A Health Savings Account (HSA) is a tax-advantaged savings account designed to help individuals with high-deductible health plans (HDHPs) save for qualified medical expenses. HSAs provide a unique combination of flexibility, growth potential, and tax benefits that make them one of the most powerful tools in personal finance. Here are the three primary tax advantages HSAs offer:

- Tax-Deductible Contributions: Contributions to an HSA are either made pre-tax through payroll deductions or can be deducted from your taxable income when filing your tax return.

- Tax-Free Growth: The funds in an HSA can grow tax-free if invested in options like mutual funds or ETFs, depending on the provider.

- Tax-Free Withdrawals: Withdrawals from an HSA are tax-free when used for qualified medical expenses, such as doctor visits, prescriptions, and certain over-the-counter items.

Key Features of HSAs

- Portability: Your HSA is yours to keep, even if you change jobs, switch health plans, or retire. This makes it a flexible savings vehicle.

- Rollovers: Unlike Flexible Spending Accounts (FSAs), unused HSA funds roll over year after year, allowing you to build a substantial balance over time.

- No Use-It-or-Lose-It Rule: You can save your HSA funds indefinitely for future medical expenses or use them as supplemental retirement savings.

- Investment Options: Many HSA providers offer investment opportunities, such as stocks, bonds, and mutual funds, which can help your savings grow over time.

Eligibility Requirements

To open and contribute to an HSA, you must meet the following criteria:

- Enrollment in an HDHP: You must be covered under a high-deductible health plan.

- No Other Health Coverage: You cannot be covered by another health plan that isn’t an HDHP.

- Not Enrolled in Medicare: Once you enroll in Medicare, you can no longer contribute to an HSA, but you can still use the funds.

- No Dependents on Another’s Tax Return: You cannot be claimed as a dependent on someone else’s tax return.

Maximize Your Health Savings Account (HSA): Don’t Let Your Cash Sit Idle

Health Savings Accounts (HSAs) are one of the most underutilized tools for building financial security, yet they hold incredible potential. Designed to help individuals with high-deductible health plans (HDHPs), HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. However, many people miss out on maximizing these benefits.

The Problem: Cash-Heavy HSAs

Despite the perks, 87% of HSA account holders keep their balances in cash, according to data from the Employee Benefit Research Institute. This means that only 13% of account holders are taking advantage of investment options available through HSAs. While holding cash provides safety and immediate liquidity, it also means missing out on the power of compound growth, which could significantly enhance your financial health over time.

Why Do People Leave Cash in Their HSAs?

There are several reasons why people choose not to invest their HSA funds:

- Lack of Awareness: Many account holders don’t realize that their HSA can function like an investment account.

- Fear of Market Volatility: Concerns about losing money in the stock market lead some to stick with cash.

- Immediate Medical Expenses: Some prefer cash for quick access to pay for current healthcare costs.

- Provider Restrictions: Some HSA providers require account holders to maintain a minimum cash balance—typically $1,000 to $2,000—before investing.

Why Investing Your HSA Matters

Investing your HSA funds can help you leverage the account’s tax advantages to build a significant nest egg for future healthcare expenses and even retirement. Here’s why investing makes sense:

- Tax-Free Growth: When you invest your HSA funds, any earnings, such as dividends and capital gains, grow tax-free.

- Long-Term Healthcare Costs: Healthcare expenses tend to increase with age, and having a larger HSA balance can provide peace of mind.

- Retirement Benefits: At age 65, HSA funds can be withdrawn for any purpose without penalty (though non-medical withdrawals will be taxed as ordinary income). This makes it a valuable supplemental retirement savings tool.

How to Start Investing Your HSA Funds

- Check Your Provider’s Investment Options: Many HSA providers offer mutual funds, ETFs, or other investment options. Review what’s available.

- Meet the Minimum Cash Balance: Ensure you maintain any required minimum balance in cash.

- Choose a Diversified Portfolio: Select investments based on your risk tolerance and long-term goals.

- Contribute Regularly: Maximize your annual HSA contributions to take full advantage of the tax benefits.

- Pay Out-of-Pocket for Current Expenses: If possible, pay for current medical expenses with other funds to allow your HSA investments to grow.

Practical Example: The Power of Investing

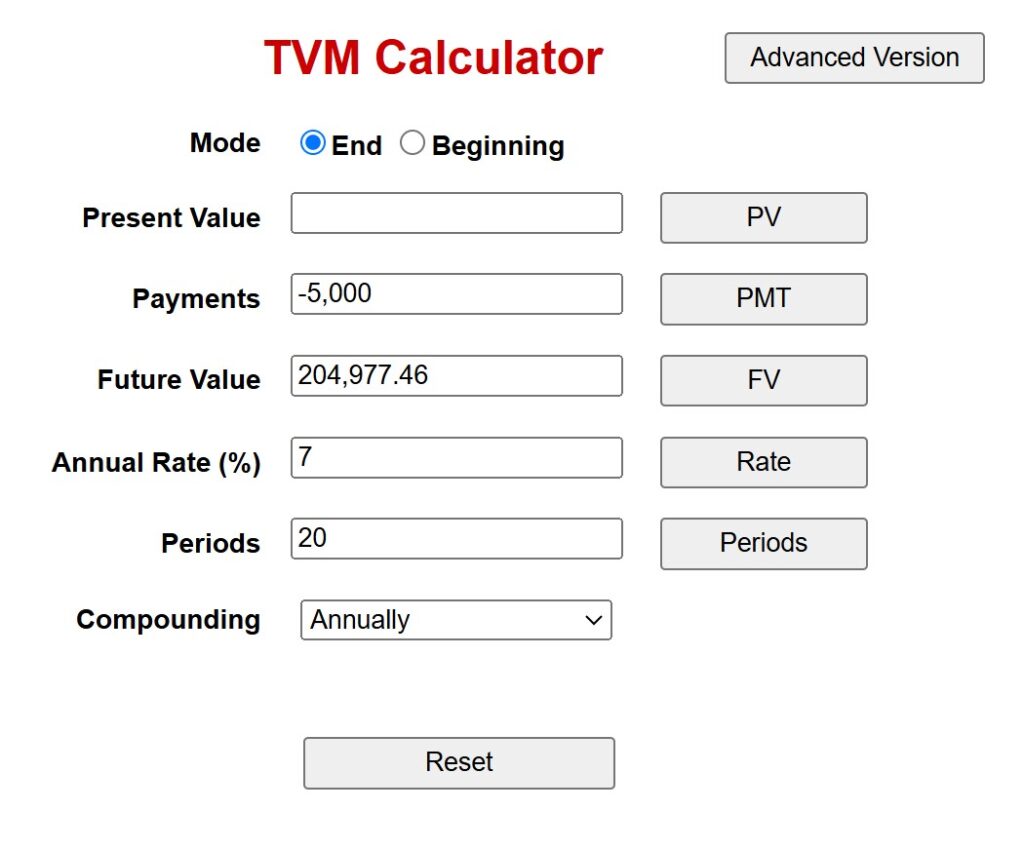

Consider this scenario: You contribute $5,000 annually to your HSA and invest the funds in a diversified portfolio earning an average of 7% annually. After 20 years, your HSA balance could grow to about $205,000, assuming no withdrawals. In contrast, if you keep the funds in cash with no growth, your balance would be limited to the total contributions of $100,000.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Final Thoughts

Don’t let your HSA’s potential go untapped. While it’s important to keep some funds liquid for immediate needs, investing the excess can transform your HSA into a powerful wealth-building tool. Consult with a financial advisor to create a strategy that aligns with your healthcare and retirement goals.

By taking a proactive approach, you can turn your HSA into more than just a savings account—it can become a cornerstone of your long-term financial security.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.