Building wealth requires intentional habits and thoughtful financial decisions. Sometimes, behaviors that seem harmless can significantly hinder progress toward financial freedom. Let’s explore these habits and how to replace them with wealth-building strategies, along with real-world examples.

Focusing on Income Instead of Net Worth

It’s easy to assume that earning a higher salary guarantees financial security. However, research reveals that even households with six-figure incomes often find themselves living paycheck to paycheck. According to a Bank of America analysis, nearly 20% of U.S. households earning over $150,000 dedicate more than 95% of their income to necessities like housing, child care, and utilities. This highlights how high incomes alone don’t translate to wealth.

Example:

Consider a household earning $160,000 annually but living in an expensive city with a high mortgage, significant child care costs, and rising utility bills. Despite their income, they have little room for savings or investments because their spending is stretched across necessities and lifestyle inflation.

The Problem with Overspending:

Higher earners often purchase larger homes with higher property taxes and utility bills, taking on bigger mortgages with the expectation of future promotions or raises. Inflation further exacerbates this issue by increasing the cost of essentials, leaving many households financially strained despite their income levels.

What to Do Instead:

Shift your focus from earning more to saving and growing your net worth. For instance:

- Downsize Lifestyle Choices: Instead of a luxury home, choose a property that meets your needs without overextending your budget.

- Prioritize Savings: Allocate a percentage of your income to savings and investments first, treating them as non-negotiable expenses.

- Reassess Necessities: Evaluate if your spending on essentials, such as private child care or high-end internet packages, can be optimized for savings.

By adopting these strategies, you can ensure that your income contributes to long-term financial growth instead of just covering immediate needs.

2. Keeping Money Idle

Allowing your money to sit in a low-interest savings account can cost you opportunities for growth, especially in the face of inflation. Even a modest improvement in interest rates can make a significant difference over time.

High-Yield Savings Account vs. Regular Savings Account Example:

Imagine you have $10,000 in a traditional savings account earning 0.05% interest. After one year, you’ll earn just $5. But if you move the same amount to a high-yield savings account earning 4%, you’ll earn $400 in the same period.

Real-Life Example:

John switched his emergency fund from a regular savings account at a big bank to a high-yield savings account offered by an online bank. Over three years, he earned $1,200 in interest instead of the $15 he would have received otherwise.

What to Do Instead:

Look for high-yield savings accounts to store your emergency fund. Ensure these accounts are FDIC-insured for security and aim for institutions offering competitive rates. Use savings comparison websites to find the best option.

3. Overlooking Small, Daily Expenses

Small, recurring expenses can add up to a significant drain on your finances over time. Many people underestimate the impact of their daily spending habits.

Example:

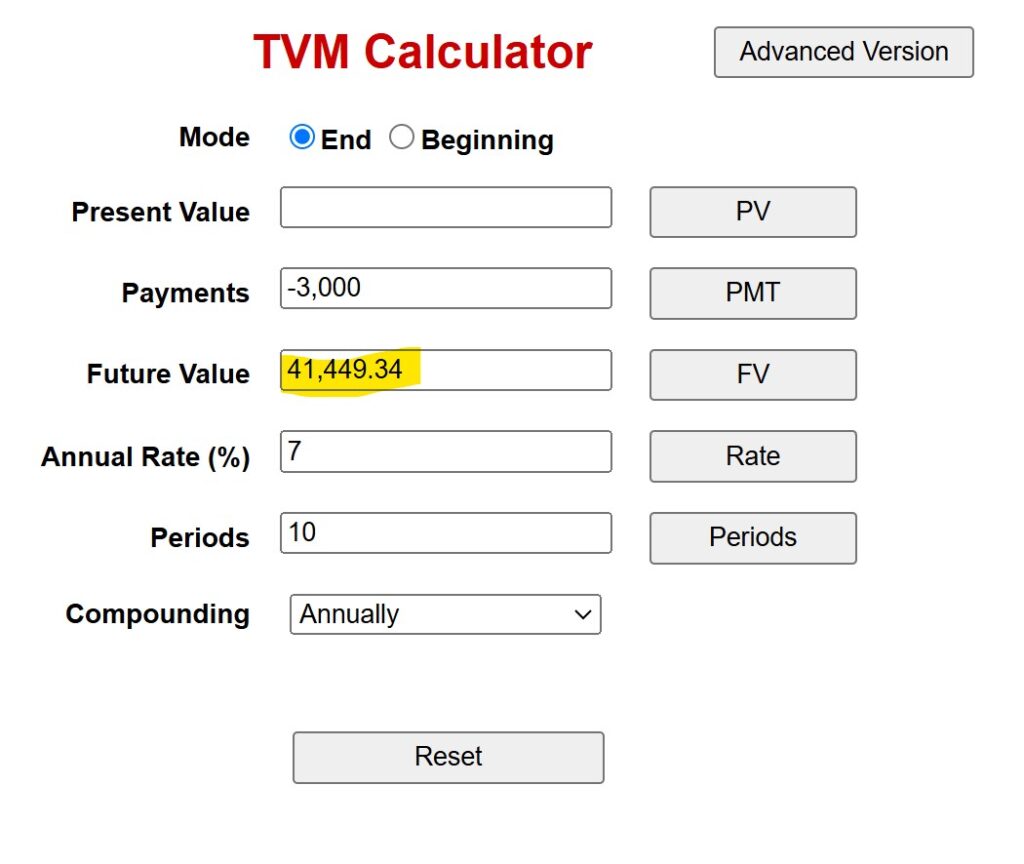

Emma spends $5 on coffee every weekday and $15 on lunch. Over a year, this adds up to $5,200. By making coffee at home and bringing lunch a few times a week, she saves $3,000 annually, which she invests in a diversified index fund. After 10 years, her savings grow to $41,449, assuming a 7% annual return.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

What to Do Instead:

Conduct a spending audit to identify areas where you can cut back. Budgeting Apps can help track expenses and find savings opportunities. Redirect these savings into investments or a high-yield savings account.

4. Procrastinating on Financial Goals

Delaying financial decisions can lead to missed opportunities. Whether it’s starting an investment account, creating a budget, or paying off debt, waiting often results in smaller returns or higher costs.

Example:

Let’s compare two individuals: Sam and Chris. Both plan to retire at age 65 and invest in an account that earns 7% annual interest.

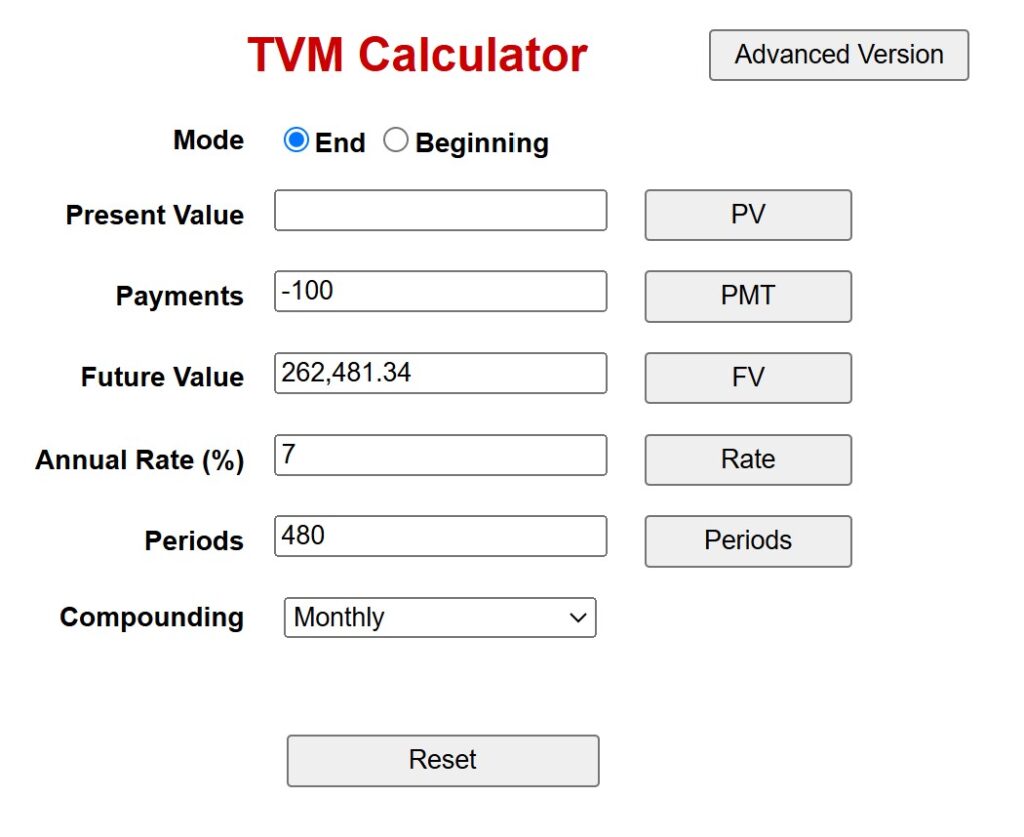

- Sam starts saving $100 per month at age 25 and saves for 40 years.

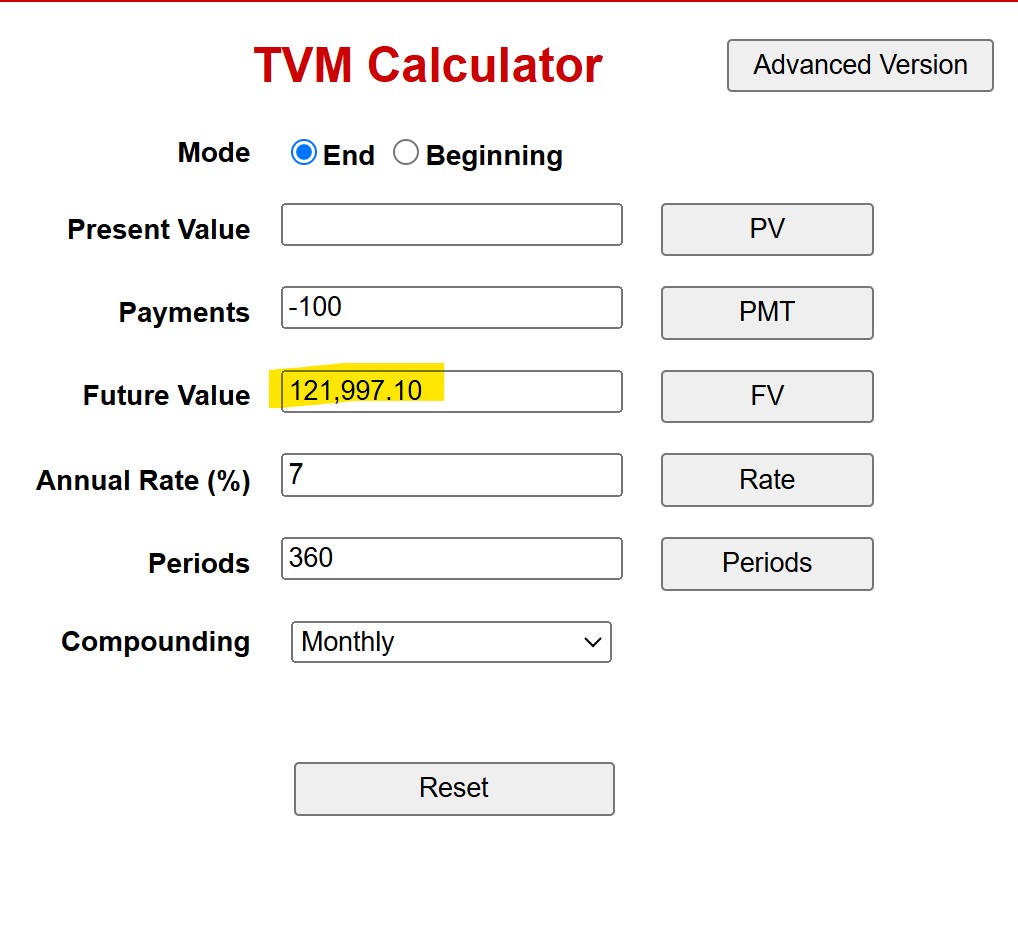

- Chris starts saving $100 per month at age 35 and saves for 30 years.

Growth with Compound Interest:

Using a 7% annual return:

Sam’s savings at age 65:

After saving $100 per month for 40 years at a 7% annual interest rate, Sam’s total savings grow to approximately $262,481.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Chris’s savings at age 65:

After saving $100 per month for 30 years at the same rate, Chris’s total savings grow to approximately $121,997.

https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Key Takeaways:

- Sam contributed only $12,000 more than Chris but ended up with twice as much due to starting earlier.

- The extra 10 years of saving and compounding significantly boosted Sam’s final savings.

- Starting early allows your money more time to grow, even with smaller contributions.

The earlier you start, the easier it becomes to achieve your financial goals!

What to Do Instead:

Set clear financial goals with specific deadlines. Use tools like financial calculators to understand the impact of starting early, and automate contributions to savings or investment accounts to ensure consistent progress.

5. Avoiding Conversations About Money

Many people avoid discussing finances due to discomfort or lack of knowledge. However, avoiding these conversations can lead to missed opportunities, misunderstandings, or financial mistakes.

Example:

Tom never discussed salary negotiation with his peers, assuming his offer was standard. When he finally asked around, he discovered that others in similar roles were earning 20% more. Armed with this knowledge, he negotiated a raise that significantly boosted his income and savings potential.

What to Do Instead:

Engage in open conversations about money with trusted friends, family, or professionals. Seek advice on investments, budgeting, or salary negotiations. Join communities or forums where people share financial insights to expand your knowledge and perspective.

The Path to Financial Freedom

Building wealth isn’t about perfection—it’s about consistent, intentional actions. By addressing these everyday habits, you can take control of your financial future and achieve long-term success.

Which habit are you ready to tackle today? Let us know in the comments below!

Our Newsletter Can Help You Build Wealth and Retire Rich!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich newsletter to receive weekly updates packed with personal finance strategies and insights that are delivered straight to your inbox!

Sign up for our free newsletter!

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.