Graduating college is a monumental achievement, marking the culmination of years of dedication and hard work. As you step into the next chapter of life, it’s time to set your sights on another milestone—becoming a 401(k) millionaire. While the number might sound daunting, it’s absolutely achievable with the right plan and mindset.

Here’s how you can turn your first paycheck into a foundation for financial independence and a future filled with opportunities.

Why Aim for a 401(k) Millionaire Status?

A 401(k) plan is one of the most powerful tools for building wealth over time. By contributing regularly, taking advantage of employer matching, and letting compound interest work its magic, you can grow your retirement savings significantly. Becoming a 401(k) millionaire doesn’t just mean retiring in comfort; it means having the freedom to live life on your terms.

Here’s why aiming for $1 million in your 401(k) is a practical goal:

- Compound Growth: Investing early allows your money to grow exponentially over time.

- Tax Advantages: Contributions to a traditional 401(k) are pre-tax, reducing your taxable income today, while Roth 401(k) contributions grow tax-free.

- Employer Matching: Many employers contribute additional funds to your 401(k), supercharging your savings.

How to Get Started

- Sign Up for Your Employer’s 401(k) Plan Immediately

- As soon as you start your first job, make enrolling in your company’s 401(k) plan a priority.

- Many employers offer matching contributions—essentially free money. For example, if your employer matches 50% of contributions up to 6% of your salary, contributing at least that amount ensures you don’t leave money on the table.

- Example: David earns $60,000 annually and chooses to save 6% of his salary in his 401(k). Over 40 years, with an assumed annual return of 7%, his retirement savings would grow to $1,118,482.41 if his employer matches 50% of his contributions. Without the employer match, his total savings would be $745,654.94. Read the article for calculation on the benefits of company matching https://buildwealthretirerich.com/retiring-a-millionaire-a-simple-path-for-everyday-people/

- Start Small but Stay Consistent

- If you can’t contribute the maximum right away, don’t worry. Start with 5%-10% of your paycheck and increase it annually or when you get a raise.

- Remember, even a small amount can grow significantly over time thanks to compound interest.

- Choose Investments Wisely

- Most 401(k) plans offer target-date funds, which automatically adjust your investments based on your retirement timeline.

- If you prefer to choose your investments, consider a mix of index funds that balance growth and risk.

- Maximize Contributions

- For 2024, the elective deferral limit for 401(k) plans is $23,000. If you’re under 50, aim to contribute as much as you can afford.

- If you’re self-employed, look into a Solo 401(k) plan for even higher contribution limits.

- Understand the Power of Compounding

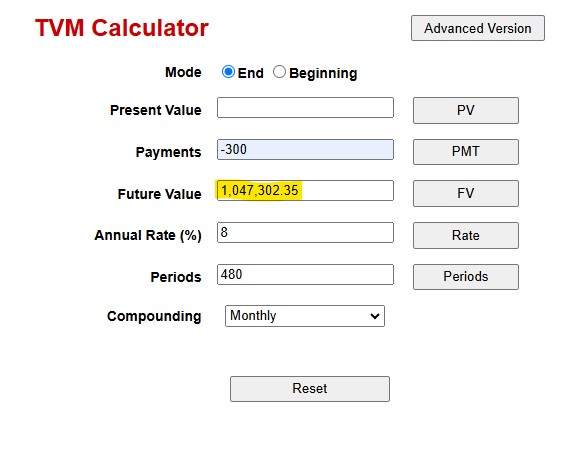

- Contributing $300 per month starting at age 22 can grow to more than $1 million by the time you turn 62, assuming an average annual return of 8%.

- The earlier you start, the less you’ll need to contribute over time.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Overcoming Common Challenges

- Student Loan Payments: Make paying off high-interest debt a priority, but don’t delay saving for retirement entirely. Even a small contribution early on can have a big impact.

- Lifestyle Inflation: Resist the urge to upgrade your lifestyle as your income increases. Instead, funnel raises and bonuses into your 401(k).

- Market Volatility: It’s normal for markets to fluctuate. Stay focused on your long-term goals and avoid the temptation to pull your money out during downturns.

Celebrate the Milestones Along the Way

Reaching $1 million in your 401(k) might seem far off, but setting smaller milestones—like your first $10,000 or $100,000—can keep you motivated. Celebrate these achievements and remind yourself that every contribution brings you closer to financial freedom.

Inspiring Statistics

- According to Fidelity, the number of 401(k) accounts with balances of $1 million or more reached an all-time high in 2024, climbing to 544,000 accounts, up 9.5% from 497,000 in the previous quarter.

- The average contribution rate for 401(k) plans, including both employee and employer contributions, stands at 14.1%, comprising 9.4% from employees and an average employer match of 4.7%. This strong savings behavior has played a key role in the growth of 401(k) balances, contributing to the record number of millionaire accounts in 2024.

Final Words: Your Future Starts Today

As a college graduate, you’ve already proven your ability to work hard and achieve great things. Building a robust 401(k) is your next big goal, and it starts now. Whether you’re dreaming of early retirement, starting your own business, or traveling the world, a well-funded retirement account can make it possible.

Remember: “The best time to start was yesterday. The second-best time is today.” So take that first step and set yourself up for a financially secure future. Congratulations, and here’s to your journey toward becoming a 401(k) millionaire!

Our Newsletter Can Help You Build Wealth and Retire Rich!

Sign up for our free newsletter!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich newsletter to receive weekly updates packed with personal finance strategies and insights—delivered straight to your inbox!

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.