If you’ve recently received a bonus, tax refund, or unexpected cash, you might be wondering: Should I use it to pay off debt or invest? It’s a common dilemma, and the right choice depends on a few key factors. Let’s break it down so you can make the best financial move for your future.

The Case for Paying Off Debt First

1. High-Interest Debt is a Wealth Killer

If you have credit card debt, personal loans, or any debt with an interest rate above 7-8%, paying it off should be a top priority. Carrying high-interest debt is like trying to fill a bucket with a hole in it—your money keeps leaking out.

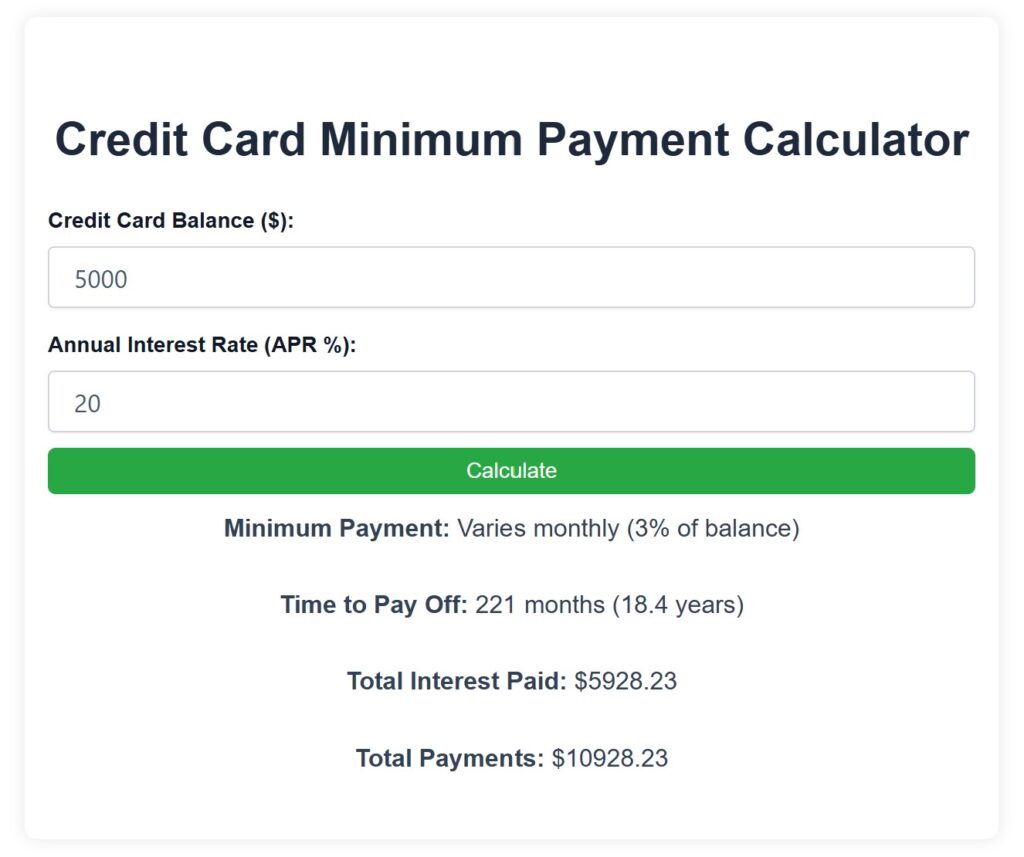

💡 Example: Alex has a $5,000 credit card balance at a 20% interest rate. If he only makes minimum payments based on 3% of balance, he could pay over $5,900 in interest alone and will take him 221 months to be rid of his debt.! Instead, he uses his tax refund to pay it off and saves thousands.

https://buildwealthretirerich.com/minimum-payment-calculator/

2. Paying Off Debt = A Guaranteed Return

Unlike investing, which comes with risks, paying off debt guarantees a fixed return—the interest savings. If your credit card has a 15% interest rate, paying it off is like earning a 15% risk-free return—an impossible feat in the stock market!

3. Peace of Mind & Financial Freedom

Debt is more than a financial burden—it’s an emotional one, too. Eliminating debt provides financial security, reduces stress, and increases flexibility to make smarter money moves in the future.

The Case for Investing Instead

1. The Power of Compound Growth

Investing allows your money to grow exponentially over time. If your debt has a low interest rate (under 5%), investing instead of prepaying debt could leave you better off in the long run.

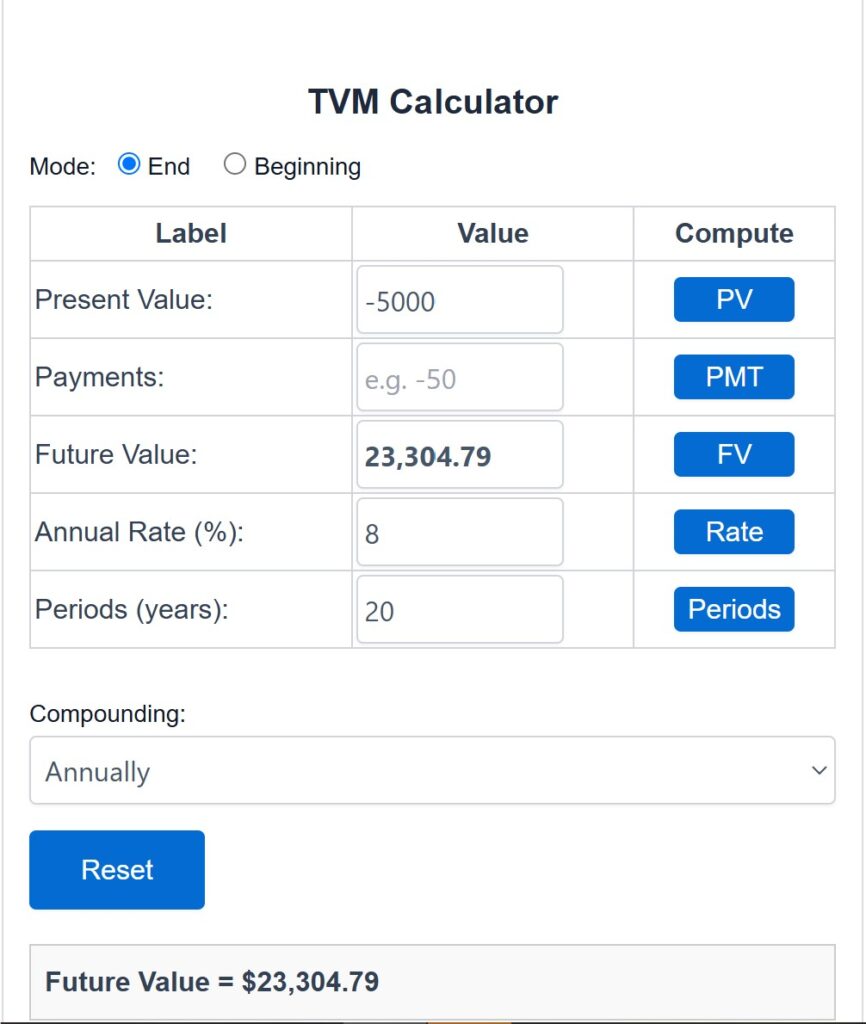

💡 Example: Emily has a $10,000 student loan at 4% interest. Instead of paying it off early, she invests $5,000 in an index fund earning an average 8% annual return. In 20 years, her investment could grow to nearly $23,000—far more than the savings from early debt payoff.

https://buildwealthretirerich.com/tvm/

2. Tax-Advantaged Accounts Multiply Returns

Investing in 401(k)s, Roth IRAs, and HSAs can provide tax-free or tax-deferred growth, making your money work even harder. If your employer offers a 401(k) match, investing up to the match is like getting free money!

3. Investing Builds Long-Term Wealth

Delaying investing means missing out on years of compound interest. Even small, consistent contributions can grow into millions over time.

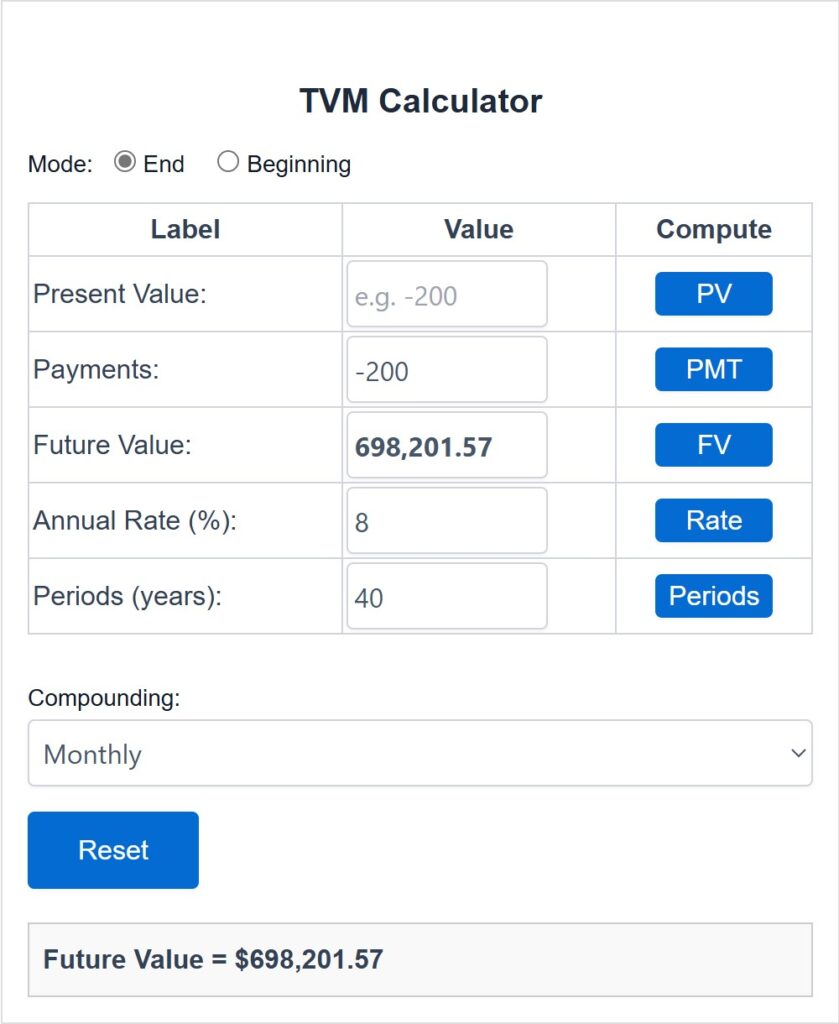

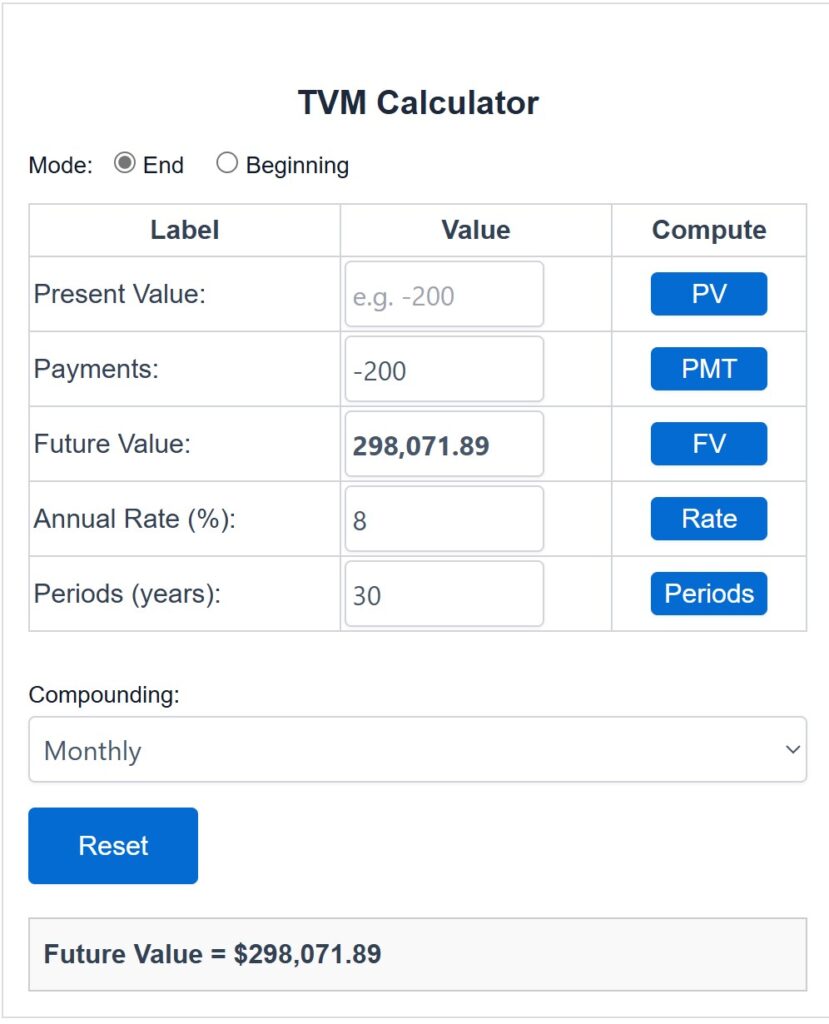

💡 Example: Sarah invests $200/month starting at age 25. By age 65, with a 8% return, she has over $698,000. If she waits until 35 to start, she ends up with only $298,000—less than half!

| Investing for 40 Years | Investing for 30 Years |

Time Value of Money – Build Wealth Retire Rich

Why a Balanced Approach Might Be Best

For many people, the best move is a mix of paying off debt and investing. Here’s a strategy that works:

✅ Step 1: Pay off any high-interest debt (over 7-8%).

✅ Step 2: Contribute enough to your 401(k) to get the employer match.

✅ Step 3: Build an emergency fund (3-6 months of expenses).

✅ Step 4: Split extra cash between paying off low-interest debt and investing.

💡 Example: Jake receives a $10,000 bonus. He puts $5,000 toward his 10% credit card balance and invests $5,000 in a Roth IRA. This way, he reduces financial stress while still building wealth.

Final Thoughts: What’s Right for You?

🔹 If you have high-interest debt, prioritize paying it off.

🔹 If your debt is low-interest, investing might be a better move.

🔹 If you can, balance both for maximum financial growth.

No matter which path you choose, the most important thing is to take action. Doing nothing is the worst financial mistake you can make.

💡 Your Mantra for Financial Success: “Spend Wisely, Invest Early”

Wealth isn’t built overnight, but with smart spending and early investing, you can achieve financial freedom faster than you think!

What’s your strategy? Do you prioritize paying off debt or investing? Let me know in the comments! 🚀

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.