Exchange-Traded Funds (ETFs) have revolutionized the way individuals and institutions invest, providing a versatile, cost-effective, and accessible way to diversify portfolios. Whether you’re a seasoned investor or just starting your financial journey, understanding ETFs can unlock new opportunities for achieving your financial goals.

What Are ETFs?

An ETF is a type of investment fund that holds a collection of assets, such as stocks, bonds, commodities, or a mix of these. ETFs trade on stock exchanges, just like individual stocks, allowing investors to buy and sell shares throughout the trading day at market prices.

How ETFs Work

- Underlying Assets: ETFs track the performance of an index, sector, or specific asset class. For example, the S&P 500 ETF tracks the S&P 500 index.

- Creation and Redemption: ETFs are created or redeemed in large blocks (called creation units) by institutional investors. This ensures liquidity and helps keep the ETF’s price close to its net asset value (NAV).

- Market Trading: Unlike mutual funds, which are priced only once at the end of the trading day, ETFs can be traded anytime the market is open.

Benefits of ETFs

- Diversification: One ETF can provide exposure to hundreds of securities, reducing the risk associated with investing in individual stocks or bonds.

- Example: Investing in an emerging markets ETF can give you exposure to multiple countries’ economies without needing to purchase individual international stocks.

- Cost Efficiency: Most ETFs have low expense ratios compared to mutual funds, making them a cost-effective option for long-term investors.

- Flexibility: Since ETFs trade like stocks, they offer features like limit orders, stop-loss orders, and the ability to short-sell.

- Transparency: ETFs disclose their holdings daily, allowing investors to know exactly what they own.

- Tax Efficiency: The structure of ETFs generally leads to fewer capital gains distributions compared to mutual funds.

Types of ETFs

- Stock ETFs: Track a specific index or sector.

- Bond ETFs: Provide exposure to fixed-income securities like government or corporate bonds.

- Sector and Industry ETFs: Focus on specific sectors like healthcare or energy.

- Thematic ETFs: Centered on trends like clean energy, artificial intelligence, or blockchain.

- Commodity ETFs: Invest in physical commodities like gold or oil.

- Inverse and Leveraged ETFs: Used for short-term trading to amplify returns or hedge against market downturns.

How to Invest in ETFs

- Set Your Investment Goals: Define your financial objectives, whether they are growth, income, or diversification.

- Research ETFs: Look at the ETF’s objective, underlying holdings, expense ratio, and performance history.

- Choose a Brokerage: Most online brokerages offer commission-free ETF trading.

- Start Small: You can invest in ETFs with as little as the price of one share or even fractional shares, depending on your brokerage.

Potential Risks

While ETFs offer many benefits, they are not without risks:

- Market Risk: Like any investment, ETFs are subject to market fluctuations.

- Tracking Errors: The ETF may not perfectly replicate the performance of its benchmark index.

- Liquidity Issues: Some niche ETFs might have low trading volumes, leading to wider bid-ask spreads.

Real-Life Example of ETF Growth

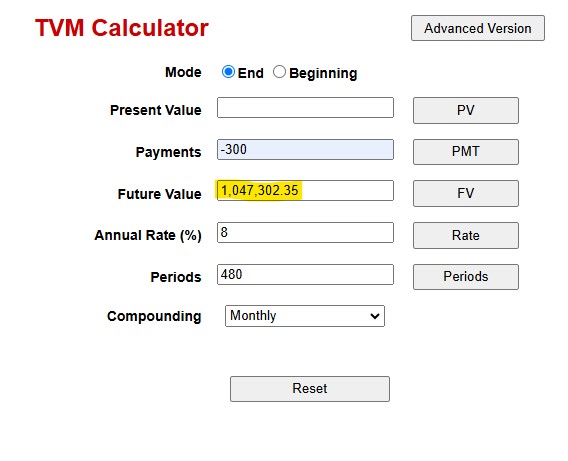

Consider an investor who consistently invests $300 per month in an ETF with an average annual return of 8%. After 40 years, their portfolio could grow to over $1,047,302.35, thanks to the power of compounding.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

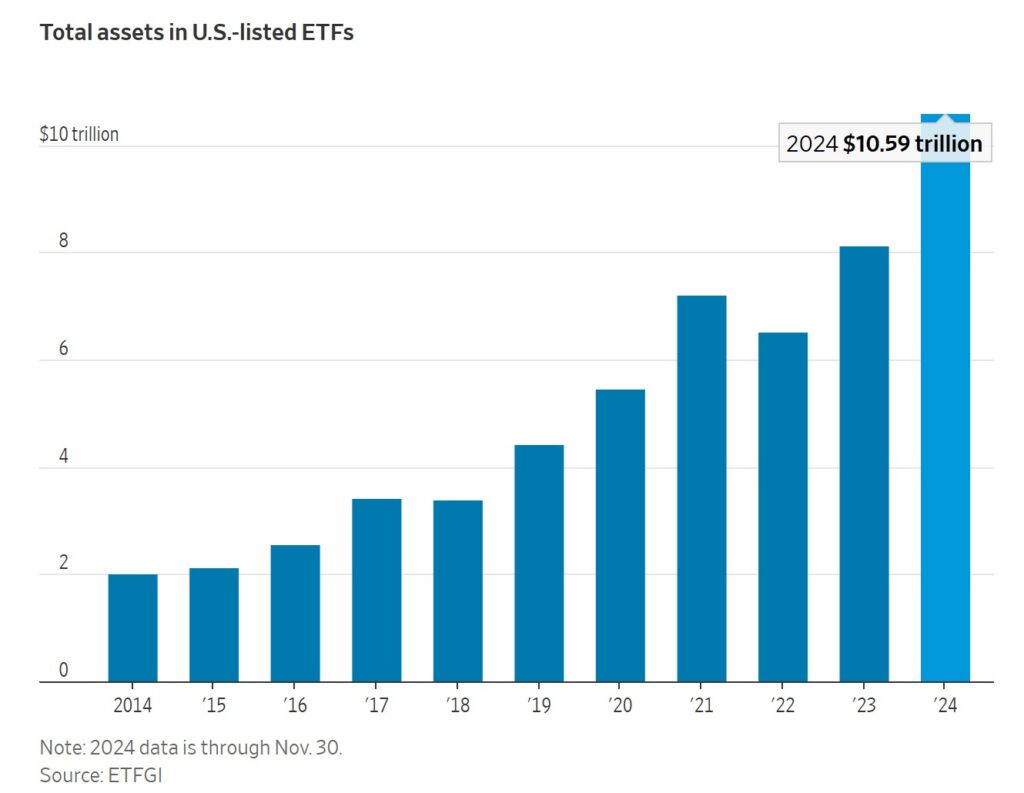

2024: A Record Year for ETFs

According to an article in the WSJ.com, ETFs witnessed record-breaking inflows in 2024, with over $1 trillion poured into U.S.-based ETFs, pushing total assets to an all-time high of $10.6 trillion by the end of November. This marked a 30% increase from the beginning of the year, driven by several factors:

- Record Inflows: Investors poured over $1 trillion into U.S. exchange-traded funds (ETFs) in 2024, setting a new record and surpassing the previous peak by a significant margin.

- Surge in ETF Assets: Total assets in U.S.-based ETFs reached $10.6 trillion by November 2024, reflecting a 30% increase from the start of the year, fueled by strong market performance and renewed investor confidence.

- Shift from Mutual Funds: The long-term trend of investors moving from mutual funds to ETFs continued due to ETFs’ tax advantages and easier trading.

- Key Drivers of Growth: The S&P 500’s 25% gain and growing interest in actively managed strategies contributed to significant inflows, with Invesco’s QQQ attracting over $27 billion by mid-December.

- Diverse Investment Strategies: Active management strategies, bitcoin-focused ETFs, and fixed-income funds gained traction, with retirees favoring options-based strategies to manage risk.

- Dominance of U.S. Stocks: U.S. equity funds dominated the market, capturing the majority of net inflows, reflecting strong investor optimism about U.S. economic growth and corporate performance.

These inflows highlight investors’ confidence and the growing appeal of ETFs as a cornerstone of modern investing.

Conclusion

ETFs are a cornerstone of modern investing, offering a mix of accessibility, cost efficiency, and diversification. Whether you’re saving for retirement, building wealth, or exploring new investment opportunities, ETFs can play a crucial role in achieving your financial objectives.

Start small, stay consistent, and always research before investing. With ETFs, you can build a robust portfolio tailored to your financial goals.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.