It’s easy to think you need a high salary or a glamorous career to retire with a million dollars. But the story of Ronald Read, a Vermont janitor and gas station attendant, proves otherwise. Read quietly amassed an $8 million fortune through disciplined saving, frugal living, and smart investing, surprising even his family and friends upon his death at age 92.

Read’s story is a testament to the idea that anyone, regardless of income, can achieve financial independence with the right approach. By following simple principles like starting early, saving consistently, and investing wisely, you can also build a seven-figure nest egg for retirement.

Here’s how to make it happen.

Start Early: The Magic of Compound Interest

Compound interest is the most powerful force in wealth building. Starting early allows your money to grow exponentially because you’re earning interest not just on your savings but also on the interest already earned.

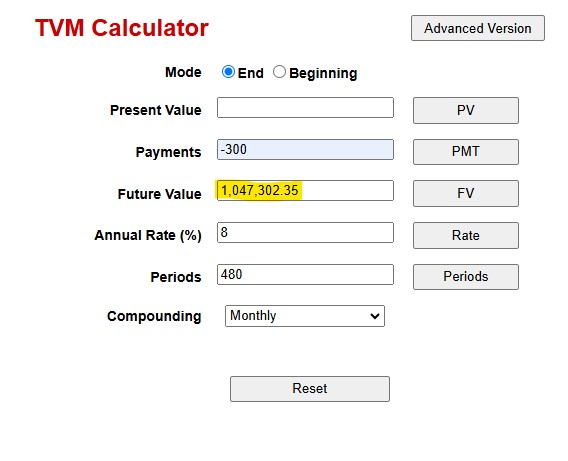

Example 1:

Imagine Sarah, a 25-year-old who invests $300 per month in a retirement account with an average annual return of 8%. By age 65, Sarah will have over $1,000,000.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

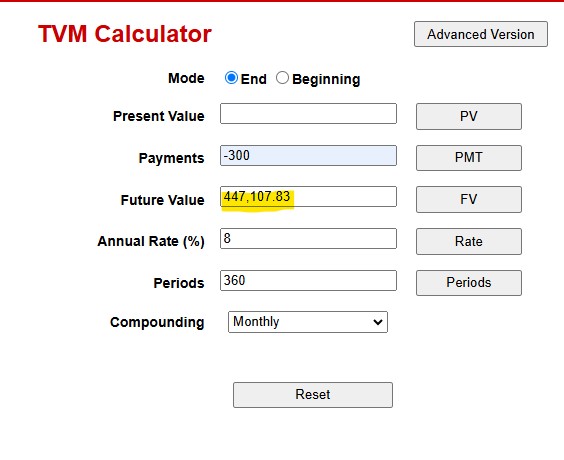

Now consider Jake, who waits until he’s 35 to start saving the same $300 per month. By 65, Jake will only have $447,000, less than half of Sarah’s total—just because he started later.

The takeaway? Starting early is like giving your money extra years to work for you.

Consistency is Key: Automate Your Savings

It’s not about saving big chunks at once—it’s about saving regularly. Automating contributions to your retirement accounts ensures that you’re consistently building wealth without needing to think about it.

Example 2:

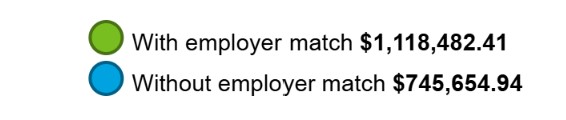

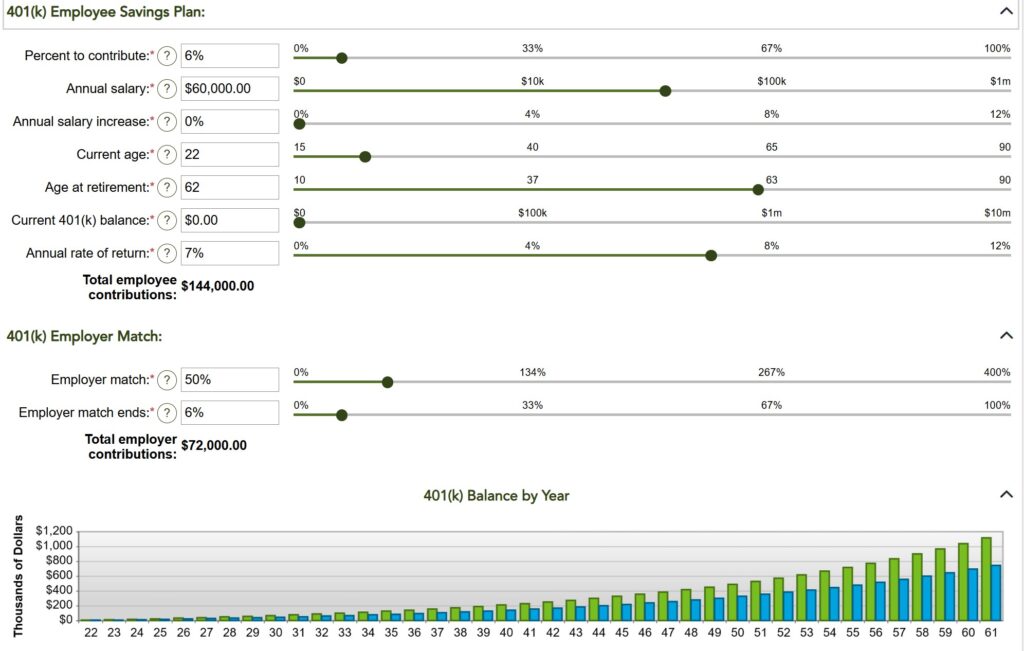

David earns $60,000 annually and chooses to save 6% of his salary in his 401(k). Over 40 years, with an assumed annual return of 7%, his retirement savings would grow to $1,118,482.41 if his employer matches 50% of his contributions. Without the employer match, his total savings would be $745,654.94.

https://www.federatedhermes.com/us/calculators/Retire401k.html

Automating his savings made it easier for David to stick to his plan and take advantage of free money through employer matches.

Invest Wisely: Keep Costs Low and Diversify

Choosing the right investments is crucial. Low-cost index funds and ETFs are excellent options because they provide diversification and minimize fees, which can erode your returns.

Avoid the Debt Trap

Debt is a significant barrier to wealth. High-interest debt, such as credit card balances, can overshadow even the best investment returns. Paying off debt early frees up more money for savings.

Example 4:

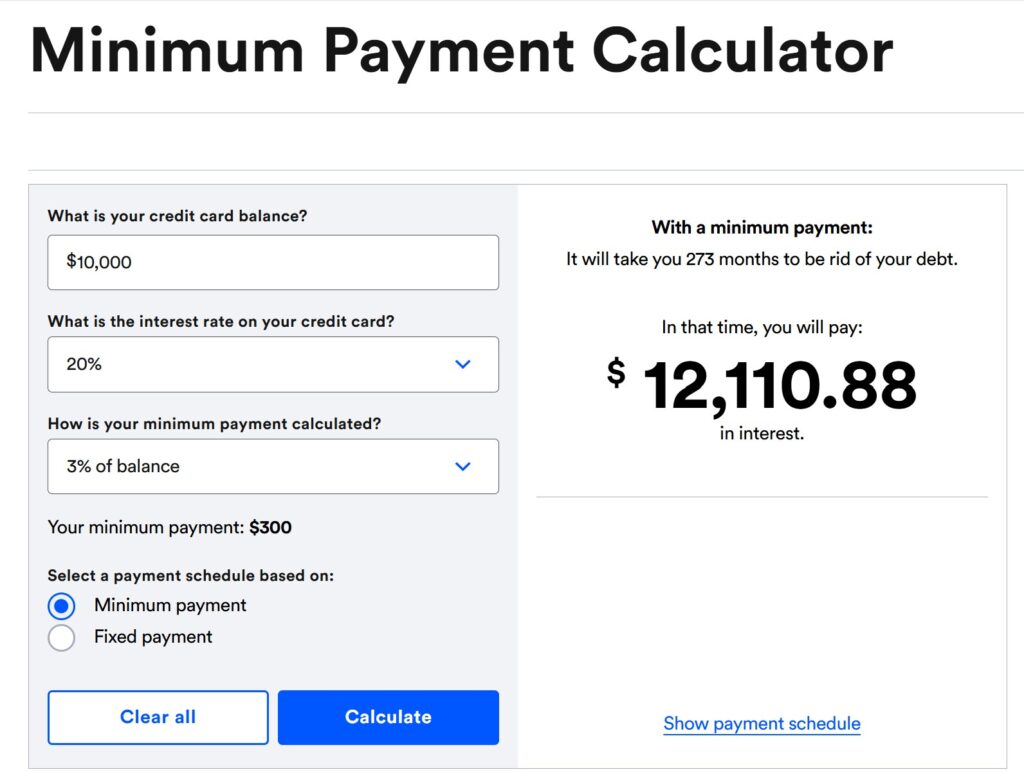

Maria has $10,000 in credit card debt with a 20% interest rate. If she only makes the minimum payments, calculated as 3% of the balance, it will take her over 20 years to pay off the debt and cost her more than $12,000 in interest. However, by aggressively paying off the debt, she can save thousands in interest and redirect those savings into her retirement fund.

https://www.bankrate.com/credit-cards/tools/minimum-payment-calculator

How Much Do You Need to Save?

The “4% rule” is a popular guideline for retirement planning. It suggests you can withdraw 4% of your retirement savings annually without running out of money.

Example 5:

If John has $1 million saved, he can withdraw $40,000 annually to cover living expenses. Combined with Social Security benefits, this amount could provide a comfortable lifestyle.

Save More as You Earn More

As your income grows, increase your savings rate. Bonuses, raises, or additional income can help accelerate your journey to $1 million.

Example 6:

Emma earns $50,000 and starts saving 10% of her income. After 5 years, her salary increases to $70,000. Instead of sticking to her original contribution of $5,000 per year, Emma raises it to 15%, or $10,500 annually. This simple adjustment significantly boosts her retirement savings over time.

Balance Today and Tomorrow

Saving for the future doesn’t mean sacrificing your quality of life today. The key is prioritizing what brings you joy while minimizing unnecessary expenses.

Example 7:

Ryan loves traveling and spends $3,000 a year on trips. To afford this while saving for retirement, he cuts back on dining out, saving $200 per month. This way, Ryan enjoys his travels while still contributing $500 a month to his IRA.

Real-Life Stories of Millionaire Retirees

Recent data from Fidelity shows there are now over 497,000 401(k) millionaires and 418,111 IRA millionaires as of September 30, 2024. These individuals weren’t all earning massive salaries—they simply followed consistent savings habits and invested wisely.

Take Action Today

Here’s a step-by-step roadmap to retiring a millionaire:

- Start Saving Now: The earlier, the better. Even small contributions grow significantly over time.

- Use Tax-Advantaged Accounts: Maximize your 401(k), IRA, or Roth IRA contributions.

- Take Advantage of Matches: Always contribute enough to get your employer’s full match.

- Invest Strategically: Opt for low-cost index funds or ETFs for diversification and lower fees.

- Increase Contributions Over Time: Save more as you earn more.

- Avoid High-Interest Debt: Focus on paying off debt to free up cash for investing.

- Find Balance: Save consistently while enjoying life.

Becoming a millionaire isn’t about earning a massive salary; it’s about building wealth one step at a time. Whether you’re earning $40,000 or $400,000, the principles remain the same: save early, save often, and invest smartly. With patience and discipline, your dream of a $1 million retirement fund can become a reality.

Your future self will thank you.

Our Newsletter Can Help You Build Wealth and Retire Rich!

Sign up for our free newsletter!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich newsletter to receive weekly updates packed with personal finance strategies and insights—delivered straight to your inbox!Please accept terms and conditions.

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.