SECURE 2.0 Act: Addressing Overfunding Concerns

A 529 college savings plan is one of the most effective tools available to families planning for the ever-increasing costs of education. This tax-advantaged plan not only helps you save but also provides multiple strategies to make your funds work smarter for you. Let’s explore the full potential of 529 plans, from harnessing compound interest to mitigating overfunding concerns through SECURE 2.0 provisions.

What Is a 529 College Savings Plan?

A 529 college savings plan is a state-sponsored investment account designed to encourage saving for educational expenses. It comes with these key advantages:

- Tax-Free Growth: Your investments grow tax-free, and withdrawals for qualified expenses are tax-exempt.

- Qualified Expenses: Funds can be used for tuition, fees, books, supplies, room and board, and even certain tech tools like laptops.

- State Tax Benefits: Many states offer tax deductions or credits for contributions, boosting your savings further.

- Ownership and Control: Unlike custodial accounts, the account owner retains control of the funds, even if the beneficiary decides not to attend college.

The account’s flexibility and tax advantages make it a cornerstone of education funding for millions of families.

The Magic of Compound Interest

Starting early is the secret weapon in education savings. Compound interest—the process of earning returns on both your initial investment and the returns it generates—can make a significant difference over time.

Stocks have historically outperformed bonds in terms of returns, making them a strong choice for long-term growth. However, managing risk is essential. The S&P 500 has delivered an average annual return of approximately 7% to 8% after adjusting for inflation.

Example:

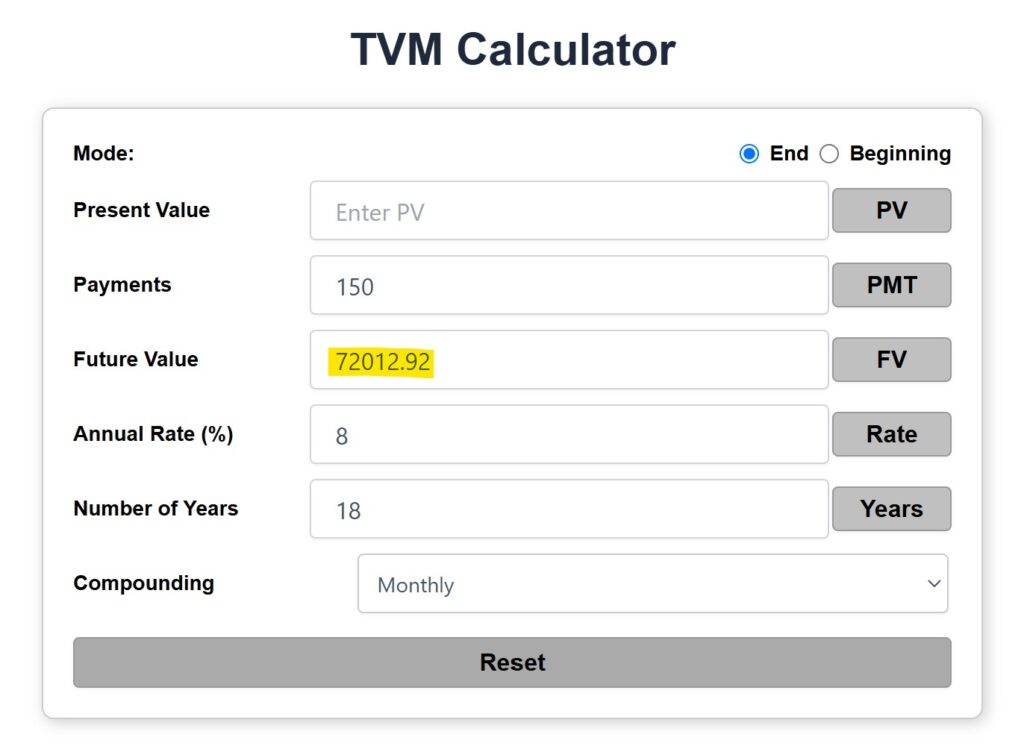

Imagine you start investing $150 a month into a 529 plan when your child is born. Assuming a 8% average annual return:

- At age 18, the account reaches approximately $72,000, with approximately $40,000 in earnings.

https://buildwealthretirerich.com/tvm/

This example illustrates how small, consistent contributions, combined with time, can lead to substantial savings.

SECURE 2.0 Act: Addressing Overfunding Concerns

One common question parents ask is: What if I save too much? Previously, overfunding a 529 plan could lead to taxes and penalties on unused funds. However, the SECURE 2.0 Act introduced a groundbreaking provision to ease this worry.

529 to Roth IRA Rollovers

Starting in 2024, parents can roll over unused 529 funds into a Roth IRA for the beneficiary under these conditions:

- 15-Year Rule: The 529 account must have been open for at least 15 years.

- Recent Contributions Ineligible: Contributions made in the past five years (and their earnings) cannot be rolled over.

- Lifetime Cap: A maximum of $35,000 can be rolled over per beneficiary.

- Annual Contribution Limits Apply: Rollovers count toward the annual Roth IRA contribution limit (The IRA contribution limits for 2024 are $7,000 for those under 50 and $8,000 for those 50 or older.)

- Beneficiary Must Have Income: The beneficiary must have earned income during the rollover year.

- No Roth Income Limits: Income restrictions for regular Roth contributions don’t apply to these rollovers.

These rollovers provide an excellent safety net, ensuring excess funds can still contribute to the beneficiary’s long-term financial well-being without penalties.

Example: Transferring Funds from a 529 Plan to a Roth IRA Under SECURE 2.0

Let’s take a practical example to understand how the SECURE 2.0 provisions work for rolling over unused 529 funds into a Roth IRA.

Scenario

Sarah and John started a 529 plan for their daughter, Emily, when she was born. Over the years, they contributed regularly, and the account now has $45,000. Emily received a full scholarship to college, leaving $20,000 unused in the 529 plan after covering all education expenses. Sarah and John want to avoid penalties and taxes on the unused funds.

Step-by-Step Application of SECURE 2.0

- Account Age Verification:

- The 529 plan has been open for 18 years, meeting the 15-year requirement.

- Eligible Funds:

- Sarah and John contributed $3,000 in the past five years. Assuming these contributions generated $500 in earnings, this $3,500 (contributions + earnings) is excluded from the rollover.

- Eligible Amount:

- $20,000 (total unused funds) – $3,500 (ineligible recent contributions and their earnings) = $16,500 potentially eligible for rollover.

- Lifetime Cap:

- The maximum lifetime amount that can be rolled over to a Roth IRA is $35,000. Since Emily’s eligible funds are below this cap, the entire $16,500 can be considered.

- Annual Contribution Limit:

- Roth IRA contributions are subject to the annual limit ($7,000 in 2024 for those under age 50).

- Sarah and John decide to roll over $7,000 in the first year and plan to roll over the remaining $9,500 in subsequent years, subject to the annual limits.

- Earned Income Requirement:

- Emily has a part-time job earning $12,000 per year, satisfying the earned income requirement.

- Roth IRA Income Limits:

- Roth income limits do not apply to this rollover, so Emily qualifies regardless of her income level.

Outcome

- In Year 1, Sarah and John roll over $7,000 to Emily’s Roth IRA. The remaining $9,500 will be rolled over in future years until the entire eligible amount is transferred.

- Emily now has a jumpstart on her retirement savings, with the funds benefiting from decades of tax-free growth.

- No penalties or taxes are incurred, and the 529 funds are repurposed effectively.

Key Benefits

- The unused 529 funds support Emily’s retirement, turning what could have been a financial penalty into a long-term wealth-building opportunity.

- By starting early, Emily gains the advantage of compound interest in her Roth IRA.

Example: If the $16,500 grows at an average annual return of 7% for 40 years, it could grow to over $247,000, entirely tax-free!

This example illustrates how the SECURE 2.0 provisions make 529 plans even more flexible, ensuring that every dollar saved can be utilized meaningfully.

Flexibility for Families

529 plans offer unparalleled flexibility, allowing families to adapt to changing circumstances:

- Multiple Beneficiaries: Funds can be transferred to siblings, cousins, or other eligible family members if one child doesn’t use the money.

- K-12 Education: Some states allow 529 funds to be used for private K-12 tuition (up to $10,000 per year).

- Student Loan Repayment: Up to $10,000 can be used to repay student loans for the beneficiary or their siblings.

- Apprenticeship Programs: Funds can also cover expenses for qualified apprenticeship programs, making 529 plans viable for non-college career paths.

Maximizing Your 529 Savings

To get the most out of your 529 plan:

- Start Early: Time is your ally. The earlier you begin, the more you benefit from compound interest.

- Make Consistent Contributions: Even modest amounts can add up significantly over 18 years.

- Take Advantage of State Tax Benefits: Research whether your state offers tax incentives for contributions.

- Reassess Investment Options: As your child nears college age, consider shifting to more conservative investments to protect your savings.

- Monitor Costs: Understand the costs associated with your 529 plan, such as management fees, which can affect long-term growth.

Considerations Beyond Education

While 529 plans are tailored for education savings, their versatility can also complement long-term financial goals:

- Retirement Savings: With SECURE 2.0, unused funds can support retirement through Roth IRA rollovers.

- Generational Wealth: These plans can be passed down, ensuring future generations benefit from your savings.

The Bottom Line

A 529 college savings plan is a smart, tax-efficient way to save for education while leveraging the power of compound interest. The SECURE 2.0 Act further enhances the appeal of these plans, providing a safety net for unused funds. Whether you’re starting early or catching up, a 529 plan can be a cornerstone of your family’s financial strategy.

Start today to secure your child’s future and take advantage of the peace of mind these plans offer. If you’re unsure how to get started, consult a financial advisor to develop a plan tailored to your needs.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.