The journey to financial success doesn’t start with large amounts of money. Instead, it begins with a mindset: the millionaire mindset. This mindset is all about thinking long-term, staying disciplined, and being consistent.

The reality is that most people don’t achieve wealth overnight. The people who do tend to focus on the habits and behaviors that will lead to success over time. When it comes to investing, this means:

- Starting Small: You don’t need a large sum to start investing. As we will discuss even a small investment like $10 can grow into something substantial over time.

- Being Consistent: Regularly contributing to your investments, whether it’s daily, weekly, or monthly, is key to achieving your financial goals.

- Thinking Long-Term: Wealth isn’t built in a day. It’s built over decades. The earlier you start investing, the more time your money has to grow. You need patience and a long-term perspective to truly reap the rewards of compound interest.

- Staying Disciplined: There will always be temptations to spend money on things you don’t need. The key to building wealth is resisting those temptations and staying disciplined with your investments.

The millionaire mindset is all about focusing on the future and staying the course, even when it feels like progress is slow. The good news is that you don’t need to be a financial genius to adopt this mindset; you just need to commit to small, consistent actions that align with your long-term goals.

In today’s fast-paced world, $10 doesn’t seem like much. Whether you grab a cup of coffee from your favorite café, buy lunch, or get a couple of snacks at the grocery store, you know that $10 doesn’t go far. It’s easy to think, “What could I possibly do with just ten bucks?”

But here’s a thought: what if you took that same $10 and invested it? What if you consistently set aside small amounts, and instead of spending it, you put it to work, allowing it to grow over time? What if I told you that by investing $10 at an 8% return, compounded daily, you could become a millionaire over time? This is not some far-fetched dream; it’s a clear demonstration of how the power of compound interest can turn small amounts into a fortune.

The Power of Compounding

Albert Einstein famously called compound interest “the eighth wonder of the world.” Why? Because compounding doesn’t just allow you to earn interest on your original investment, but also on the interest accumulated from prior periods. Over time, this can have a profound impact on your wealth.

Let’s break this down: If you invest $10 at an 8% annual return, compounded daily for 40 years, it grows exponentially. You’re not just earning 8% on your original $10 each year; you’re earning interest on your accumulated interest. That snowball effect is what makes compound interest so powerful.

Consistent Investing Turns Small Change into Big Returns

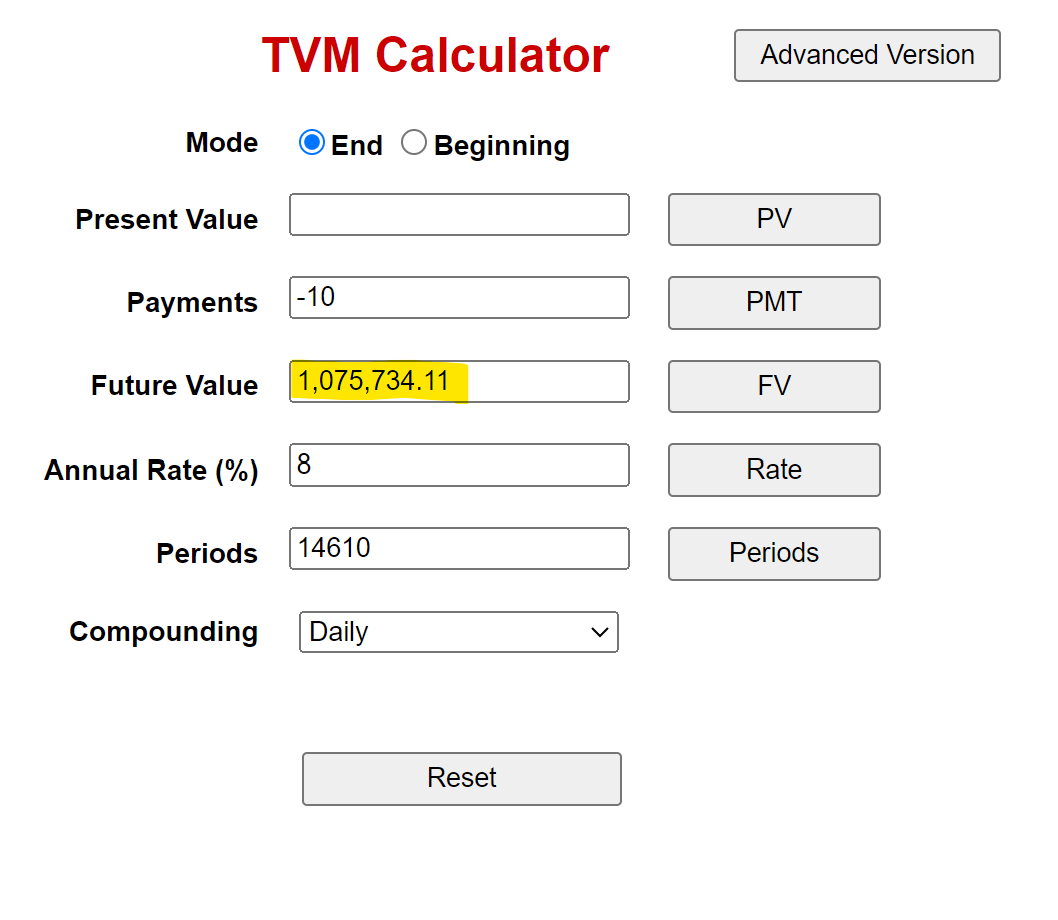

The key to reaching millionaire status with small investments is consistency. If you were to invest $10 every day at an 8% annual return, your wealth could accumulate to over $1 million within 40 years. Here’s why: each $10 you invest starts earning interest from the day you invest it, and the earlier you start, the more your money can grow.

- Daily Investment: If you invest $10 a day at an 8% return, your daily contributions could accumulate to over $1.0 million after 40 years.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

The point here is that even small amounts, invested consistently, can grow into a significant sum. The earlier you start, the better your results will be, thanks to the exponential growth of compound interest.

Investing is for Everyone

One of the biggest misconceptions about investing is that it’s only for the wealthy. In reality, investing is accessible to anyone with a little bit of money and the willingness to commit to it. Today, many brokerage platforms allow you to invest with as little as $5. They make it easy to set up recurring investments, so you can start building wealth with just a few dollars a day. And the best part? You don’t need to be a stock market expert.

Save and Invest $10: A Small Step Towards Financial Independence

When you change how you think about money, even small amounts like $10 can have a significant impact on your financial future. By adopting the millionaire mindset and understanding the power of compound interest, you can turn seemingly insignificant sums into meaningful wealth.

Here’s how you can start:

- Identify Small Savings: Look for areas in your life where you can cut back by just $10. It could be skipping a takeout meal once a week, bringing your own coffee, or cutting a subscription you rarely use.

- Set Up Recurring Investments: Choose an investment platform that allows you to automate your investments. Set a recurring $10 investment daily, weekly, or monthly, depending on what you can afford.

- Stay Consistent: The key to building wealth is consistency. Stick with your investment plan, and resist the urge to withdraw your funds. Let compound interest work its magic over time.

- Think Long-Term: Focus on the long-term benefits of your investment. Don’t be discouraged if your initial returns seem small. Remember, wealth takes time to grow, and the longer you leave your money invested, the more it can grow.

Conclusion: From $10 to a Millionaire

Building wealth doesn’t require huge sums of money or complicated strategies. With a millionaire mindset, a bit of discipline, and a commitment to consistent investing, you can turn even the smallest amounts into a substantial fortune.

Remember, it’s not about how much money you start with; it’s about how consistently you invest and how long you let your investments grow. Start with just $10, and let the power of compound interest turn it into something much, much bigger.

It’s time to take control of your financial future. Start saving, start investing, and watch as your wealth begins to grow.

Our Newsletter Can Help You Build Wealth and Retire Rich!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich newsletter to receive weekly updates packed with personal finance strategies and insights that are delivered straight to your inbox!

Sign up for our free newsletter!

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.