Building wealth is less about luck and more about disciplined strategies that stand the test of time. Wealthy individuals often follow key principles to ensure their money grows steadily, minimizing risks while maximizing returns. Here are seven proven strategies that can help you on your journey to financial success, along with additional tips to make the most of your investments.

1. Leverage the Power of Compound Interest

Compound interest is often referred to as the eighth wonder of the world for a reason—it allows your money to grow exponentially over time. The earlier you start investing, the more time your money has to grow.

With compound interest, your investments generate earnings, and those earnings are reinvested to create even more earnings. This snowball effect can turn small, consistent contributions into significant wealth over decades.

Example:

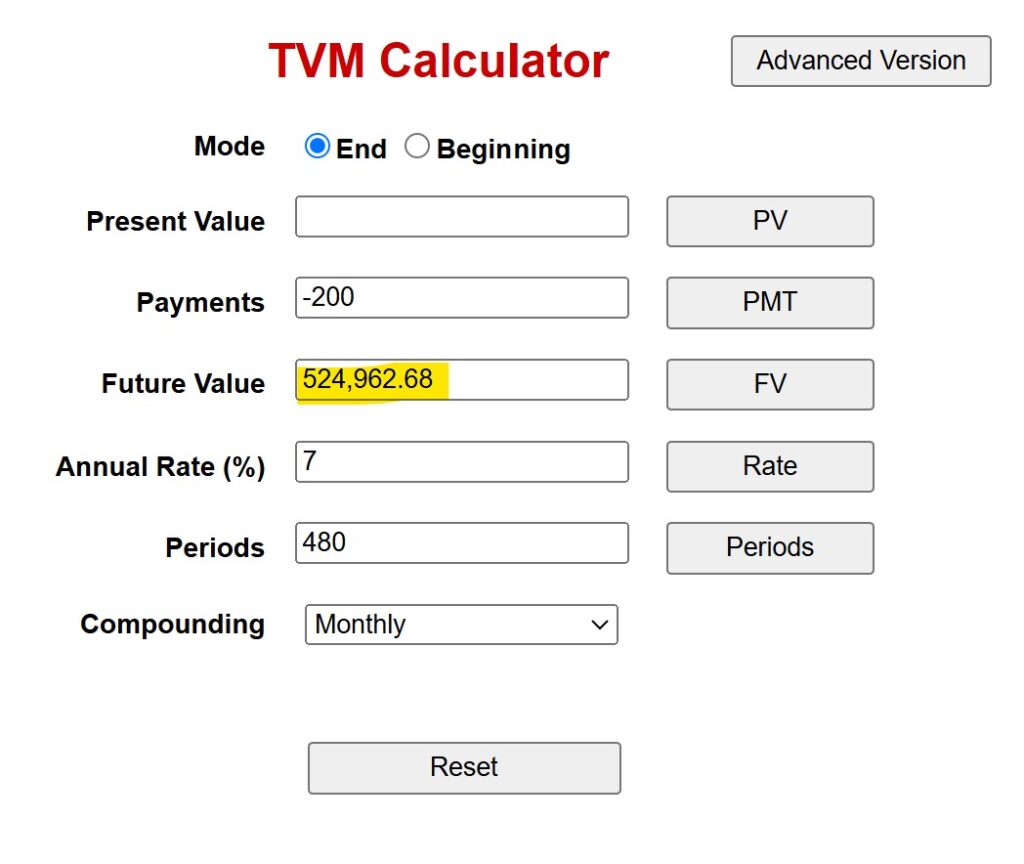

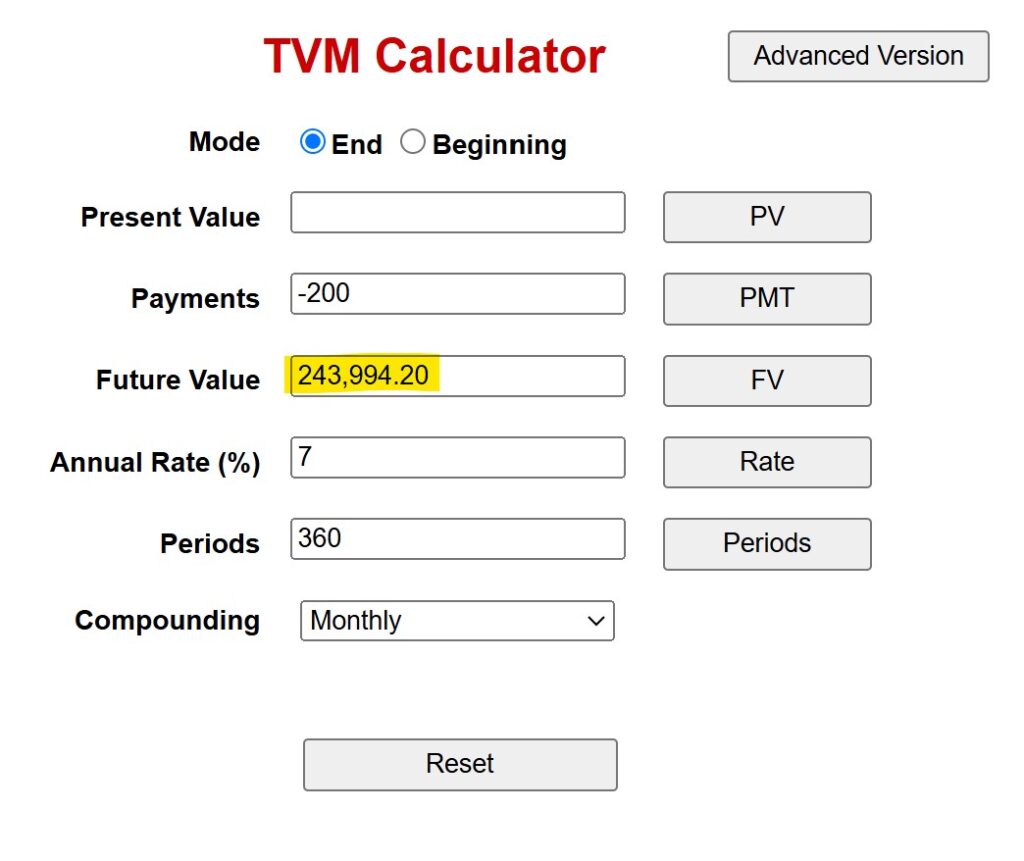

If you invest $200 a month starting at age 25 with an average annual return of 7%, you’ll have over $524,000 by age 65. Start at age 35, and the same contributions grow to only about $243,000. Time is your biggest asset.

Investing for 40 years (480 months)

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Investing for 30 years (360 months)

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Bonus Tip: Before starting your investment journey, ensure you have an emergency fund covering 3-6 months of expenses. This safety net protects your investments from being liquidated for unexpected costs.

2. Use Dollar-Cost Averaging with Recurring Investments

Wealthy investors know the value of consistency. Dollar-cost averaging (DCA) involves investing a fixed amount at regular intervals, regardless of market conditions. This strategy helps you avoid trying to time the market—a notoriously difficult task—and takes advantage of market fluctuations.

Setting up a recurring investment plan automates this process, ensuring you stay consistent and build wealth over time.

Example:

If you invest $500 monthly into a diversified stock index fund, you’ll buy more shares during market dips and fewer during market highs, lowering your average cost per share over the long run.

Bonus Tip: Start small if needed. Even $50-$100 per month invested consistently can grow into a substantial sum over time.

3. Maximize Employer Matching Contributions

If your employer offers a matching contribution to your 401(k) or similar retirement plan, take full advantage. Employer matching is essentially free money added to your retirement savings, instantly boosting your investment returns.

Failing to contribute enough to receive the full match is like leaving money on the table. Wealthy individuals understand the value of these contributions and make it a priority to maximize them.

Example:

If your employer matches 100% of your contributions up to 5% of your salary and you earn $60,000 annually, contributing $3,000 means you’ll receive an additional $3,000 from your employer. That’s a 100% return on your contribution before any investment growth.

4. Invest in Tax-Advantaged Accounts

Tax-advantaged accounts like 401(k)s, IRAs, and HSAs play a critical role in wealth building. These accounts reduce your tax burden, allowing your investments to grow more efficiently.

- Traditional Accounts: Contributions are tax-deductible, and your investments grow tax-deferred until withdrawal.

- Roth Accounts: Contributions are made with after-tax dollars, but withdrawals (including growth) are tax-free in retirement.

Wealthy individuals strategically use these accounts to optimize their tax liability and boost long-term returns.

Pro Tip:

If you’re self-employed, explore options like a Solo 401(k) or SEP IRA to take advantage of higher contribution limits and tax benefits.

5. Diversify Your Investments

Diversification is a fundamental principle of risk management. By spreading investments across different asset classes (e.g., stocks, bonds, real estate) and sectors, wealthy individuals protect their portfolios from significant losses during market downturns.

Diversification ensures that no single investment’s poor performance will severely impact your overall portfolio.

Example:

A portfolio with a mix of 60% stocks, 30% bonds, and 10% real estate can balance growth potential and risk, providing steadier returns over time.

Bonus Tip: Regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and goals. This disciplined approach keeps your portfolio optimized for growth.

6. Avoid Emotional Investing

Successful investors know how to keep emotions out of their decisions. Market volatility can tempt you to sell during downturns or chase high-performing stocks, but these emotional moves often lead to losses.

Pro Tip:

Stay the course and remember Warren Buffett’s advice: “Be fearful when others are greedy, and greedy when others are fearful.”

7. Invest in Financial Education

Wealthy individuals continually expand their knowledge about investing. The more you understand financial markets, investment strategies, and tax laws, the better equipped you’ll be to make informed decisions.

Pro Tip:

Dedicate time to learning about personal finance through books, courses, or trusted online resources. A well-informed investor is a confident and successful one.

Conclusion

These strategies—harnessing compound interest, leveraging dollar-cost averaging, maximizing employer matching contributions, using tax-advantaged accounts, diversifying your portfolio, and maintaining emotional discipline—are the foundation of wealth-building success.

Additionally, by prioritizing an emergency fund, consistently rebalancing your portfolio, and investing in financial education, you’ll have a comprehensive approach to building and preserving wealth.

Building wealth is a marathon, not a sprint. Stay disciplined, focus on long-term goals, and let time work its magic. The steps you take today will shape your financial future.

Which of these strategies are you using, or which ones will you start today? Let us know in the comments!

Our Newsletter Can Help You Build Wealth and Retire Rich!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich newsletter to receive weekly updates packed with personal finance strategies and insights that are delivered straight to your inbox!

Sign up for our free newsletter!

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.