When most people think about a Health Savings Account (HSA), they see it as a short-term tool for covering medical expenses. However, what many don’t realize is that an HSA can be a powerful investment vehicle—one that offers unmatched tax benefits and can play a crucial role in long-term financial security.

If used strategically, an HSA can accumulate hundreds of thousands of dollars—or even reach $1 million—by retirement. Instead of treating it like a medical checking account, consider maximizing its growth potential.

What Is an HSA?

An HSA is a tax-advantaged savings account available to individuals enrolled in a high-deductible health plan (HDHP). It is designed to help people save for medical expenses while providing significant tax advantages.

The Triple Tax Advantage

One of the most attractive features of an HSA is its triple tax advantage:

- Tax-free contributions: Contributions to an HSA are made pre-tax, lowering your taxable income.

- Tax-free growth: Investments inside an HSA grow tax-free, meaning there are no capital gains taxes.

- Tax-free withdrawals: When used for qualified medical expenses, HSA withdrawals are completely tax-free.

Unlike Flexible Spending Accounts (FSAs), your HSA funds roll over year after year—there’s no deadline for using the money.

2025 HSA Contribution Limits

For 2025, the HSA contribution limits are:

- Individuals: $4,300

- Families: $8,550

- Catch-up contribution (age 55 and older): Additional $1,000

The earlier you start contributing, the more time your money has to grow.

Can You Really Reach $1 Million With an HSA?

A study by the Employee Benefit Research Institute found that under the right conditions, an HSA could reach $1 million by retirement. The study assumed:

- The individual starts contributing at age 25 and continues through age 64.

- Annual contributions are maxed out each year.

- The funds are invested and earn a 7.5% return per year.

With these assumptions, an HSA balance could reach $1 million by retirement. Even with a more conservative 5% annual return, the account could still grow to $540,000—a substantial sum to cover healthcare costs in retirement.

How to Maximize Your HSA for Long-Term Growth

Most people use HSAs to pay for current medical expenses, but if you want to unlock their full potential, consider the following strategies:

1. Contribute the Maximum Amount Every Year

Even if you cannot contribute the full amount, try to save as much as possible. Every dollar contributed lowers your taxable income and gives your money more time to grow.

2. Invest Your HSA Funds

One of the biggest mistakes people make is leaving their HSA funds in cash instead of investing them. Many HSA providers allow you to invest in:

- Index funds

- Exchange-traded funds (ETFs)

- Mutual funds

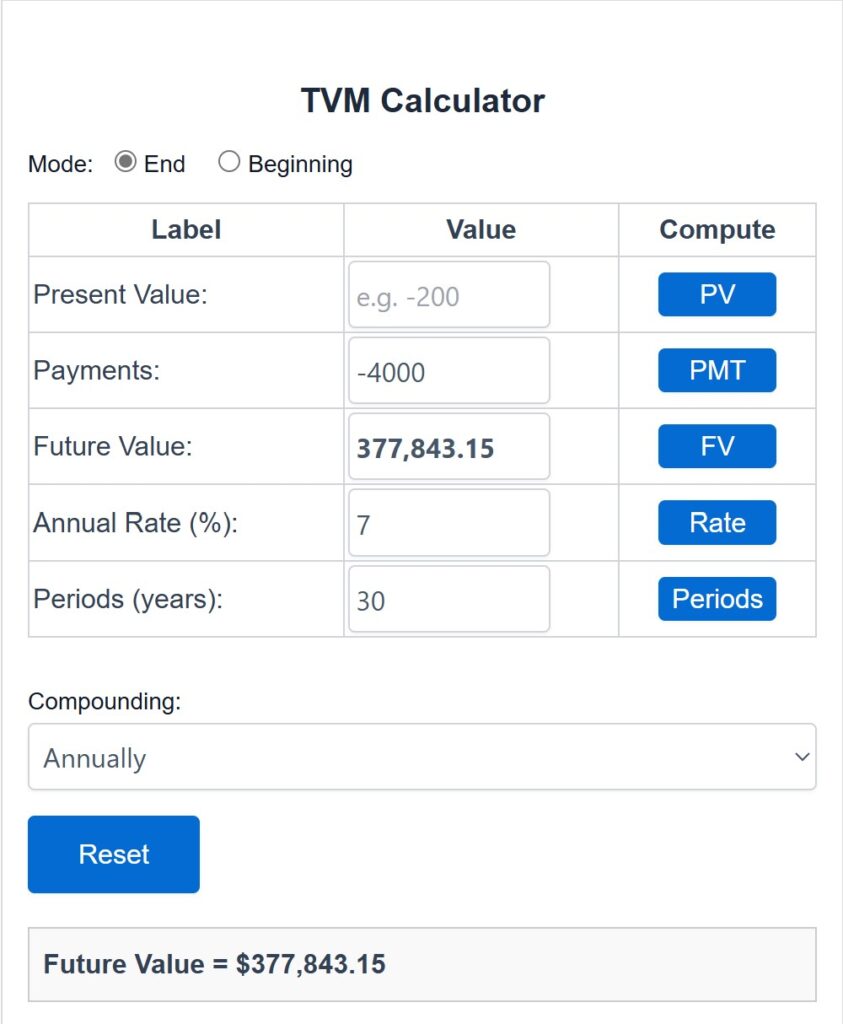

For example, if you contribute $4,000 per year and earn an average 7% return, your HSA could grow to over $377,000 in 30 years.

Time Value of Money – Build Wealth Retire Rich

3. Pay for Medical Expenses Out of Pocket When Possible

Instead of withdrawing from your HSA, consider paying for medical expenses with other funds. Since there’s no deadline to use HSA funds, you can let the balance grow and reimburse yourself years later when needed.

For example, if you pay $2,000 in medical expenses today, you can save the receipt and withdraw that amount decades later, tax-free, when your account has grown significantly.

4. Use Your HSA as a Retirement Health Fund

Once you turn 65, HSA funds can be used for any expense—not just medical costs. Withdrawals for non-medical expenses will be taxed like a 401(k) or IRA, but there is no penalty.

By keeping an HSA invested long-term, you can build a dedicated fund for:

- Medicare premiums

- Long-term care

- Out-of-pocket medical expenses in retirement

What Happens to Your HSA If You Change Jobs?

One of the greatest benefits of an HSA is that it stays with you even if you change jobs.

Unlike employer-sponsored health benefits like FSAs, HSAs are fully portable. If you switch employers, you keep the funds and continue using them for qualified medical expenses. There is no time limit on when you must use the funds.

For example, if you accumulate $50,000 in an HSA over several years, that money remains yours even if you leave your job, switch to a new insurance plan, or retire.

Common Myths About HSAs

Myth 1: I Need to Use My HSA Funds Right Away

Reality: HSA funds roll over each year, and there’s no deadline to spend them.

Myth 2: I Can’t Invest My HSA Funds

Reality: Many providers offer investment options, allowing you to grow your HSA like a retirement account.

Myth 3: I’ll Lose My HSA If I Change Jobs

Reality: HSAs are not tied to an employer—the money belongs to you no matter where you work.

Myth 4: HSAs Are Only for the Wealthy

Reality: Anyone with a high-deductible health plan (HDHP) can open an HSA. Even small contributions add up over time.

Is an HSA Right for You?

HSAs are not for everyone. To qualify, you must be enrolled in a high-deductible health plan (HDHP).

If you have frequent medical expenses and struggle with out-of-pocket costs, an HSA might not be the best option. However, if you can afford to cover healthcare expenses with other funds, an HSA can be one of the best long-term savings tools available.

Even if you don’t reach $1 million, having a well-funded HSA can provide:

- Peace of mind for future medical costs

- Tax-free savings for healthcare

- Additional retirement funds after age 65

Final Thoughts

A Health Savings Account is more than just a way to cover medical bills. With its unique tax advantages, it can serve as a powerful tool for building long-term wealth.

If you have access to an HSA, consider maximizing contributions, investing funds, and delaying withdrawals to let your money grow. Even if you do not contribute the full amount each year, starting early and being consistent can make a significant difference in your financial future.

Before making any decisions, check with your HSA provider to see if you have investment options available. If your funds are sitting in cash, you may be missing out on thousands of dollars in potential growth.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.