Introduction

The gig economy has grown rapidly, with millions of workers choosing freelancing, contracting, and side gigs over traditional employment. While this offers flexibility and independence, it also presents unique financial challenges, particularly when it comes to saving for retirement. Unlike traditional employees, gig workers do not have access to employer-sponsored retirement plans like 401(k)s or pensions. This makes it essential for them to take proactive steps in planning their financial future.

Without a structured plan, many gig workers risk working indefinitely or struggling financially in their later years. However, by leveraging tax-advantaged accounts, smart investing strategies, and disciplined financial planning, gig workers can secure their retirement and build long-term wealth.

The Retirement Challenge for Gig Workers

Gig workers face several retirement hurdles that traditional employees do not encounter:

- No employer-sponsored retirement plans: Unlike corporate employees, gig workers don’t have access to an automatic 401(k) with employer matching.

- Irregular or fluctuating income: This makes it difficult to set a fixed savings amount every month.

- Self-employment taxes: Gig workers must cover both employer and employee Social Security and Medicare taxes, reducing disposable income.

- Lack of long-term financial benefits: No automatic payroll deductions for retirement savings means gig workers must take initiative to invest.

Despite these challenges, gig workers can still build significant retirement wealth using the right investment vehicles.

Best Retirement Accounts for Gig Workers

To counter the lack of a traditional 401(k), gig workers can take advantage of several tax-advantaged retirement accounts. Below are the best options and their key benefits, incorporating the latest SECURE 2.0 provisions:

Solo 401(k): Ideal for High Earners and Self-Employed Individuals

- How it works: Allows gig workers to contribute as both the employee and employer, significantly increasing contribution limits.

- Contribution Limits (2025): Up to $70,000 (or $77,500 if age 50+).

- New Age Bracket (60-63 under SECURE 2.0): Allows an additional catch-up contribution of $11,250 for individuals aged 60-63.

- Best for: Freelancers, consultants, and self-employed professionals earning substantial income.

- Example:

- Sarah, a freelance graphic designer, earns $80,000 per year. She contributes $23,500 as an employee and 20% of her net earnings ($16,500) as an employer, maximizing her tax savings and retirement growth.

SEP IRA: A Simple Option for Gig Workers with Variable Income

- How it works: Employers (including self-employed individuals) contribute up to 25% of net earnings.

- Contribution Limits (2025): Maximum contribution of $70,000.

- Best for: Gig workers who experience seasonal or fluctuating income.

- Example:

- Mark, a ride-share driver, has inconsistent monthly earnings. With a SEP IRA, he can contribute a high percentage of his earnings in strong months and lower amounts in slow months.

SIMPLE IRA: Best for Gig Workers with a Small Business

- How it works: A retirement plan similar to a traditional IRA but with higher contribution limits.

- Contribution Limits (2025): Employees can contribute $16,500 ($20,000 if 50+), with a required employer match.

- Best for: Gig workers who operate small businesses or hire employees.

Roth IRA: Ideal for Long-Term, Tax-Free Growth

- How it works: Contributions are made with after-tax income, and withdrawals are tax-free in retirement.

- Contribution Limits (2025): Up to $7,000 ($8,000 if 50+).

- Best for: Young gig workers or those expecting higher future tax rates.

- Example:

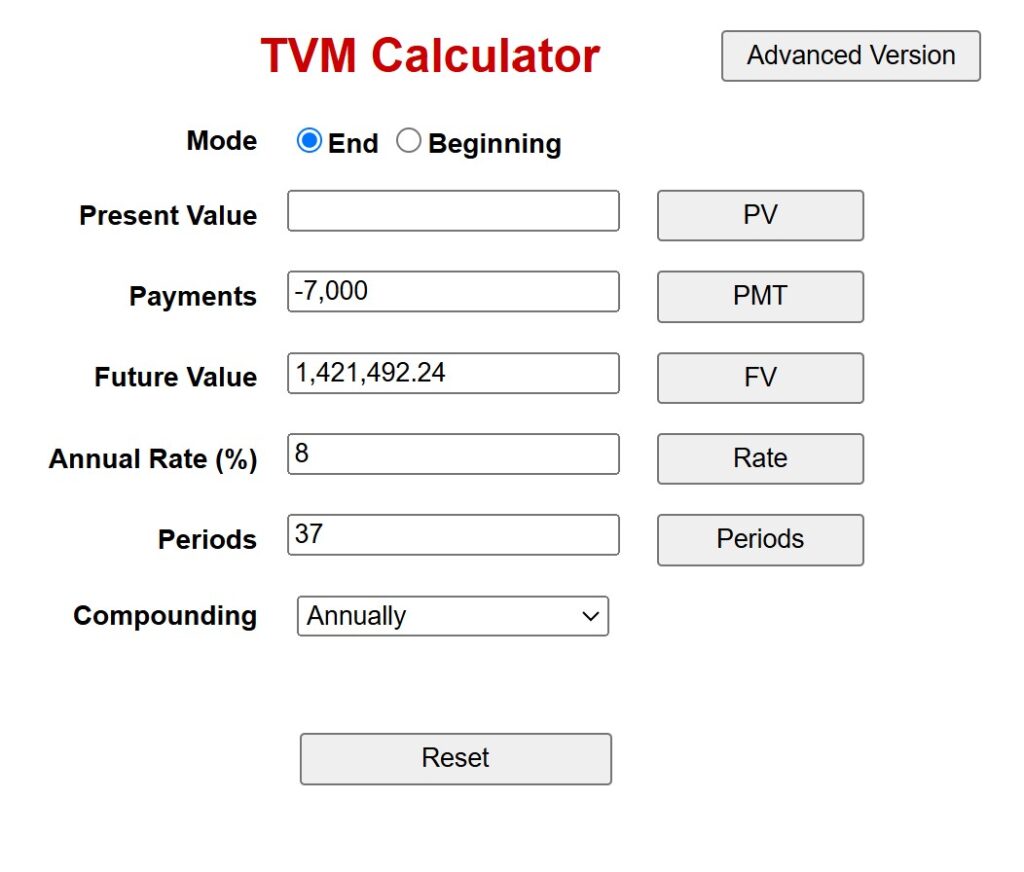

- Emily, a 28-year-old online tutor, contributes $7,000 per year. By age 65, assuming an 8% return, she will have over $1.4 million tax-free.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Breaking the Myth: “I’ll Start Saving When I Earn More”

Many gig workers delay investing, thinking they need a large income to start. However, even small, consistent investments can lead to significant wealth over time.

Example:

- If you invest just $5 a day ($150 per month) in an index fund with an 8% return, you’ll have over $350,000 in 40 years.

- Investing early allows you to take advantage of compounding interest, meaning your money grows faster over time.

Fear Factor: What Happens If You Don’t Invest?

Social Security alone is not enough for most retirees. The average monthly benefit is around $1,800, while most retirees need at least $3,500 per month for basic expenses. This gap can lead to financial struggles in retirement. Investing consistently can help bridge that gap and ensure long-term financial security.

How Gig Workers Can Save for Retirement with Irregular Income

- Automate Savings: Set up recurring contributions during high-earning months.

- Follow the Percentage Rule: Save 10-20% of each paycheck to adjust for fluctuating income.

- Build an Emergency Fund First: Having 3-6 months of expenses saved allows you to invest with confidence.

- Take Advantage of Tax Benefits: Contributions to a Solo 401(k) or SEP IRA reduce taxable income.

Long-Term Investment Strategies for Gig Workers

- Diversify Investments: Allocate funds across stocks, bonds, and ETFs to minimize risk.

- Reinvest Dividends: This accelerates compounding growth over time.

- Use Target-Date Funds: A hands-off approach that automatically adjusts your asset allocation.

- Monitor and Adjust: Review your portfolio annually and adjust contributions as income changes.

Conclusion

Even without an employer-sponsored 401(k), gig workers can secure their financial future by choosing the right retirement accounts, automating savings, and taking advantage of tax breaks. The key is to start early, stay consistent, and invest strategically.

By making smart financial decisions today, gig workers can achieve financial independence and a stress-free retirement.

Build Wealth Mantra

✔ Spend Wisely – Control expenses and avoid lifestyle inflation. ✔ Invest Early – Time in the market beats timing the market. ✔ Stay Consistent – Automate savings and stick to long-term goals. ✔ Use Tax Advantages – Leverage deductions and credits to grow wealth faster. ✔ Plan for the Future – Keep retirement a priority, no matter how uncertain income may seem.

By applying these principles, gig workers can ensure a secure retirement and financial freedom. Start planning today!

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.