The Time Value of Money (TVM) is one of the most fundamental financial principles. It explains that money today is worth more than the same amount in the future due to its earning potential. Whether you’re saving for retirement, paying off a loan, or planning an investment, our TVM Calculator at Build Wealth Retire Rich makes complex financial calculations easy.

This guide walks you through how to use the calculator to make smarter financial decisions.

TVM Calculator

Key Features of the TVM Calculator

Our TVM Calculator is designed for ease of use and allows you to:

✔️ Select whether payments occur at the beginning or end of the period

✔️ Enter a Present Value (PV), Future Value (FV), or solve for either

✔️ Choose a payment frequency (weekly, monthly, annually, etc.)

✔️ Adjust for different compounding periods (annually, monthly, weekly, or daily)

✔️ Automatically compute results based on your inputs

Key Inputs

- Present Value (PV): The starting amount of money (investment or loan).

- Payment (PMT): The regular contribution or withdrawal per period.

- Future Value (FV): The amount accumulated at the end of the given years.

- Annual Interest Rate (%): The yearly rate of return or loan interest.

- Periods (Number of Years): The total number of years for the investment or loan.

- Compounding Frequency: Choose from annually, monthly, weekly, or daily.

Important:

- If you deposit or invest money, enter PV and PMT as negative numbers because they represent cash outflows.

- If you are taking out a loan, enter PV as a positive number since it represents borrowed money.

How to Use the TVM Calculator for Different Financial Goals

1. Calculate Future Value of an Investment

To find out how much your money will grow over time:

✔️ Enter Present Value (PV): Initial investment amount (negative value).

✔️ Enter Payment (PMT): Recurring contribution (negative value).

✔️ Enter Annual Interest Rate (%): Expected return.

✔️ Enter Periods (Number of Years): Duration of the investment.

✔️ Select Compounding Frequency: Choose how often interest compounds.

✔️ Click “Compute” next to FV to calculate your total future amount.

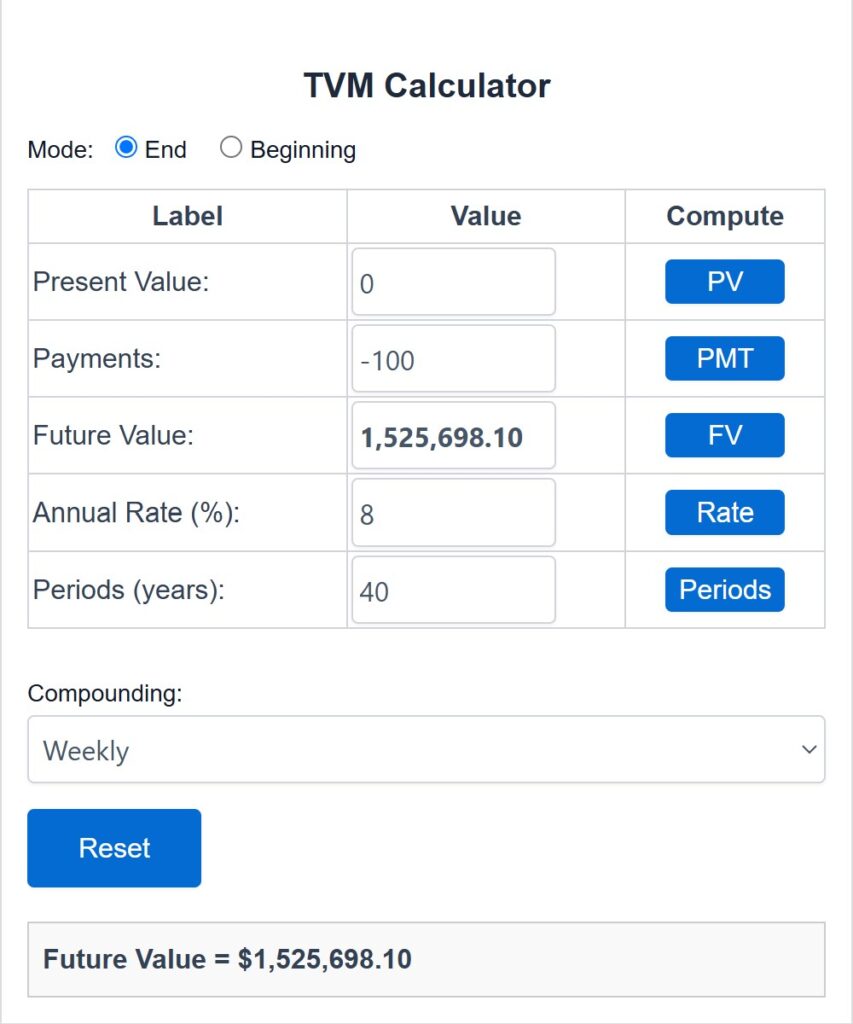

Example:

- Investment: $100 a week

- Annual Interest Rate: 8%

- Years: 40

- Compounded Weekly

Input:

- PV: 0

- Payments: -100 (if contributing $100 per week)

- Annual Rate: 8

- Period Years: 40

- Compounding: Weekly

- Output: Future Value (FV) = $1,525,698.10

2. Find Out How Much You Need to Save to Reach a Goal

✔️ Enter Future Value (FV): Your desired final amount.

✔️ Enter Present Value (PV): Any initial savings (negative value).

✔️ Enter Annual Interest Rate (I/Y): Expected return.

✔️ Enter Number of Years: Time until your goal.

✔️ Select Compounding Frequency: Choose compounding method.

✔️ Click “Compute” next to PMT to see how much you need to save per period.

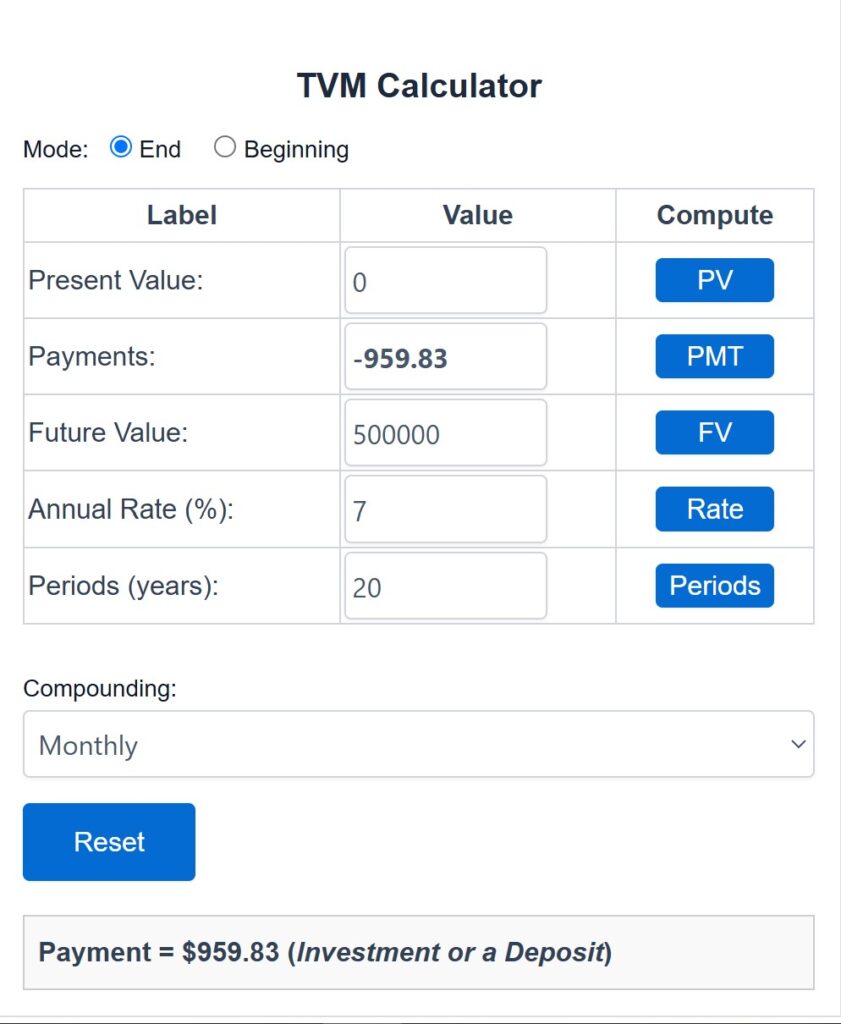

Example:

- Goal: $500,000

- Annual Interest Rate: 7%

- Periods (Years): 20

- Compounded Monthly

Input:

- Present Value: 0

- Annual Rate (%): 7

- Years: 20

- Compounding: Monthly

- Compute PMT

Output:

- You need to save $959.83 per month

3. Calculate Loan or Mortgage Payments

✔️ Enter Present Value (PV): Loan amount (positive value).

✔️ Enter Annual Interest Rate (I/Y): Loan interest rate.

✔️ Enter Number of Years: Loan duration.

✔️ Select Compounding Frequency: Choose how often interest compounds.

✔️ Click “Compute” next to PMT to see required payment per period.

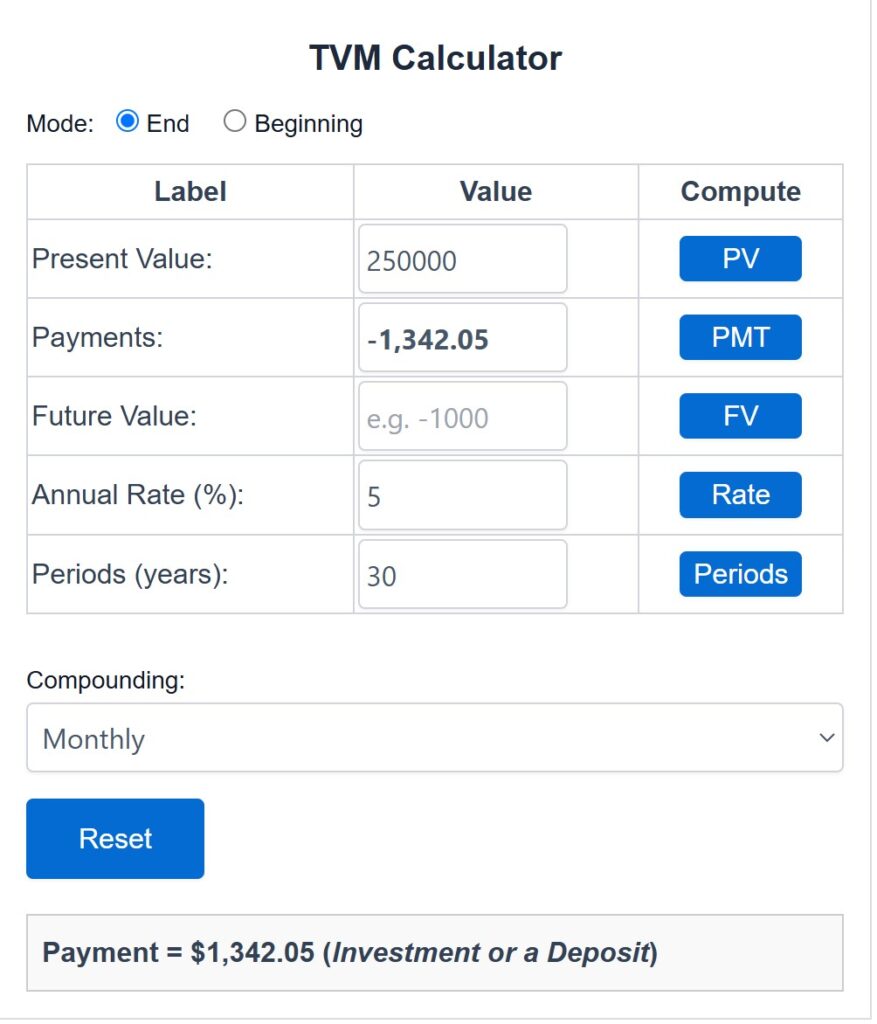

Example:

- Loan Amount: $250,000

- Annual Interest Rate: 5%

- Years: 30

- Compounded Monthly

Input:

- Present Value: 250,000

- Annual Rate (%): 5

- Periods(Years: 30

- Compounding: Monthly

- Compute PMT

Output:

- Monthly Payment (PMT) = $1,342.05 (Deposit)

Note: The negative sign means this is a payment (cash outflow).

Understanding Mode: End vs. Beginning Payments

The TVM Calculator allows you to choose whether payments occur at the beginning or end of each period.

✔️ End Mode: Most common setting, where payments are made at the end of each period.

✔️ Beginning Mode: Used for cases where payments are made at the start of each period (e.g., rent payments).

Example: If rent is due at the start of the month, use Beginning Mode; if payments are made after a service period, use End Mode.

Why Use This TVM Calculator?

✔️ Simple & Intuitive: Just enter values and hit “Compute”—no manual formulas required!

✔️ Multiple Payment & Compounding Options: Supports annual, monthly, weekly, and daily compounding.

✔️ Accurate Results: Ensures correct calculations without needing Excel or a financial calculator.

✔️ Works for Both Investments & Loans: Helps with retirement planning, wealth building, and debt management.

Start Planning Your Financial Future Today!

The TVM Calculator is an essential tool for financial success. Whether you’re investing, saving, or borrowing, mastering the Time Value of Money will help you maximize wealth and avoid costly financial mistakes.

👉 Try the TVM Calculator Now: Build Wealth Retire Rich TVM Calculator