Achieving a seven-figure net worth may seem like a distant dream, but with discipline, strategy, and consistency, it’s well within your reach. Whether you’re starting from scratch or looking to grow your existing wealth, these seven steps will set you on the path to financial success.

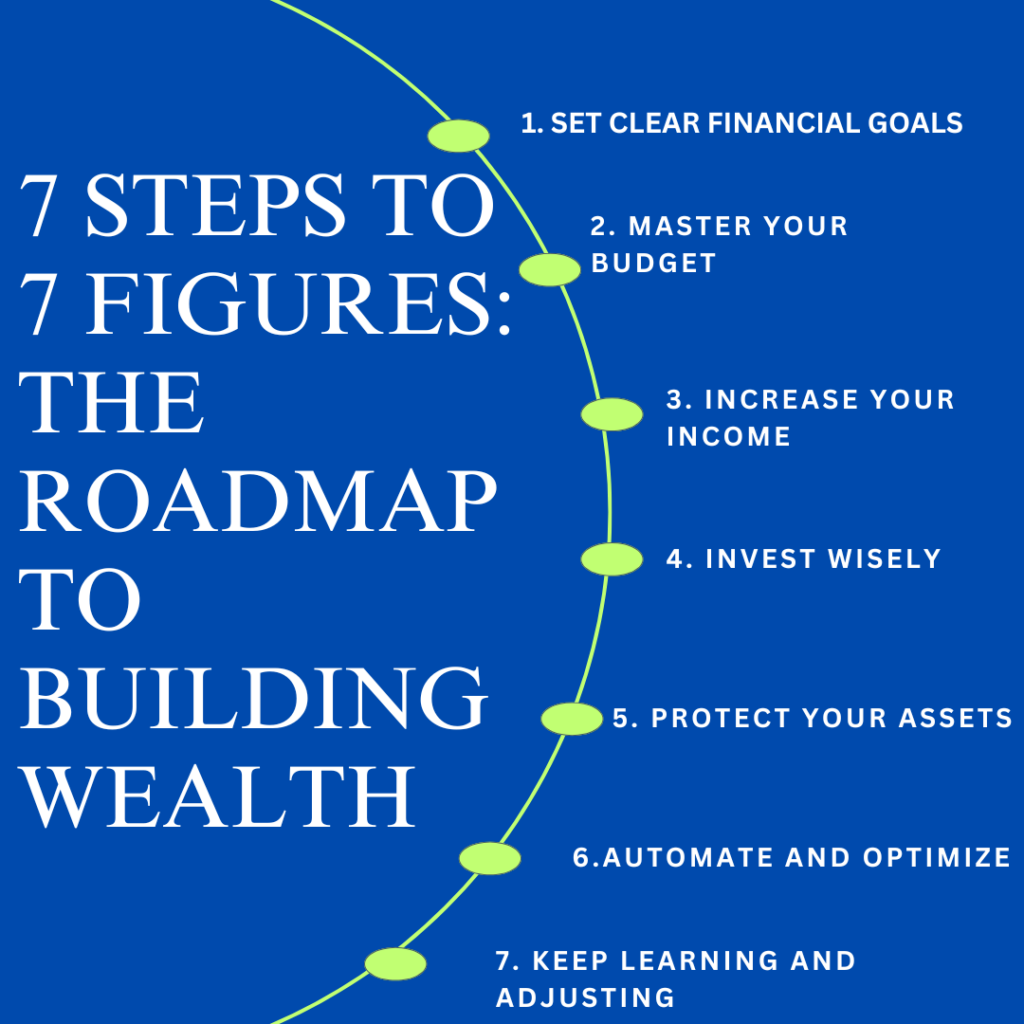

Step 1: Set Clear Financial Goals

Before embarking on your journey, define what “7 figures” means to you. Are you aiming for $1 million in liquid assets, investments, or total net worth? Break down your goal into smaller, actionable steps. For instance:

• Save your first $10,000 within 6 months.

• Invest to grow your wealth by 10% annually.

A clear vision keeps you motivated and focused.

Step 2: Master Your Budget

Building wealth starts with mastering cash flow. Create a budget to track income and expenses. Follow the 50/30/20 rule:

• 50% for necessities (rent, utilities, groceries)

• 30% for wants (entertainment, dining out)

• 20% for savings and investments

Live below your means, and direct any extra funds toward investments.

Step 3: Increase Your Income

Relying on a single income stream slows your progress. Diversify your earnings through:

• Side hustles (freelancing, tutoring, or online businesses)

• Passive income (real estate rentals, dividends, or royalties)

• Career advancement (upskilling, promotions, or changing jobs for higher pay)

Remember, every additional dollar earned can be invested to compound your wealth.

Step 4: Invest Wisely

Saving alone won’t get you to seven figures—investing will. Start early and harness the power of compound interest. Consider:

• Stocks and Index Funds: Average annual returns of 7-10% over time.

• Real Estate: Rental properties or REITs for long-term appreciation and cash flow.

• Business Investments: Entrepreneurship or investing in others’ businesses for potentially high returns.

Pro tip: Use tax-advantaged accounts like 401(k)s, IRAs, or HSAs to grow your wealth faster while minimizing taxes.

Step 5: Protect Your Assets

Building wealth is half the battle—protecting it is equally critical. Safeguard your financial future by:

• Creating an emergency fund (3-6 months of expenses)

• Getting adequate insurance (health, life, and liability coverage)

• Diversifying investments to reduce risk

Financial security ensures you can weather life’s uncertainties without derailing your progress.

Step 6: Automate and Optimize

Remove human error by automating savings and investments. Set up:

• Direct deposits into savings or investment accounts

• Automatic contributions to retirement funds

• Recurring debt payments to avoid penalties

Automation ensures consistency and keeps your finances on track.

Step 7: Keep Learning and Adjusting

Markets change, and so do financial strategies. Commit to lifelong learning by:

• Reading books on personal finance (e.g., The Millionaire Next Door)

• Attending workshops and seminars

• Following experts and staying informed on market trends

Be flexible. As your wealth grows, your strategy should evolve to align with your goals.

Final Thoughts

Reaching 7 figures takes time, patience, and persistence. The earlier you start, the better your results, thanks to the magic of compounding. Stick to these steps, track your progress, and celebrate milestones along the way.

Your journey to 7 figures starts now. What’s your next move?

Share your thoughts and goals in the comments below.

Your Mantra for Success: Save Consistently. Invest Smartly. Retire Richly.

Legal Disclaimer for Build Wealth Retire Rich Blog/Website

The information provided on the “Build Wealth Retire Rich” blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, Build Wealth Retire Rich and its contributors, including AI tools used in the creation of some content, do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

Build Wealth Retire Rich is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on “Build Wealth Retire Rich” are those of the authors and do not necessarily reflect the views of the website’s owner or any affiliated institutions. “Build Wealth Retire Rich” does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that Build Wealth Retire Rich and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.