Investing can often seem like a daunting task, especially with fluctuating markets and an overwhelming number of investment choices. The good news? Building wealth doesn’t require timing the market or having expert knowledge. The cornerstone of a successful investing strategy lies in consistency, discipline, and simplicity.

A recurring investment plan, particularly one focused on a diversified index fund, provides a clear path to financial security. It automates your investments, builds long-term wealth, and minimizes the stress of managing your portfolio. Here’s why this approach works and how you can implement it to secure your financial future.

1. The Power of Recurring Investments

Recurring investment plans are about regularly putting money into your investment accounts, like a 401(k), IRA, or brokerage account. Many brokers now allow you to set up recurring investments in tax-advantaged accounts, such as IRAs, with minimum amounts as low as $1.

These plans are flexible and let you decide how often to invest—daily, weekly, or monthly—making it easy to start even with a small budget. For example, if you set up a recurring plan to invest $5 daily, you could build a significant portfolio over time with very little effort.

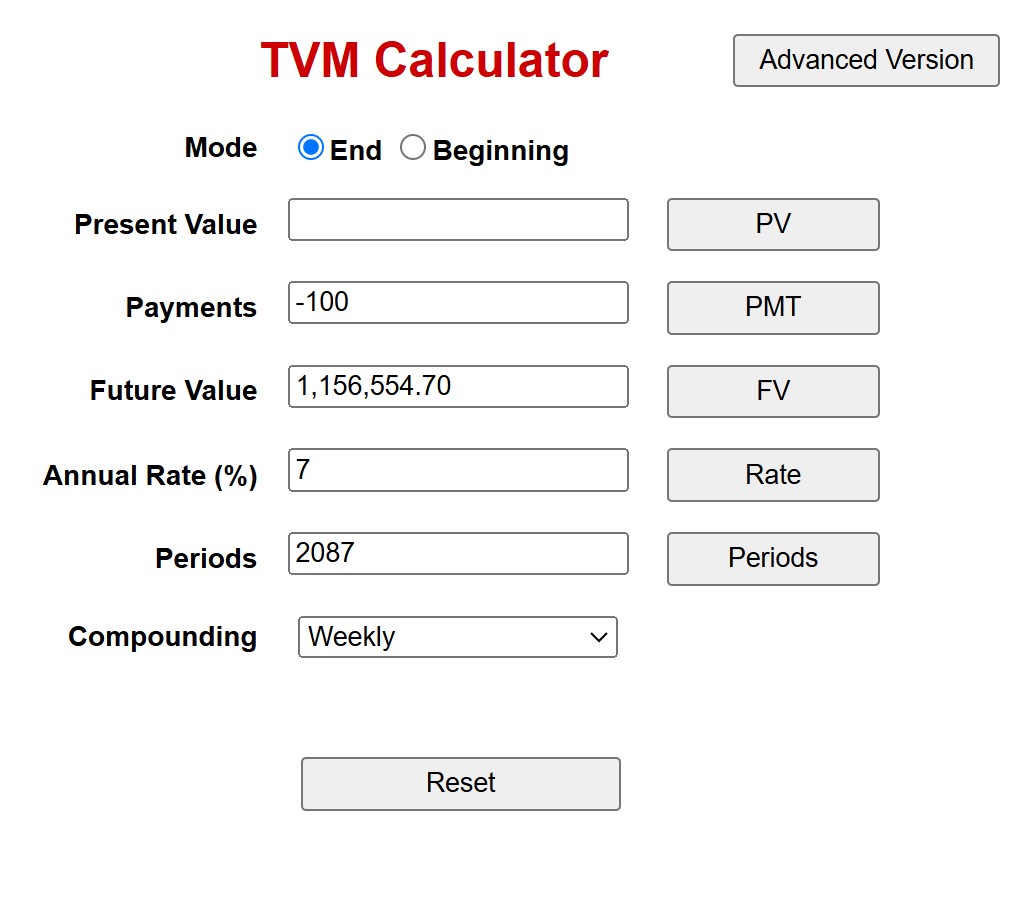

For instance, Sarah, a 20-year-old professional, invests $100 every week in her Roth IRA account. Over 40 years, she contributes a total of $208,700. However, with an average return of 7% per year, her account grows to an impressive $1,156,554.70 by the time she’s 60.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Automation also helps you avoid procrastination or skipping investments when things feel uncertain. Once you set it up, your money works for you without any extra effort.

2. Fractional Shares and Zero Commissions: Making Recurring Investments Accessible

Thanks to advancements in modern investing platforms, fractional shares and zero-commission trading have made recurring investment plans more accessible than ever. Fractional shares allow you to buy a portion of a stock or fund, meaning you don’t need thousands of dollars to invest in expensive funds like those tracking the S&P 500 or companies like Amazon and Alphabet. For example, even with just $10, you can start building a position in high-value investments, making it easier for anyone to get started with investing.

Zero-commission trading has further reduced barriers by eliminating transaction fees, allowing you to invest small amounts frequently without worrying about costs eating into your returns. Together, these innovations enable you to set up recurring investment plans with minimal amounts, automating contributions to funds that align with your goals. Whether it’s $5 a day or $50 a week, fractional shares and commission-free platforms empower you to steadily grow your wealth, even with a modest budget.

This accessibility ensures that anyone, regardless of income level, can begin their investment journey and benefit from consistent contributions over time.

3. Diversification Makes Investing Safer

Choosing the right investments can feel overwhelming, but diversification makes it easier to build a portfolio that balances growth and stability. Diversification means spreading your investments across different asset classes—such as stocks, bonds, and cash—to reduce the overall risk of your portfolio. By not putting all your eggs in one basket, you minimize the impact of any single investment performing poorly.

For example, many people invest in a diversified index fund, like one tracking the S&P 500, which gives exposure to 500 of the largest U.S. companies. However, diversification can go a step further by including bonds alongside stocks. Bonds tend to be more stable than stocks and provide a buffer during market downturns, making them a great choice for those seeking to lower overall risk.

Investing in a fund that blends stocks and bonds—such as a balanced fund or target-date fund—can help align your portfolio with your financial goals and risk tolerance. A younger investor saving for retirement might choose a fund with a higher proportion of stocks for growth, while someone nearing retirement might prefer a fund with more bonds for stability.

A recurring investment plan can also be set up with a desired fund that matches your goals and risk preferences. This means you can automate your contributions to a specific diversified fund, ensuring consistency and eliminating the need for manual adjustments. Whether you aim for aggressive growth, steady income, or a mix of both, choosing the right fund for your recurring investment plan allows your portfolio to grow while staying aligned with your objectives.

By combining diversification with the automation of recurring investments, you create a strategy that’s both effective and easy to maintain, helping you achieve long-term financial success.

4. Rebalancing Your Recurring Investment Plan

As life changes, so do your financial goals and circumstances. It’s important to periodically review and rebalance your recurring investment plan to ensure it aligns with your current life situation. Rebalancing involves adjusting the allocation of your investments to maintain the right mix of assets, such as stocks, bonds, and cash. For example, a young professional might prioritize higher-growth investments like stocks, while someone nearing retirement might shift to more stable assets like bonds to preserve wealth.

Additionally, major life events—such as getting married, having children, or receiving a promotion—may require increasing or modifying your contributions. For instance, if your income rises, you can increase your weekly or monthly investment amount to accelerate your wealth-building goals. Conversely, during challenging times, you might reduce contributions temporarily but should aim to stay consistent when possible.

Rebalancing ensures your investment strategy evolves with your needs, helping you stay on track toward long-term financial security.

Simple Steps to Start a Recurring Investment Plan

Getting started is easy:

- Pick the Right Account: Decide whether a brokerage account, IRA, or 401(k) aligns with your goals. Many brokers now let you start with as little as $1, making it easy to take the first step.

- Choose a Diversified Fund: Look for low-cost index funds or ETFs. They’re simple and effective.

- Set Up Automation: Schedule automatic transfers from your bank account or paycheck into your investment account. Decide if you want to invest daily, weekly, or monthly.

- Stick to the Plan: Focus on your long-term goals and avoid reacting to short-term market changes.

Bonus Tips to Grow Your Wealth

- Reinvest Dividends: Instead of taking dividends as cash, use them to buy more shares. This speeds up growth through compounding.

- Use Fractional Shares: Invest small amounts in big companies by buying fractions of shares. For example, even with $50, you can own a piece of companies like Amazon.

- Take Advantage of Zero Fees: Many platforms now offer commission-free trades, so you can invest without extra costs.

Why Simple Strategies Work

Investing doesn’t have to be overwhelming. A recurring investment plan reduces the complexity of wealth building, focusing on steady contributions, diversification, and compounding. By removing the stress of market timing and stock picking, you create a sustainable strategy for financial freedom.

Whether you’re starting with $50, $100, or $1,000 a month, what matters is getting started and staying consistent. Over time, your efforts will pay off, and you’ll be on the path to financial freedom.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.