© stock.adobe.com

Achieving early retirement isn’t just a dream—it’s a goal that many people are turning into a reality with the right financial strategies. Here are some proven tips inspired by a financial planners who help clients retire early:

1. Start Saving Early

Time is your greatest asset. The earlier you start saving, the more you benefit from the power of compound interest. Even small, consistent contributions can grow into a substantial nest egg over time.

Let’s compare two individuals: Sam and Chris. Both plan to retire at age 65 and invest in an account that earns 7% annual interest.

- Sam starts saving $100 per month at age 25 and saves for 40 years.

- Chris starts saving $100 per month at age 35 and saves for 30 years.

Growth with Compound Interest:

Using a 7% annual return:

Sam’s savings at age 65:

After saving $100 per month for 40 years at a 7% annual interest rate, Sam’s total savings grow to approximately $262,481.

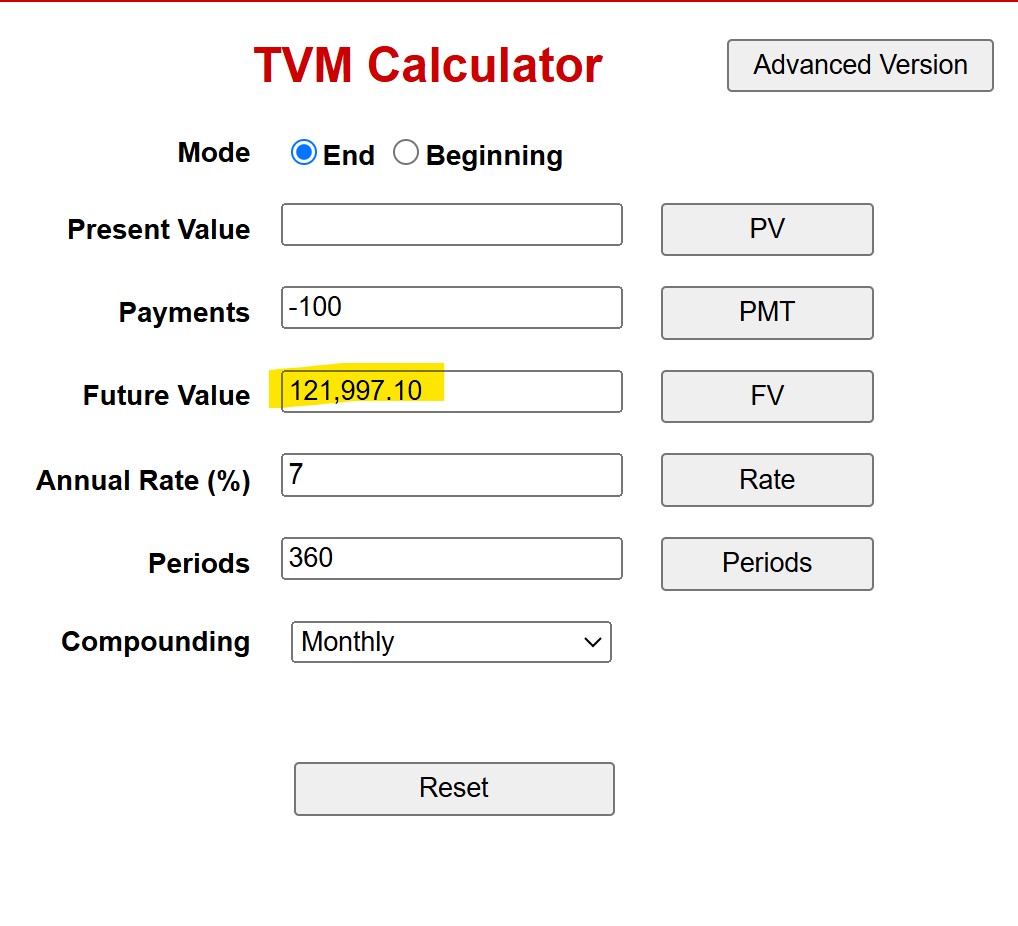

Chris’s savings at age 65:

After saving $100 per month for 30 years at the same rate, Chris’s total savings grow to approximately $121,997.

Calculator: https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Key Takeaways:

- Sam contributed only $12,000 more than Chris but ended up with twice as much due to starting earlier.

- The extra 10 years of saving and compounding significantly boosted Sam’s final savings.

- Starting early allows your money more time to grow, even with smaller contributions.

The earlier you start, the easier it becomes to achieve your financial goals!

2. Save Aggressively

Early retirees often save a significant portion of their income—sometimes 50% or more. This may require prioritizing savings over discretionary spending, but the payoff is worth it. Every dollar saved brings you closer to financial independence.

3. Invest Wisely

Choose investments that balance growth and risk. Low-cost index funds, stocks, and bonds are excellent choices for long-term growth. A diversified portfolio ensures stability, even during market fluctuations.

4. Live Below Your Means

Avoid lifestyle inflation, even as your income grows. Focus on needs, not wants, and find satisfaction in financial security over material possessions.

5. Maximize Tax-Advantaged Accounts

Take full advantage of retirement accounts like 401(k)s and IRAs. Not only do these accounts offer tax benefits, but they also allow your savings to grow faster. If you’re 50 or older, make catch-up contributions to boost your savings further.

6. Pay Off High-Interest Debt

Debt, especially high-interest debt like credit cards, can derail your financial goals. Eliminating debt frees up more resources for saving and investing.

7. Prepare for Healthcare Costs

Healthcare is a significant expense in retirement. If you’re eligible, use a Health Savings Account (HSA) to save for medical costs. These accounts offer triple tax advantages: contributions, growth, and withdrawals for qualified expenses are tax-free.

8. Delay Social Security

For those who plan to partially retire early, delaying Social Security can increase your monthly benefits when you do claim them. This provides more financial security in your later years.

9. Review and Adjust Your Plan

Life and markets change. Regularly review your financial plan to ensure it aligns with your goals. Adjust investments, savings rates, or spending habits as needed.

Why Early Retirement?

Early retirement isn’t just about quitting your job—it’s about financial freedom. It allows you to pursue passions, spend time with loved ones, or explore hobbies without the stress of earning a paycheck.

These strategies, when followed consistently, can turn your dream of early retirement into a reality. Remember, the journey requires discipline, but the reward is living life on your terms.

What’s your biggest challenge or question about planning for early retirement? Let’s discuss in the comments!

Our Newsletter Can Help You Build Wealth and Retire Rich!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich Newsletter to receive weekly updates packed with personal finance strategies and insights—delivered straight to your inbox!

Sign up for our free newsletter!

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.