Planning for retirement is one of the most critical steps in achieving long-term financial security. With so many options available, finding the right retirement plan can feel overwhelming. At Build Wealth, Retire Rich, we believe that understanding your choices is the first step toward a prosperous future. Here, we break down the most common retirement plans and accounts to help you make informed decisions.

Understanding Retirement Plans

Retirement plans fall into two primary categories: employer-sponsored plans and individual accounts. Depending on your employment status and financial goals, certain plans might be better suited for you. Let’s explore the key options.

Employer-Sponsored Retirement Plans

1. 401(k) Plans

A 401(k) is the most common employer-sponsored retirement plan.

- Tax Advantages: Contributions are pre-tax, lowering your current taxable income. Your savings grow tax-deferred until withdrawal.

- Employer Matching: Many employers offer matching contributions—essentially free money for your retirement.

- High Contribution Limits: In 2024, you can contribute up to $23,000, with an additional $7,500 if you’re 50 or older.

- Ease of Use: Automatic payroll deductions make saving effortless.

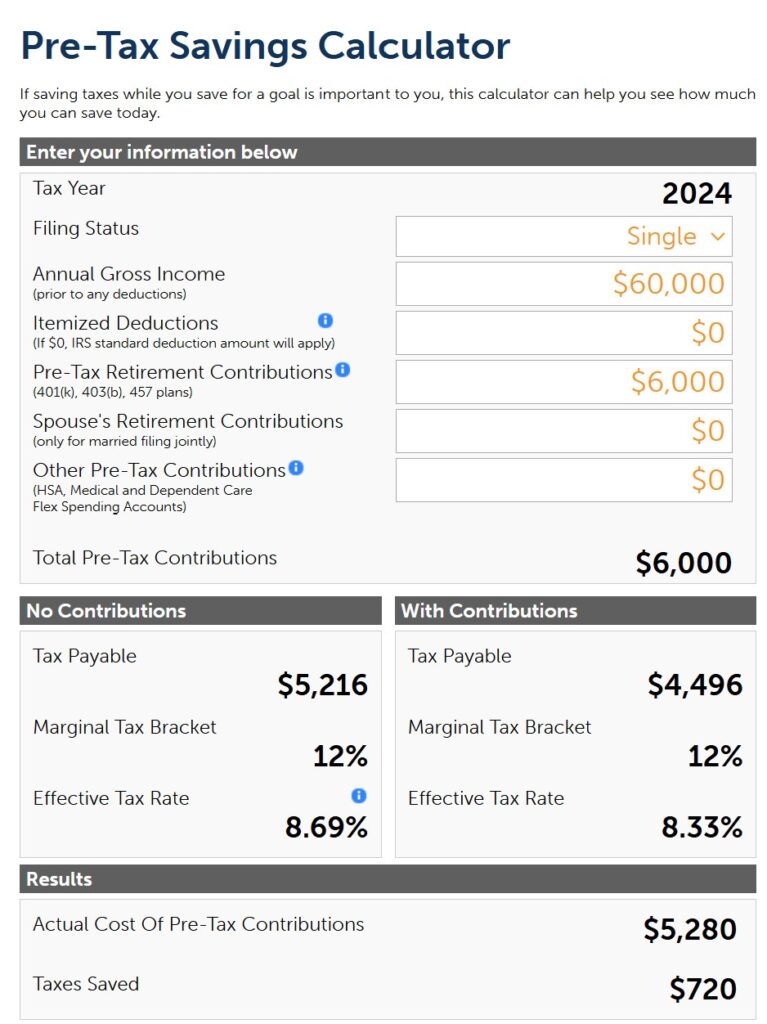

Example of Tax Savings in a 401(k)

Let’s say you are single and your annual salary is $60,000, and you contribute 10% of your salary ($6,000) to your 401(k). Here’s how it affects your taxes:

- Before Contribution: Your taxable income is $60,000.

- After Contribution: Your taxable income is reduced to $54,000 ($60,000 – $6,000).

- Tax Savings: In 2024, you will save $720 in federal taxes.

Source: https://ffcalcs.com/pretax_savings

By contributing to a 401(k), you’re not only saving for retirement but also reducing your current tax liability—a win-win situation!

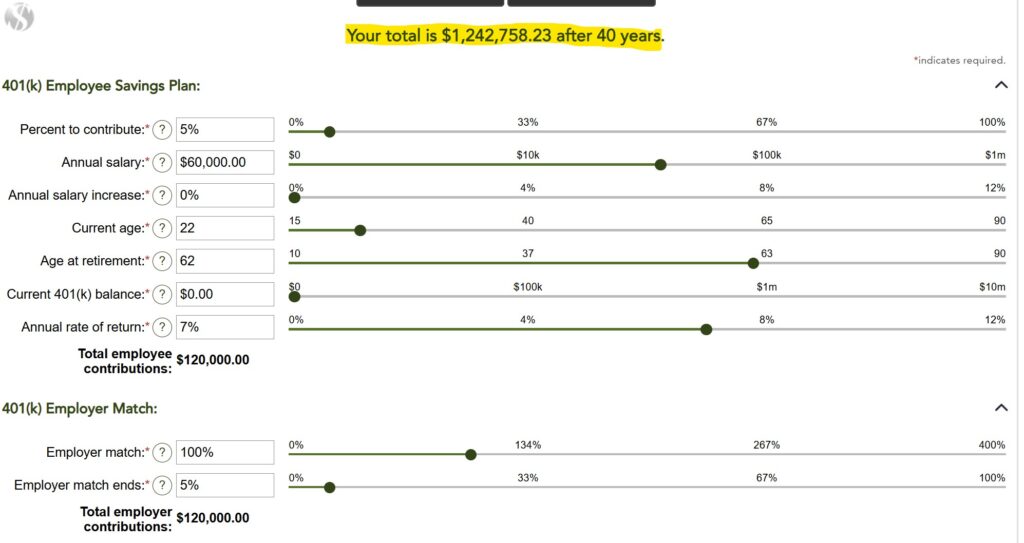

Example of Employer Matching

Imagine you earn $60,000 annually and your employer offers a 100% match on the first 5% of your salary you contribute to the 401(k). Here’s what happens:

Imagine you earn $60,000 annually and your employer offers a 100% match on the first 5% of your salary you contribute to the 401(k). Over 40 years, with an assumed annual return of 7%, your retirement savings would grow to over $1,200,000 if his employer matches 100% of his contributions. Without the employer match, his total savings would be $621,379.12

Source: https://www.federatedhermes.com/us/calculators/Retire401k.html

- Your Contribution over 40 years: $120,000

- Employer Match over 40 years: $120,000

- Total Contribution: $240,000

With the employer match, your contribution is effectively doubled. Over time, this additional contribution can significantly boost your retirement savings, especially when combined with compound growth.

2. 403(b) Plans

Designed for nonprofit and public sector employees, 403(b) plans share many similarities with 401(k)s.

- Unique Perks: Some plans offer a 15-year service catch-up provision for long-term employees.

- Flexibility: You can often contribute to both a 403(b) and a 457(b) plan simultaneously, boosting your savings potential.

3. Thrift Savings Plan (TSP)

Available to federal employees and military personnel, the TSP is one of the most cost-effective retirement plans.

- Employer Matching: Federal employees receive a 5% match on their contributions.

- Low Fees: The TSP is known for its low administrative costs, leaving more money in your account.

4. 457(b) Plans

Ideal for state and local government employees, 457(b) plans offer unique benefits.

- No Early Withdrawal Penalty: You can withdraw funds without penalties before age 59½ if you separate from service.

- Additional Savings: Contributions can be made alongside a 403(b) or 401(k) plan.

Plans for Small Businesses and Self-Employed Individuals

5. SIMPLE IRA

Perfect for small businesses with 100 or fewer employees.

- Tax Advantages: Contributions reduce taxable income and grow tax-deferred.

- Employer Contributions: Employers can match up to 3% of employee compensation or provide a 2% non-elective contribution.

- Contribution Limits: $16,000 for 2024, with a $3,500 catch-up contribution for those 50+.

6. SEP IRA

A Simplified Employee Pension (SEP) IRA is ideal for self-employed individuals and small businesses.

- Flexible Contributions: Employers can decide how much to contribute each year.

- High Limits: Contributions can reach up to $69,000 in 2024, depending on income.

7. Solo 401(k)

Tailored for self-employed individuals, Solo 401(k)s offer high contribution limits.

- Dual Contributions: You can contribute as both employee and employer, maximizing your retirement savings.

- Roth Option: Post-tax contributions grow tax-free.

- Limits: Up to $69,000 in 2024, or $76,500 if you’re 50 or older.

Individual Retirement Accounts (IRAs)

Traditional IRA

- Tax Deductibility: Contributions may be tax-deductible, depending on your income.

- Growth: Funds grow tax-deferred until withdrawal.

Roth IRA

- Tax-Free Withdrawals: Contributions are post-tax, but withdrawals in retirement are tax-free.

- Flexibility: Contributions can be withdrawn anytime without penalties.

Other Savings Tools

Health Savings Accounts (HSAs)

- Triple Tax Advantage: Contributions are pre-tax, growth is tax-deferred, and withdrawals for qualified expenses are tax-free.

Brokerage Accounts

- Unlimited Contributions: Invest as much as you want with no income restrictions.

- Tax Efficiency: Long-term gains are taxed at lower rates than regular income.

Tips for Choosing the Right Plan

- Leverage Employer Matching: Always contribute enough to receive your employer’s full match.

- Start Early: Time is your greatest asset. The earlier you save, the more your money can grow.

- Diversify: Consider using multiple accounts, such as a 401(k) and an IRA, to maximize tax benefits.

- Plan for Taxes: Roth accounts offer tax-free withdrawals, providing flexibility in retirement.

Final Thoughts

Retirement planning is a journey, not a sprint. By understanding your options and taking advantage of the right tools, you can build wealth and retire rich. At Build Wealth, Retire Rich, we’re here to guide you every step of the way. Start today—your future self will thank you!

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.