you optimize your retirement strategy and address your specific concerns.

Retirement might feel far away, but every dollar you invest today works harder for you tomorrow. Take advantage of employer matching and watch your savings soar.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.