Building wealth is not just about earning high returns—it’s also about making strategic choices that maximize the growth potential of your investments. One such powerful strategy is dividend reinvestment, a simple yet effective way to harness the power of compounding for long-term financial success.

What Is Dividend Reinvestment?

Dividend reinvestment is the practice of using dividends earned from stocks or funds to purchase additional shares rather than taking the payout in cash. This creates a snowball effect where the reinvested dividends themselves begin to generate additional returns. Over time, this compounding effect can significantly boost your portfolio’s value.

The Power of Compounding in Action

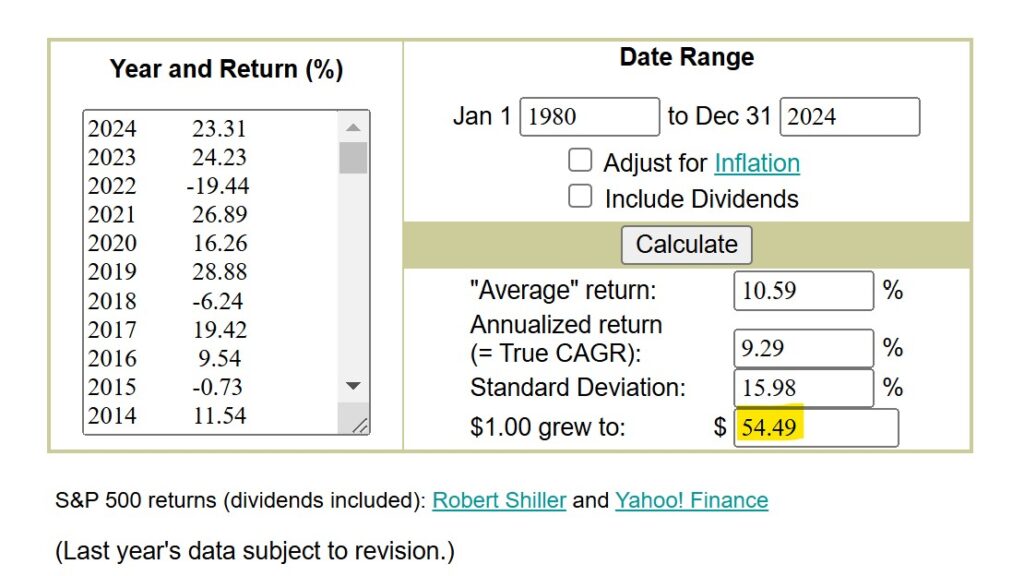

To illustrate the impact of dividend reinvestment, let’s examine the historical growth of the S&P 500 Index from 1980 to 2024:

• Without Reinvestment: $1 invested in the S&P 500 grew to $54.49, representing the price appreciation of the index alone.

http://www.moneychimp.com/features/market_cagr.htm

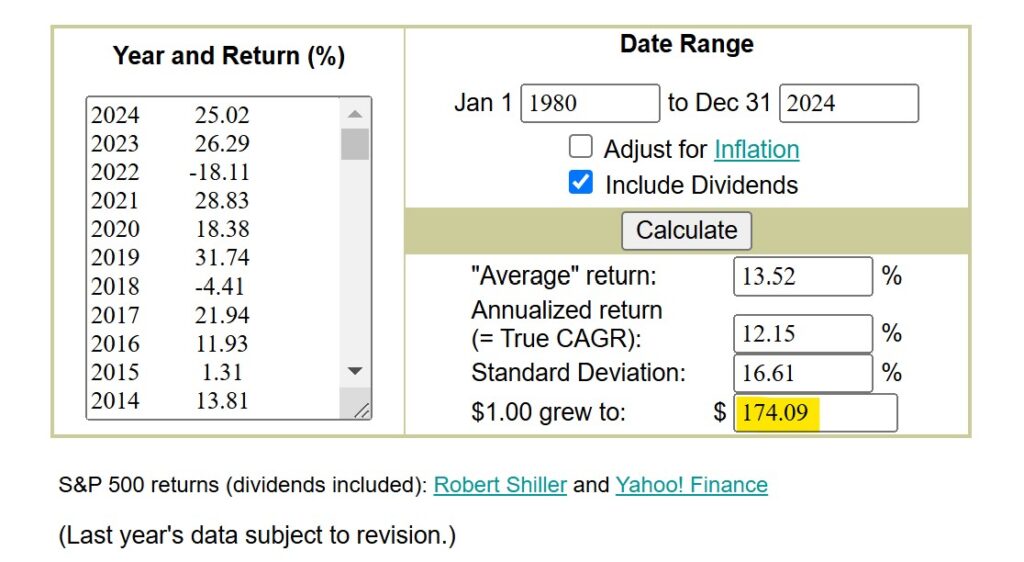

• With Reinvestment: The same $1 grew to an impressive $174.09, thanks to the compounding effect of reinvested dividends.

http://www.moneychimp.com/features/market_cagr.htm

This dramatic difference underscores the critical role dividends play in driving long-term growth. While $54.49 is substantial, $174.09 is life-changing—and the key to achieving it lies in reinvesting your dividends.

Why Dividend Reinvestment Works

1. Compounding Growth: Each reinvested dividend buys more shares, which then generate additional dividends. Over time, this cycle builds exponential growth.

2. Dollar-Cost Averaging: By automatically reinvesting dividends, you’re buying shares at different price points, potentially reducing your average cost per share.

3. Maximized Returns: Dividends account for a significant portion of the total returns from stock investments. Reinvesting them ensures you’re not leaving money on the table.

How to Start Reinvesting Dividends

Getting started with dividend reinvestment is straightforward:

1. Enroll in a Dividend Reinvestment Plan (DRIP): Many companies and brokerages offer these plans, allowing you to automatically reinvest dividends into additional shares.

2. Choose Dividend-Paying Investments: Focus on high-quality stocks or funds with a strong history of paying and growing dividends.

3. Be Consistent: Stick with the strategy over time, even during market downturns, to fully benefit from compounding.

Key Considerations

While dividend reinvestment is a powerful tool, it’s important to:

• Assess Your Cash Flow Needs: If you rely on dividends for income, reinvesting them may not be practical.

• Diversify Your Portfolio: Avoid over-concentration in dividend-paying stocks. Maintain a well-balanced investment strategy.

Final Thoughts

Dividend reinvestment is a long-term strategy that can significantly amplify your wealth over time. As the S&P 500 example shows, the difference between reinvesting and not reinvesting dividends is staggering. By embracing this strategy, you’re not just growing your investments—you’re compounding your future.

Start today, and let the power of dividend reinvestment work its magic on your portfolio. After all, the sooner you begin, the greater your rewards will be.

Want to learn more about building wealth? Visit BuildWealthRetireRich.com for tips and strategies to achieve financial freedom!

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.