Introduction

Building wealth isn’t just about earning more—it’s about adopting the right mindset toward investing. Many people remain stuck in a paycheck-to-paycheck cycle because they see money as something to spend rather than grow.

To retire rich, you must shift your mindset from consumption to investment-driven wealth building. This means prioritizing long-term growth, strategic financial decisions, and disciplined investing over short-term gratification. Let’s explore how adopting an investor’s mindset can help you build long-term financial security and financial independence.

1. The Poor Mindset: “I Deserve to Spend” vs. The Rich Mindset: “I Deserve to Invest”

Many people believe that when they earn more, they should immediately upgrade their lifestyle—a bigger house, a nicer car, more vacations. This is known as lifestyle inflation, where spending increases in proportion to income, keeping individuals financially stagnant.

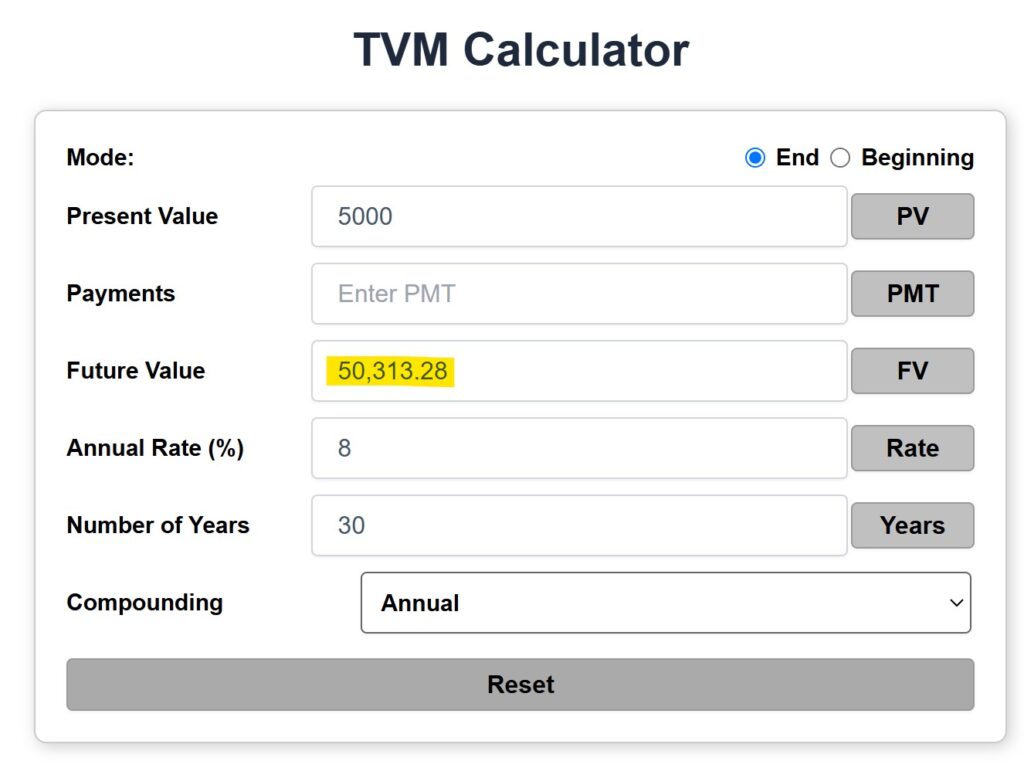

Example:

- Jake gets a $5,000 bonus. He thinks, “I worked hard, I deserve to treat myself,” and spends it on a new TV and a vacation.

- Emma gets the same $5,000 bonus. She thinks, “I deserve to make this money work for me,” and invests it in an index fund. At an 8% return, that $5,000 could grow to $50,000 in 30 years—without adding another penny.

- Stocks have historically outperformed bonds in terms of returns, making them a strong choice for long-term growth. However, managing risk is essential. The S&P 500 has delivered an average annual return of approximately 7% to 8% after adjusting for inflation.

https://buildwealthretirerich.com/tvm/

Mindset Shift: Before spending extra money, ask yourself: “How can I make this money generate more wealth for me?”

2. The Poor Mindset: “Money Is for Spending” vs. The Rich Mindset: “Money Is for Investing”

People with a poor mindset believe money is meant to be spent, while people with a rich mindset view money as a tool for investment growth. The wealthy understand that every dollar should have a job—either working for them through investments or providing for essential needs.

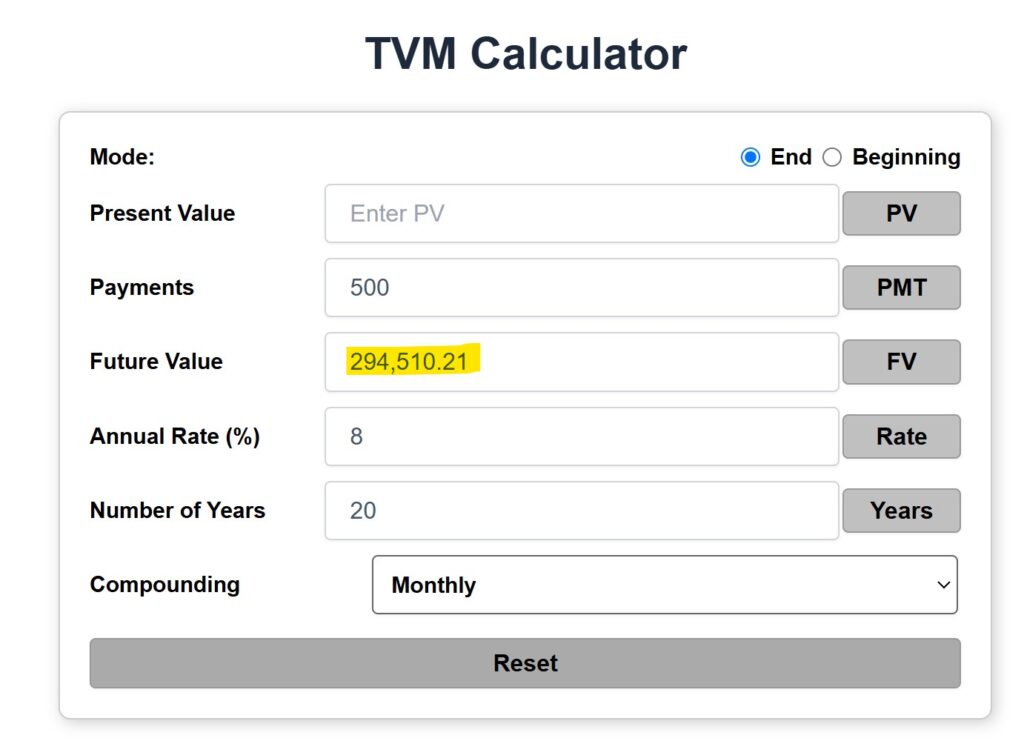

Example:

- Lisa spends $500 a month on unnecessary purchases, like designer clothes and frequent dining out. Over 20 years, that’s $120,000 spent with no return.

- Kevin invests $500 a month into an index fund with a 8% return. With compound growth, his investment grows to almost $300,000 in 20 years.

https://buildwealthretirerich.com/tvm/

Mindset Shift: Every time you’re about to spend money, ask: “Is this purchase increasing my wealth or just making someone else richer?”

3. The Poor Mindset: “I Can’t Afford to Invest” vs. The Rich Mindset: “I Can’t Afford NOT to Invest”

Many people believe they need a high salary to start investing. However, the real cost is waiting. Investing even small amounts early results in exponentially greater returns than waiting until you have a larger income.

Example:

- Alex says, “I’ll invest later when I make more money.” He waits 10 years, then starts investing $500 per month.

- Mia starts investing $200 per month today. Even though she invests less per month, she will have more money than Alex by retirement—because starting early beats investing more later.

Mindset Shift: Even if you start with $50 a month, begin investing today. The most expensive investment is the one you never make.

4. The Poor Mindset: “Saving Is Enough” vs. The Rich Mindset: “Investing Grows Wealth”

Saving money is important, but saving alone won’t make you wealthy. Inflation erodes the value of cash over time, while investments outpace inflation and provide long-term security.

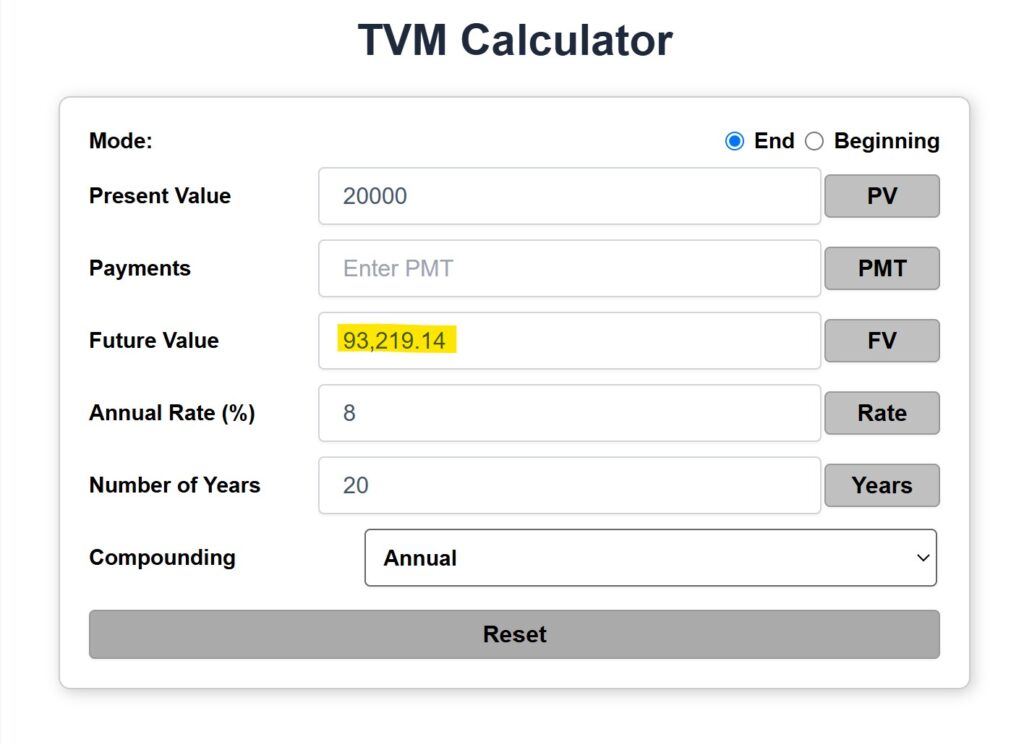

Example:

- Ryan saves $20,000 in a bank account earning 0.5% interest. After 20 years, inflation has reduced his purchasing power, and his savings have barely grown.

- Sophia invests $20,000 in an index fund. With an average 8% return, her investment grows to $93,000 in the same period.

https://buildwealthretirerich.com/tvm/

Mindset Shift: Saving is just step one—the key to wealth is investing savings in high-growth assets.

5. The Poor Mindset: “Debt Is a Burden” vs. The Rich Mindset: “Debt Is a Tool”

Many people avoid debt at all costs, but those with an investor’s mindset know that strategic debt can accelerate wealth building when used wisely.

Example:

- Mark uses credit cards for shopping sprees, accumulating high-interest debt that drains his income.

- Olivia takes out a low-interest loan to purchase a rental property that generates passive income and appreciates over time.

Mindset Shift: Not all debt is bad—use good debt to buy assets that increase in value and generate income.

6. The Poor Mindset: “Retirement Is Too Far Away” vs. The Rich Mindset: “Retirement Planning Starts Now”

Many young people believe retirement planning can wait. In reality, early investing means needing less money to retire comfortably.

Example:

- David starts saving for retirement at 45, needing to invest $1,500 per month to reach his goal.

- Natalie starts investing at 25 and only needs $400 per month to reach the same retirement amount.

Mindset Shift: The earlier you invest, the less you have to save and the more wealth you build.

7. The Poor Mindset: “Investing Is Too Risky” vs. The Rich Mindset: “Risk Comes from Not Investing”

Some people avoid investing because they fear market downturns. However, avoiding investments means losing out on long-term compound growth.

Example:

- Ethan avoids investing because he’s afraid of stock market crashes. Instead, he keeps his money in a low-interest savings account.

- Ava invests steadily over 30 years. While she experiences market downturns, her long-term gains far exceed Ethan’s stagnant savings.

Mindset Shift: Avoiding investments is the biggest risk. Long-term investors see market dips as buying opportunities.

Final Thought: Investing Is a Mindset Shift

The journey to wealth isn’t about luck—it’s about making smart financial decisions early and consistently.

- Think like an investor, not a spender.

- Let your money work for you through investments.

- Invest first, spend later.

- Use debt strategically to build assets.

By shifting to an investor’s mindset, you create the foundation for long-term financial security, generational wealth, and financial independence.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.