When it comes to building wealth, compound interest is one of the most powerful tools available. Albert Einstein once called it the “eighth wonder of the world,” and for good reason—it can turn small, steady investments into a large amount of money over time. In this post, we’ll explain what compound interest is, how it works, and how you can use it to grow your wealth and secure your financial future.

What is Compound Interest?

Compound interest means earning interest on your money and then earning interest on that interest. It’s different from simple interest, which only grows based on your original amount (called the principal).

How It Works

Imagine you put $1,000 in a savings account that earns 5% interest per year. At the end of the first year, you earn $50 in interest, so you now have $1,050. In the second year, you earn 5% on $1,050—not just $1,000—so your interest grows to $52.50. Over time, this snowball effect gets bigger and bigger.

Why Compound Interest is So Powerful

1. The Time Factor

Time is the single most important element in maximizing the effects of compound interest. The earlier you start saving or investing, the longer your money has to grow exponentially. Even modest contributions can turn into substantial sums over decades.

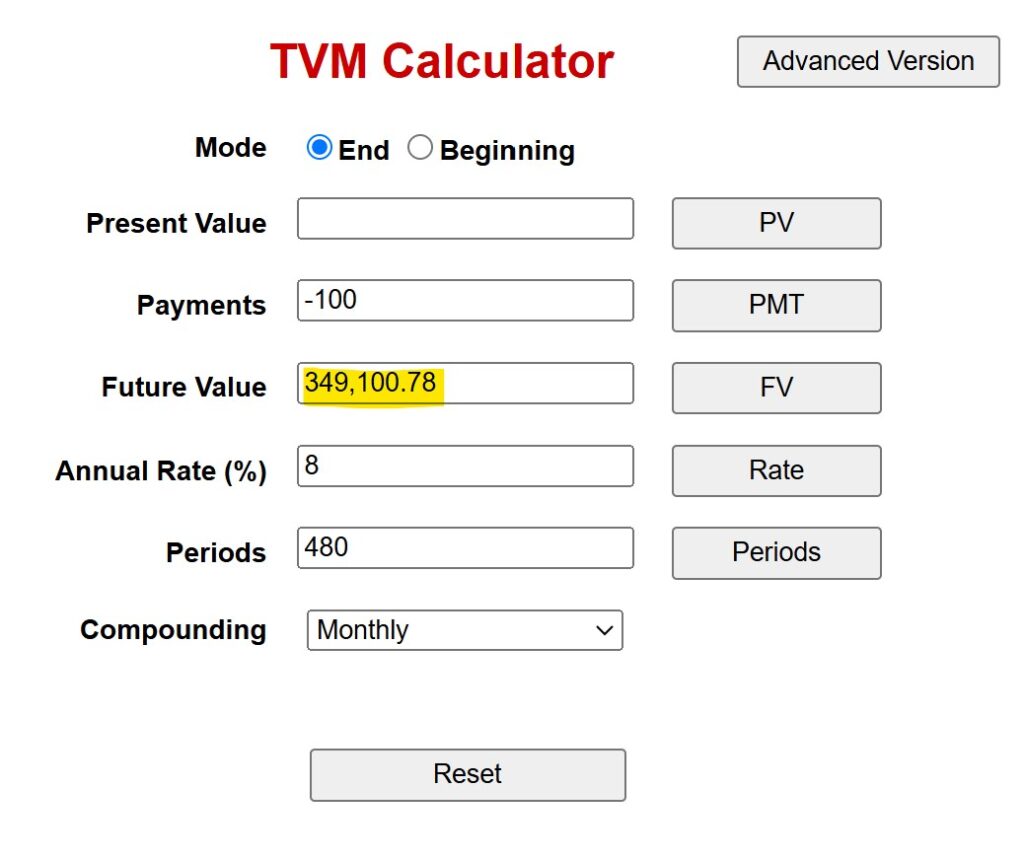

Example:

Scenario 1: Sarah starts saving $100 a month at age 25, earning 8% annually. By age 65, she’ll have accumulated nearly $349,000.

Calculator source: https://www.fncalculator.com/financialcalculator?type=tvmCalculator

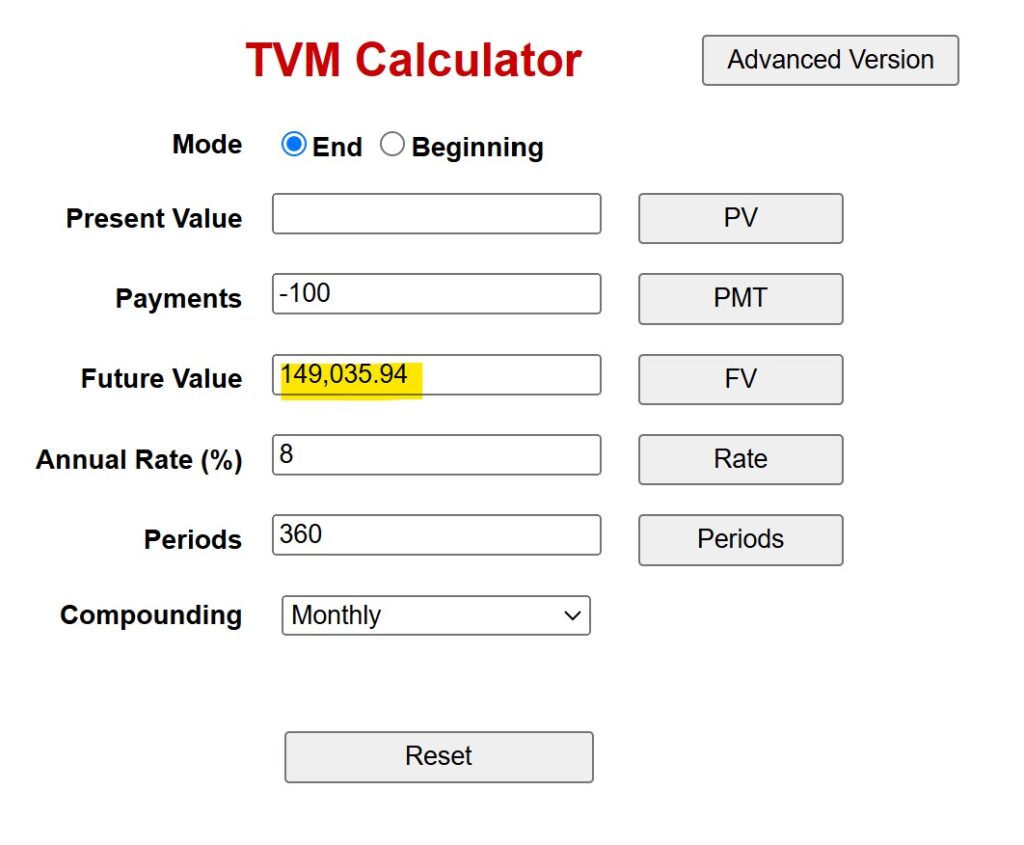

Scenario 2: John starts saving the same $100 a month at age 35. By age 65, he’ll only have around $149,000—less than half of Sarah’s total.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Starting early gives Sarah an extra decade for compounding to work its magic, which makes a massive difference.

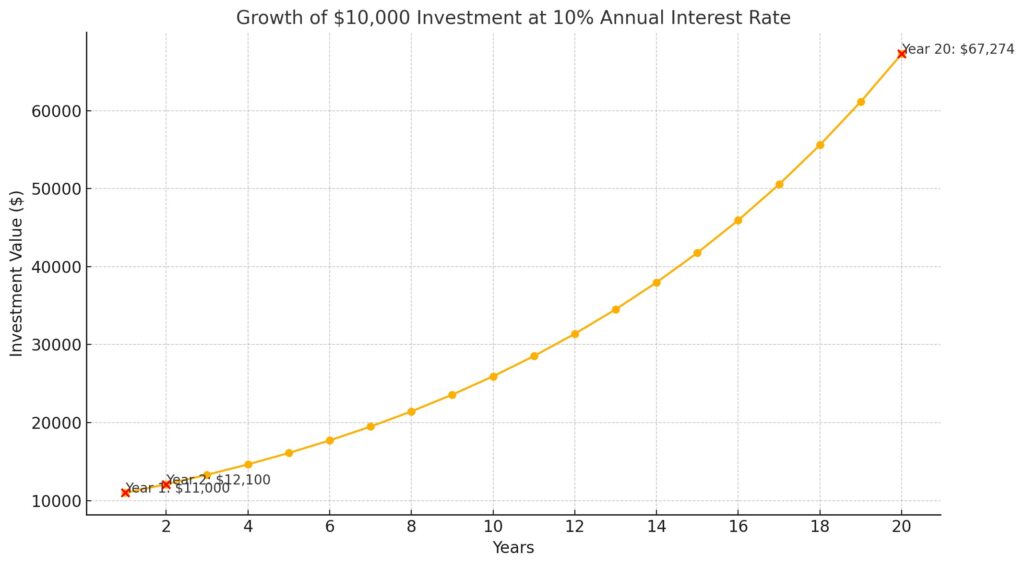

2. Exponential Growth Over Time

The compounding effect becomes more significant as time passes. In the early years, your growth might seem slow, but over time, the growth accelerates. This is why compound interest is often referred to as “interest on interest.”

Example:

Let’s say you invest $10,000 at a 10% annual interest rate:

- Year 1: $11,000

- Year 2: $12,100

- Year 20: Over $67,000

- This demonstrates the power of compound interest over time

Here’s a chart showing the growth of a $10,000 investment at a 10% annual interest rate over 20 years. It highlights key points:

How to Leverage Compound Interest to Build Wealth

1. Start Saving or Investing Early

The earlier you start, the more powerful the compounding effect becomes. Even if you start small, the impact of compounding over decades can be monumental.

Pro Tip: Encourage young adults to save early—even a few years of delay can have a significant impact on long-term growth.

2. Make Regular Contributions

Consistency is key to maximizing the benefits of compounding. Setting up automatic contributions to your savings or investment accounts ensures you’re continuously adding to your principal.

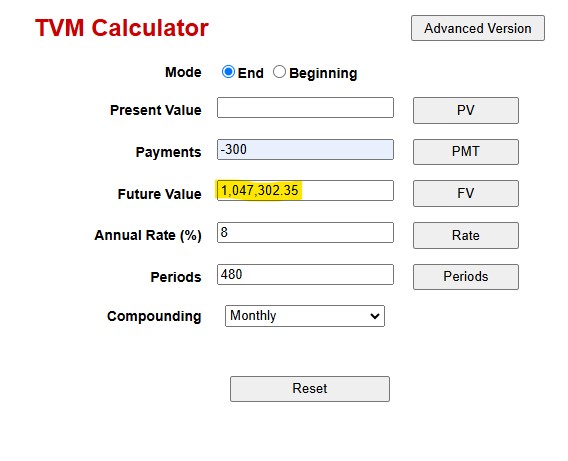

Example:

- Investing $300 per month at an 8% annual return will grow to $1,047,302.35 in 40 years.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

3. Reinvest Earnings

Whether you’re earning dividends from stocks or interest from bonds, reinvesting those earnings allows them to generate additional returns. This reinvestment is crucial to achieving exponential growth.

4. Use Tax-Advantaged Accounts

Accounts like 401(k)s, Roth IRAs, 529 College Savings Plan and Health Savings Accounts (HSAs) allow your investments to grow either tax-free or tax-deferred. By minimizing taxes, you retain more of your earnings, accelerating the compounding process.

5. Focus on Long-Term Investments

The stock market can be volatile in the short term, but historically, it has delivered solid long-term returns. By staying invested and avoiding the temptation to withdraw during market downturns, you allow compounding to work uninterrupted.

6. Take Advantage of Employer Contributions

Many employers offer matching contributions for retirement accounts like 401(k)s. This is essentially free money that grows with compound interest. Always contribute enough to maximize your employer match.

7. Be Patient

Compounding takes time, and the biggest rewards come later in the journey. Avoid withdrawing your funds prematurely or chasing short-term gains. Staying disciplined and patient is key to unlocking the full potential of compound interest.

Common Pitfalls to Avoid

- Delaying Your Start: Waiting just a few years can drastically reduce your wealth-building potential.

- Not Reinvesting Earnings: Spending your earnings prevents them from contributing to future growth.

- Ignoring Inflation: Ensure your investments outpace inflation to maintain purchasing power.

- High Fees: Investment fees can erode returns over time. Opt for low-cost index funds or ETFs when possible.

Final Thoughts

Compound interest is a true game-changer for building wealth, but it requires three key ingredients: time, consistency, and patience. Whether you’re saving for retirement, your child’s education, or financial independence, starting early and staying consistent can help you achieve your goals.

Remember, building wealth isn’t about overnight success—it’s about leveraging the tools at your disposal to create sustainable, long-term growth. By understanding and using compound interest, you’re setting yourself on the path to financial security and freedom.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.