The recent survey by the Bipartisan Policy Center highlights a concerning disconnect between retirement expectations and reality.

Here’s a more detailed guide, enriched with practical examples, to help you take charge of your retirement planning.

Key Survey Insights:

1. Overestimating the Role of Personal Savings

• Expectation: 48% of workers expect personal savings, such as 401(k) or IRA accounts, to be a major source of retirement income.

• Reality: Only 36% actively contribute to these accounts. Without regular contributions and strategic investing, personal savings may fall short of expectations.

2. Misjudging Employment Income

• Expectation: 19% of workers anticipate part-time work to provide significant retirement income.

• Reality: Only 7% of retirees depend on part-time work. Health issues, caregiving responsibilities, or limited opportunities often make this difficult.

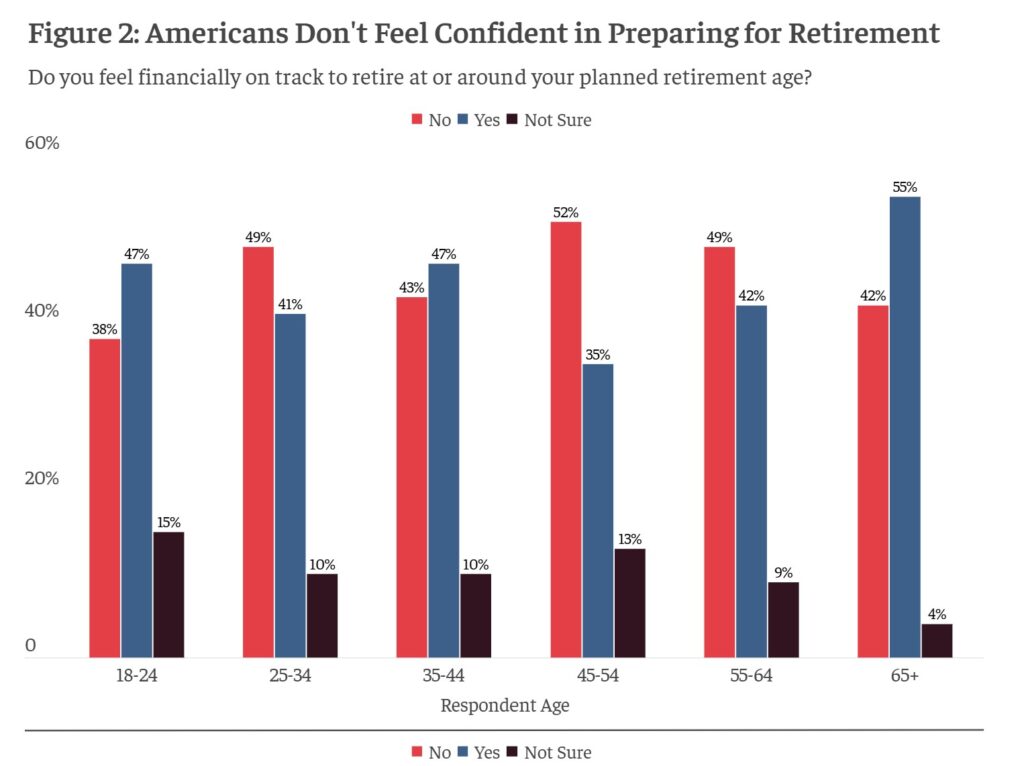

3. Confidence Gap

• Over half of Americans doubt their ability to retire comfortably. This lack of confidence is especially evident among workers aged 45–54, who are nearing retirement but may not feel financially prepared.

Source: BPC’s American Savings Education Council (ASEC) Survey

Actionable Steps to Strengthen Your Retirement Readiness

1. Maximize Employer Contributions

Employer-sponsored retirement plans are a powerful tool to build retirement wealth. One key advantage is that contributions are deducted from your paycheck before you even see it, ensuring you “pay yourself first.” Additionally, these plans often offer significant tax benefits, reducing your taxable income and allowing your investments to grow tax-deferred.

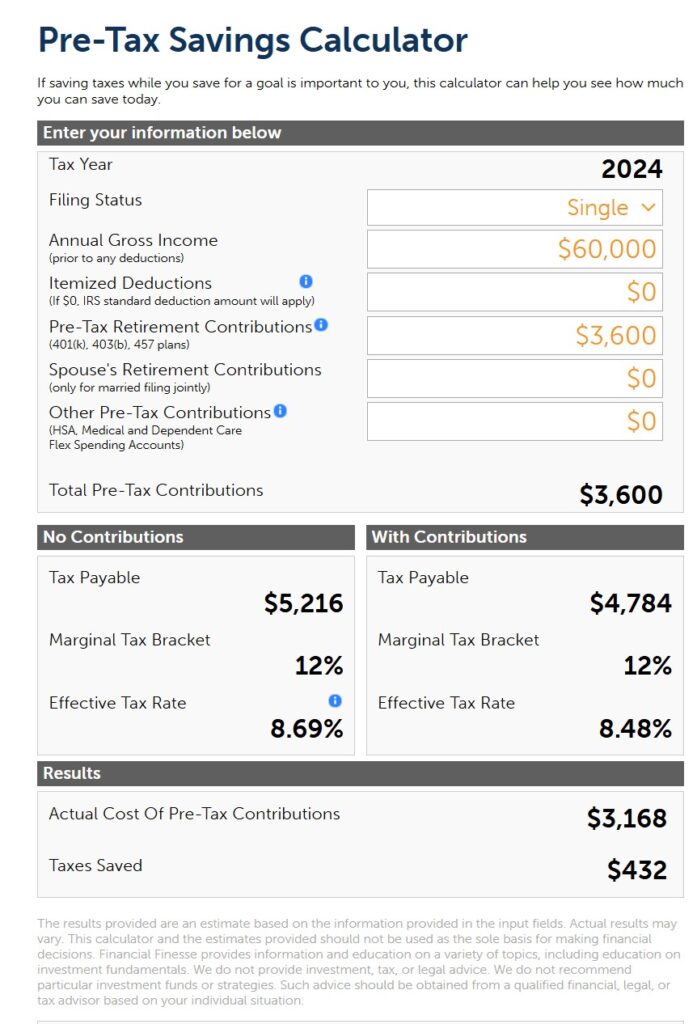

Contributing to a 401(k) using pre-tax dollars significantly lowers the actual cost of your contributions due to tax savings. For example, if you earn $60,000 annually and contribute $3,600 to your 401(k), your taxable income is reduced to $56,400, lowering the amount of federal taxes you owe. This reduction in taxable income results in immediate tax savings—$432 in this case—effectively reducing the real cost of your $3,600 contribution to just $3,168. By taking advantage of these pre-tax contributions, you can save for retirement while minimizing the impact on your take-home pay.

https://ffcalcs.com/pretax_savings

By contributing enough to receive the full employer match, you can effectively double a portion of your savings instantly, making it one of the smartest financial moves you can make early on.

Example: Sarah earns $60,000 annually, and her employer offers a 50% match on contributions up to 6% of her salary. If Sarah contributes $3,600 (6%), her employer adds $1,800, giving her $5,400 in total annual contributions.

• Takeaway: Not contributing enough to receive the full match is like leaving part of your salary behind.

2. Contributions in an Individual Retirement Account (IRA)

In addition to contributing consistently to your employer-sponsored retirement plan, opening a Roth IRA can provide significant benefits, especially when it comes to diversifying the tax impact in retirement. Unlike 401(k) contributions, which are pre-tax, Roth IRA contributions are made with after-tax dollars, allowing your investments to grow tax-free and enabling tax-free withdrawals in retirement. This tax diversification can be a game-changer, as it provides flexibility to manage your tax liability in retirement. Furthermore, Roth IRAs often offer a wider range of investment options compared to employer-sponsored plans, giving you more control over how your money is invested. By consistently contributing to both a 401(k) and a Roth IRA, you can maximize your retirement savings while balancing your current tax savings and future tax-free income.

3. Commit to Consistent Investing

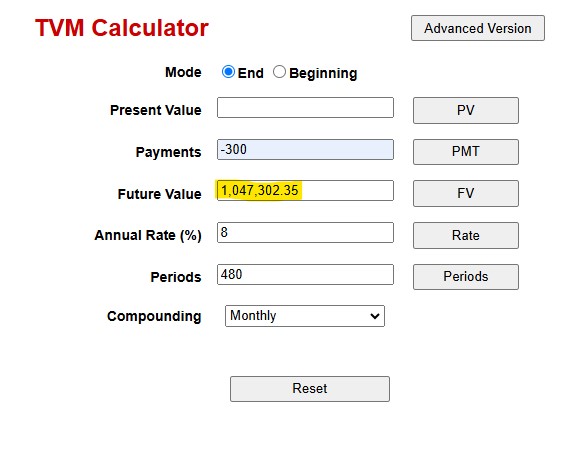

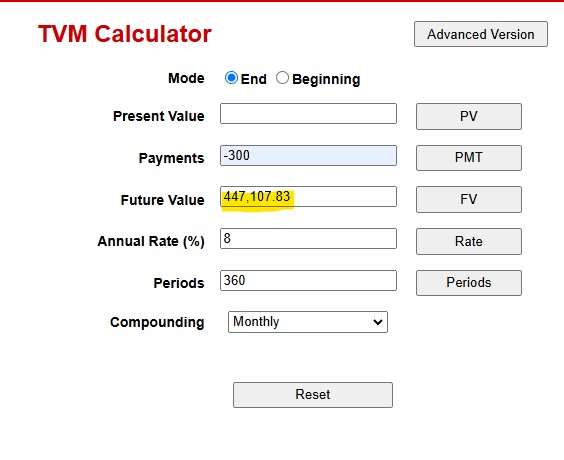

Example: John starts investing $300 in an IRA account per month at age 25 in a retirement account earning an average 8% annual return. By age 65, he has nearly $1,000,000. If he starts at 35, the same monthly contribution only grows to about $445,000.

$300 a month at 8% for 40 years

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

$300 a month at 8% in 30 years

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

• Takeaway: Consistency and starting early harness the power of compounding to grow wealth exponentially.

4. Reinvest Dividends for Compounding Growth

Dividend reinvestment is a powerful strategy that allows investors to use dividends earned from stocks or funds to purchase additional shares, instead of taking the cash. This approach enables the investor to benefit from compounding growth over time, as reinvested dividends generate their own returns.

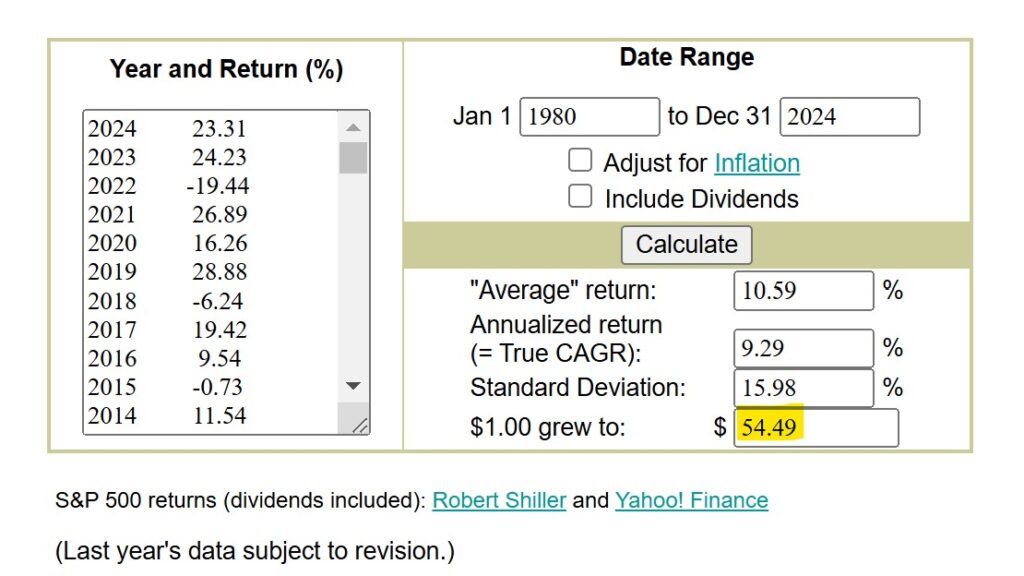

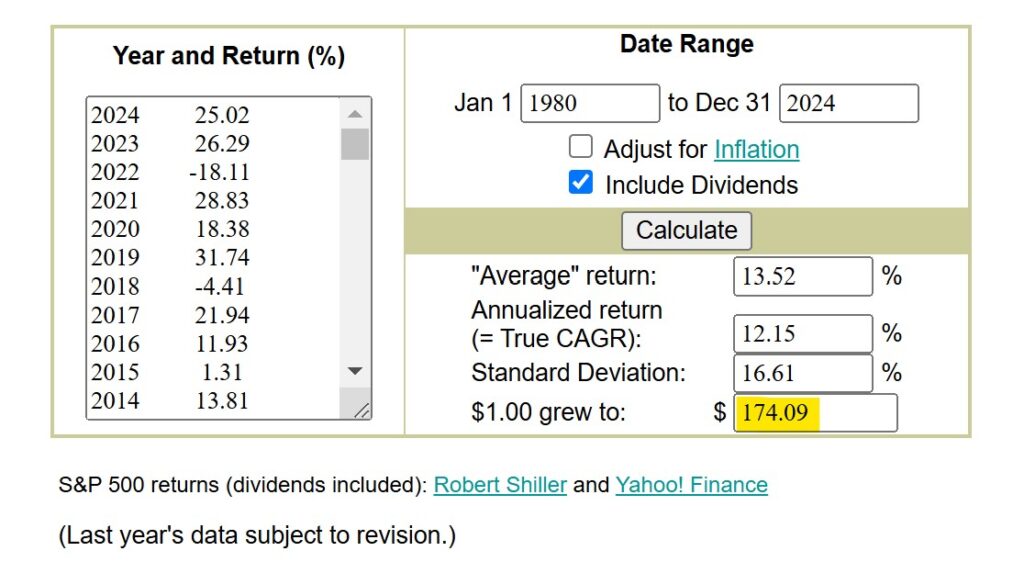

Example: Growth of $1 in S&P 500 Index with and without dividend reinvestment

Over the period from 1980 to 2024, the growth of $1 invested in the S&P 500 demonstrates the significant impact of dividends on long-term returns. Without reinvesting dividends, $1 grew to $54.49, reflecting the price appreciation of the index alone. However, when dividends were reinvested, the same $1 grew to an impressive $174.09, highlighting the power of compounding returns through dividend reinvestment. This stark difference underscores the critical role dividends play in maximizing investment growth over time.

Source: http://www.moneychimp.com/features/market_cagr.htm

• Takeaway: Reinvesting dividends accelerates growth over the long term.

5. Stay Invested for the Long Term

Remaining invested through market fluctuations is essential for maximizing long-term growth. Market timing—trying to predict and capitalize on short-term market movements—can significantly reduce returns and increase risk. By staying invested, you allow your portfolio to recover from downturns and benefit from periods of strong growth, ensuring steady progress toward your financial goals. Patience and consistency are key to leveraging the full potential of the market over time.

• Takeaway: Market timing is risky. Staying invested through market ups and downs ensures you benefit from long-term growth.

6. Rebalance Your Portfolio Regularly

Example: David’s portfolio was initially 60% stocks and 40% bonds. After a strong year for stocks, his allocation shifted to 70% stocks and 30% bonds. Rebalancing back to 60/40 protects David from taking on more risk than he intended.

• Takeaway: Rebalancing helps maintain your desired risk-reward profile and ensures diversification.

Additional Strategies for a Secure Retirement

1. Automate Savings

• Set up automatic contributions to your retirement account to ensure you’re consistently saving without the temptation to spend.

2. Diversify Investments

• A well-diversified portfolio, including stocks, bonds, and other assets, reduces risk and improves the likelihood of steady returns over time.

• Example: A portfolio with 70% stocks and 30% bonds might be ideal for someone in their 30s, but a retiree might shift to 50% stocks and 50% bonds to reduce risk.

3. Plan for Healthcare Costs

• According to Fidelity, a 65-year-old couple retiring today can expect to spend over $300,000 on healthcare costs in retirement. Investing in an HSA (Health Savings Account) can help.

• Example: With an HSA, you can save tax-free for medical expenses. If you contribute $8,550 annually (family limit in 2025) and invest the funds, you could have a significant tax-free healthcare fund by retirement.

The Power of Starting Now

It’s easy to feel overwhelmed by retirement planning, but small steps today make a big difference tomorrow.

• Start Small but Stay Consistent: Even $50 or $100 per month adds up over time.

• Review Your Plan Annually: Check your contributions, portfolio, and retirement goals to stay on track.

• Seek Professional Guidance: A financial advisor can provide tailored advice and help optimize your plan.

The Importance of Financial Education

Understanding the principles of investing and personal finance is a crucial step toward building long-term wealth. Financial education empowers individuals to make informed decisions, avoid common pitfalls, and develop strategies aligned with their goals. Whether it’s learning about the benefits of staying invested, the power of dividend reinvestment, or the risks of market timing, financial literacy provides the confidence and knowledge needed to navigate the complexities of the financial world. By prioritizing financial education, individuals can create a solid foundation for achieving financial security and independence.

By taking these steps, you can bridge the gap between retirement expectations and reality. Whether you’re 25, 45, or 55, it’s never too early—or too late—to start building a secure financial future.

Remember, retirement isn’t just a dream—it’s a goal you can achieve with intentional planning and action.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.