Introduction

A well-structured investment plan is essential for achieving long-term financial success. Many individuals invest without a clear strategy, which can lead to missed opportunities, excessive risk, or failure to meet financial goals. A personalized investment plan ensures that your investments align with your objectives, risk tolerance, time horizon, and financial situation.

This guide provides a step-by-step approach to building a tailored investment strategy that helps grow and protect wealth over time.

Step 1: Define Your Financial Goals

Before making any investment decisions, it is crucial to establish clear, realistic financial goals. Common investment goals include:

- Short-Term Goals (1-5 years): Emergency fund, down payment on a house, vacation fund, car purchase.

- Medium-Term Goals (5-15 years): College savings, home renovations, starting a business.

- Long-Term Goals (15+ years): Retirement, financial independence, wealth transfer.

Each goal should follow the SMART principle:

- Specific (clearly defined goal)

- Measurable (quantify the amount needed)

- Achievable (realistic based on income and savings rate)

- Relevant (aligned with your overall financial objectives)

- Time-Bound (specific deadline for reaching the goal)

Example: If your goal is to retire with $2 million in 30 years, you can calculate the amount you need to save and invest monthly to reach that goal.

Step 2: Assess Your Risk Tolerance

Risk tolerance varies among investors and is influenced by factors such as age, income, financial stability, and investment experience.

Risk Tolerance Categories:

- Conservative Investor – Prefers low-risk investments with steady returns (bonds, dividend stocks, CDs).

- Moderate Investor – Balances risk and return with a mix of stocks, bonds, and ETFs.

- Aggressive Investor – Focuses on high-risk, high-reward assets like growth stocks, real estate, and cryptocurrencies.

Assessing Risk Tolerance:

- Can you handle market fluctuations without panic selling?

- Do you prefer stable, predictable returns over potential high gains?

- Would you be comfortable holding investments during a market downturn?

A good rule of thumb: The younger you are, the more risk you can take, as you have time to recover from market downturns.

Step 3: Determine Your Asset Allocation

Asset allocation is the process of dividing your portfolio among different asset classes to manage risk and maximize returns.

Recommended Asset Allocation by Age

| Age Group | Stocks | Bonds | Alternatives (Real Estate, REITs, Crypto) |

|---|---|---|---|

| 20s-30s | 80-90% | 10-20% | 5-10% |

| 40s-50s | 60-75% | 25-35% | 5-10% |

| 60s+ | 40-50% | 50-60% | 5% |

Younger investors should allocate more to stocks and growth assets since they have time to ride out volatility. Older investors should shift towards bonds and income-generating investments to preserve capital.

Step 4: Select Investment Vehicles

Once you determine your asset allocation, it’s time to choose the right investment vehicles.

Stock Market Investments:

- Index Funds & ETFs: Low-cost, diversified funds (e.g., S&P 500 index fund, total market ETFs).

- Individual Stocks: Investing in strong companies with growth potential.

- Dividend Stocks: Companies that provide steady income.

Fixed-Income Investments:

- Bonds: Government, municipal, and corporate bonds.

- Bond ETFs: Provides exposure to a basket of bonds.

Alternative Investments:

- Real Estate & REITs: Investing in rental properties or real estate investment trusts.

- Cryptocurrency: Bitcoin, Ethereum, and altcoins (only for high-risk investors).

- Commodities: Gold, silver, oil, and agricultural products.

Example Portfolio for a 35-Year-Old Moderate Investor:

- 60% in stock market (index funds + individual stocks)

- 25% in bonds and fixed income

- 10% in real estate

- 5% in cryptocurrency

Step 5: Choose the Right Accounts

The type of account you use can impact your investment returns due to tax advantages.

| Account Type | Purpose | Tax Benefit |

| 401(k) / 403(b) | Retirement | Tax-deferred growth, employer match |

| Roth IRA | Retirement | Tax-free withdrawals in retirement |

| Traditional IRA | Retirement | Tax deductions on contributions |

| Brokerage Account | General investing | No tax benefits but unlimited access |

| 529 Plan | Education savings | Tax-free withdrawals for education expenses |

| HSA (Health Savings Account) | Medical expenses | Triple tax benefits |

Tax-efficient investing helps you maximize your returns and minimize the tax burden.

Step 6: Implement a Contribution Strategy

Consistency is key when investing. Consider these strategies:

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of market conditions.

- Lump-Sum Investing: Invest a large sum at once if you have extra cash available.

- Automatic Contributions: Set up recurring contributions to your investment accounts.

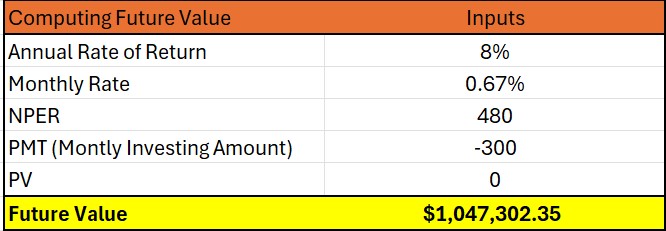

Example: If your goal is to retire with $1 million in 40 years, contributing $300 per month to an investment growing at 8% annually will help you reach that target.

Step 7: Regularly Monitor and Rebalance Your Portfolio

Market fluctuations can shift your portfolio away from your target allocation. Rebalancing ensures that your investments stay aligned with your strategy.

When to Rebalance:

- Every 6-12 months

- If an asset class shifts more than 5-10% from your target allocation

- During major life changes (marriage, having children, retirement)

Step 8: Avoid Common Investing Mistakes

- Emotional Investing: Making impulsive decisions during market downturns.

- Timing the Market: Trying to predict market highs and lows.

- Neglecting Fees: Investing in high-fee funds that eat into returns.

- Ignoring Diversification: Putting all money in one stock or sector.

- Overlooking Taxes: Not using tax-efficient strategies.

Conclusion: Stay the Course and Build Wealth

A personalized investment plan helps you achieve financial security by aligning investments with your goals, risk tolerance, and time horizon. Investing is a long-term journey, and by following a disciplined approach, you can grow wealth over time while managing risks effectively.

Key Takeaways:

- Define clear financial goals before investing.

- Assess risk tolerance and adjust investments accordingly.

- Diversify across stocks, bonds, and alternative investments.

- Use tax-advantaged accounts for maximum efficiency.

- Stick to a consistent contribution strategy and rebalance regularly.

Your Mantra for Success: “Plan smart. Invest wisely. Build wealth.”

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.