Retirement planning is a critical part of financial wellness, yet it often seems complicated. However, building a solid retirement nest egg doesn’t require a master’s degree in finance or hours of stock market analysis. Instead, you can create a reliable and growing retirement fund by following a straightforward three-step process: opening a Roth IRA, picking low-cost index funds, and setting up a recurring investment plan to take advantage of compound interest and dollar cost averaging. Additionally, reinvesting dividends can further accelerate your wealth-building efforts.

Let’s dive into each step and explore how they work together to secure your financial future.

Step 1: Open a Roth IRA Account

What is a Roth IRA?

A Roth Individual Retirement Account (IRA) is a retirement savings account that offers unique tax advantages. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t receive a tax deduction when you contribute. However, the significant benefit is that your investments grow tax-free, and qualified withdrawals during retirement are also tax-free.

Why Choose a Roth IRA?

- Tax-Free Growth and Withdrawals: The primary advantage of a Roth IRA is the ability to grow your investments without being taxed on the gains. When you reach retirement age, you can withdraw the money tax-free, provided certain conditions are met.

- Flexibility: Roth IRAs offer more flexibility in terms of withdrawal rules. Unlike traditional IRAs, you can withdraw your contributions (not the earnings) at any time without penalties or taxes.

- No Required Minimum Distributions (RMDs): Traditional IRAs require you to start taking distributions at age 73, but Roth IRAs do not have RMDs during your lifetime, allowing your investments to continue growing tax-free for as long as you live.

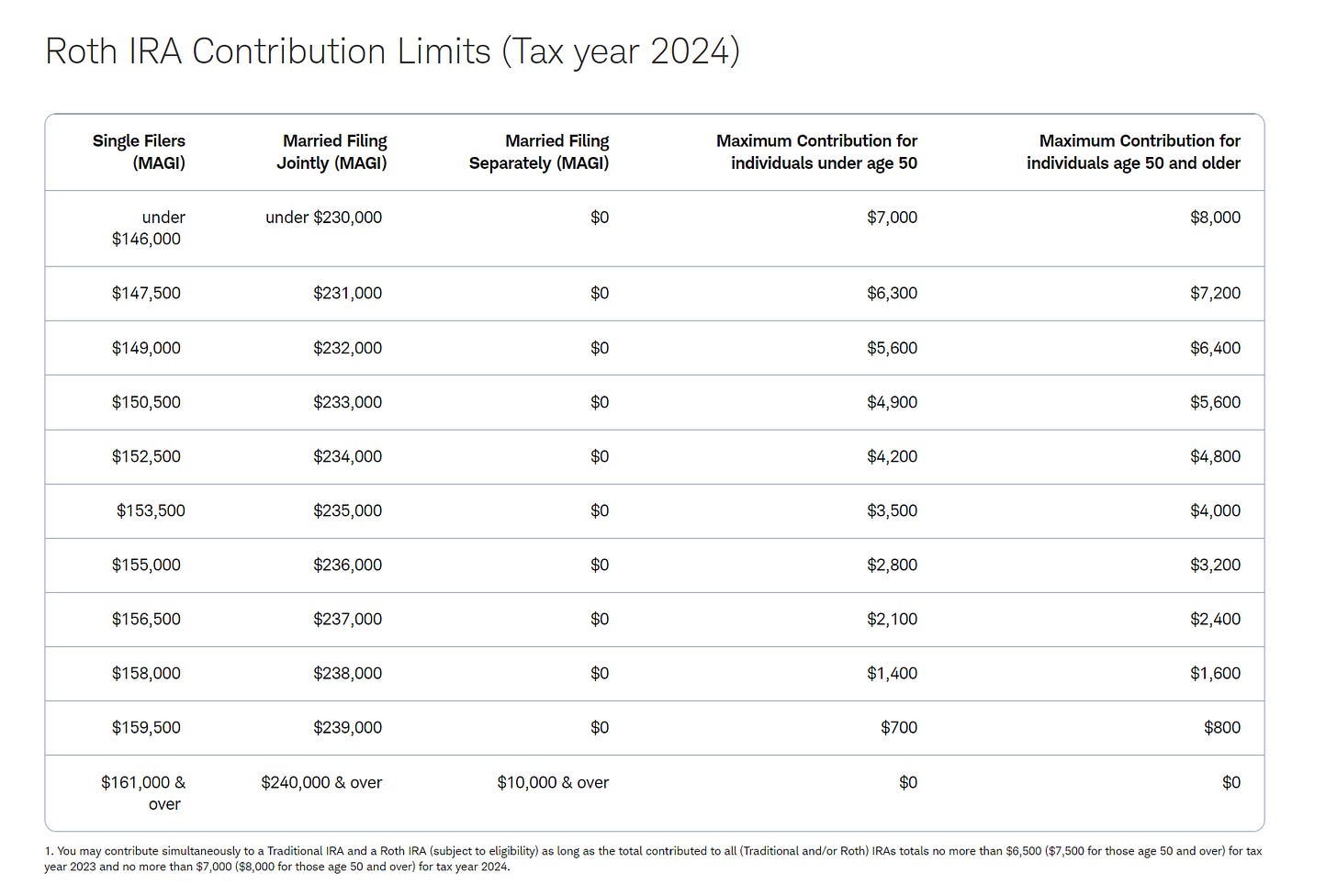

Income Eligibility for a Roth IRA

While Roth IRAs offer significant advantages, not everyone is eligible to contribute directly due to income restrictions. Understanding these limits is crucial to determine if you can take advantage of a Roth IRA or if you need to consider alternative strategies.

Source: https://www.schwab.com/ira/roth-ira/contribution-limits#:~:text=Tax%20Year%202024%20%2D%20%247%2C000%20if,re%20age%2050%20or%20older.

Backdoor Roth IRA

If your income exceeds the Roth IRA limits, you can still contribute to a Roth IRA indirectly through a strategy known as the “Backdoor Roth IRA.” This involves making a non-deductible contribution to a Traditional IRA and then converting it to a Roth IRA. While this method can be beneficial, it’s essential to be aware of potential tax implications and consult with a financial advisor to ensure it aligns with your financial situation.

How to Open a Roth IRA

Opening a Roth IRA is a straightforward process:

- Choose a Provider: Select a financial institution that offers Roth IRAs. Consider factors like fees, investment options, and customer service. Popular providers include Vanguard, Fidelity, and Charles Schwab.

- Complete the Application: Provide personal information such as your Social Security number, employment details, and beneficiary information.

- Fund Your Account: You can start with an initial deposit and set up automatic contributions from your bank account. For 2024, the maximum contribution limit is $7,000 per year ($8,000 if you’re 50 or older).

- Select Your Investments: Once your account is funded, you can choose where to invest your money. This leads us to the next crucial step.

Step 2: Pick Low-Cost Index Funds

What are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific market index, such as the S&P 500. Instead of actively managed portfolios, index funds passively track the index, holding all (or a representative sample) of the securities in that index.

Benefits of Low-Cost Index Funds

- Diversification: By investing in an index fund, you gain exposure to a broad range of companies across various sectors, reducing the risk associated with individual stocks.

- Low Fees: Index funds typically have lower expense ratios compared to actively managed funds because they don’t require extensive research or frequent trading. Lower fees mean more of your money stays invested and grows over time.

- Consistent Performance: While they may not outperform the market, index funds generally provide consistent returns that mirror the market’s performance, making them a reliable long-term investment.

- Simplicity: Managing a portfolio of index funds is straightforward, requiring less time and effort compared to selecting individual stocks or actively managed funds.

Choosing the Right Index Funds

When selecting index funds for your Roth IRA, consider the following:

- Expense Ratio: Look for funds with low expense ratios, ideally below 0.10%.

- Diversification: Ensure the fund covers a broad spectrum of the market. Funds that track the S&P 500, total stock market, or international markets can provide comprehensive diversification.

- Tracking Error: This measures how closely the fund follows its benchmark index. Lower tracking errors indicate better performance in mirroring the index.

- Fund Size and Liquidity: Larger funds with higher trading volumes tend to have better liquidity, making it easier to buy and sell shares without significant price fluctuations.

Step 3: Set a Recurring Investment Plan

The Power of Compounding

Compounding is the process where the earnings on your investments generate their own earnings. Over time, this can lead to exponential growth in your investment portfolio. By consistently investing, you allow your money to grow not just on the initial contributions but also on the accumulated earnings.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach reduces the impact of market volatility by spreading out your investment over time, potentially lowering the average cost per share.

How to Implement a Recurring Investment Plan

- Automate Contributions: Set up automatic transfers from your bank account to your Roth IRA. Automating your investments ensures consistency and removes the temptation to time the market.

- Determine Contribution Amount: Decide how much you can comfortably invest each month. Even small, regular contributions can add up significantly over time.

- Reinvest Dividends: Ensure that any dividends paid by your index funds are automatically reinvested. Reinvesting dividends accelerates the compounding process, as dividends purchase additional shares that can generate their own earnings.

- Monitor and Adjust: Periodically review your investment plan to ensure it aligns with your retirement goals. Adjust your contributions or investment choices as needed, especially as your financial situation or market conditions change.

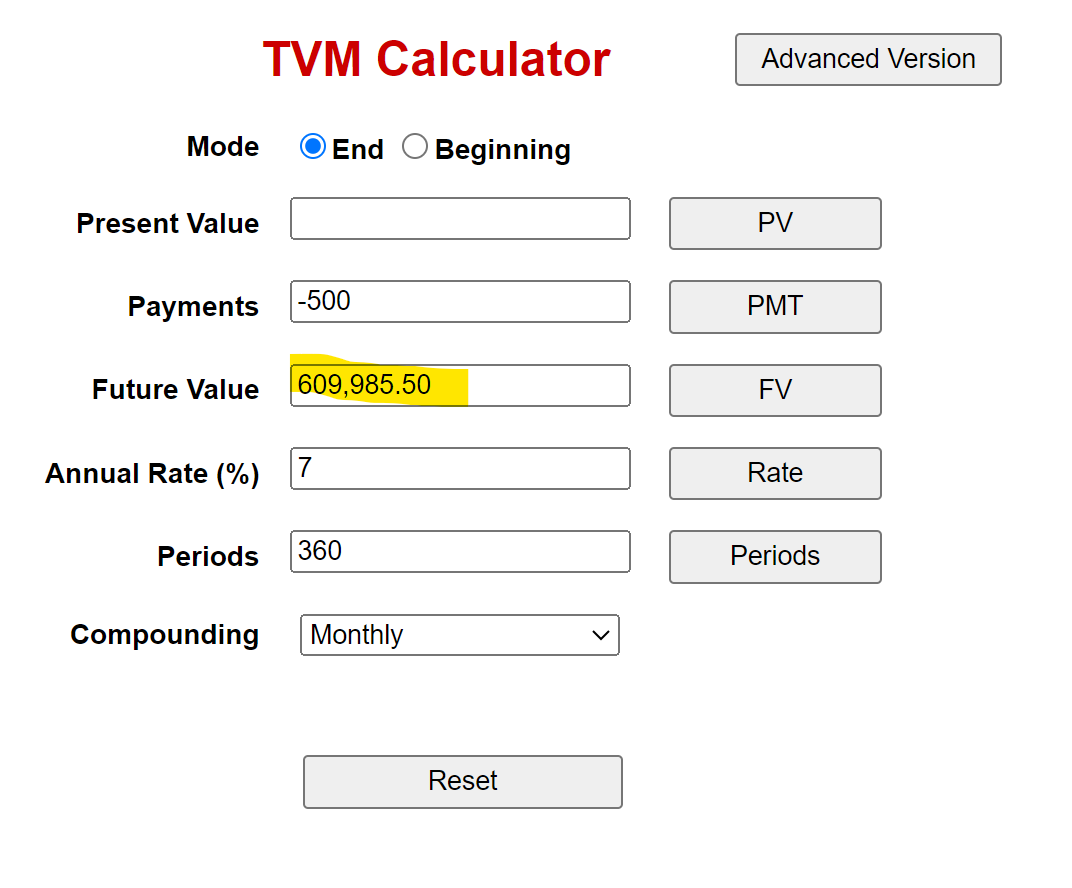

Example of a Recurring Investment Plan

Let’s say you contribute $500 monthly to your Roth IRA, invested in a low-cost index fund with an average annual return of 7%. Over 30 years, your investments would grow to approximately $600,000, thanks to the power of compounding and consistent contributions. If you start early and increase your contributions over time, the potential for growth becomes even more substantial.

Calculator source: https://www.fncalculator.com/financialcalculator?type=tvmCalculator

Reinforcing the Strategy: Reinvesting Dividends

Dividends are portions of a company’s earnings distributed to shareholders. Reinvesting dividends means using these payouts to purchase additional shares of the fund, rather than taking them as cash. This practice enhances the compounding effect, as each dividend payment contributes to buying more shares that can generate future dividends and capital gains.

Benefits of Reinvesting Dividends

- Enhanced Growth: Reinvested dividends buy more shares, increasing your ownership in the fund and amplifying potential future returns.

- Cost Efficiency: Reinvesting dividends automatically allows you to take advantage of buying additional shares without incurring transaction fees, especially if your provider offers free reinvestment options.

- Time Efficiency: Automated dividend reinvestment saves you the time and effort of manually reinvesting, ensuring that your investments continue to grow seamlessly.

How to Reinvest Dividends

Most brokerage accounts offer an automatic dividend reinvestment option. To enable this:

- Log into Your Account: Access your Roth IRA account through your provider’s website or mobile app.

- Navigate to Dividend Settings: Look for settings related to dividends or income distribution.

- Select Reinvest Dividends: Choose the option to automatically reinvest dividends into the same fund or another fund of your choice.

- Confirm Your Selection: Save your settings to ensure that dividends are reinvested automatically.

Putting It All Together

Building retirement wealth is a marathon, not a sprint. By following these three steps—opening a Roth IRA, selecting low-cost index funds, and setting up a recurring investment plan—you establish a solid foundation for long-term financial security. Reinvesting dividends further accelerates your wealth-building journey by leveraging the full potential of compound interest and dollar-cost averaging.

Additional Tips for Success

- Start Early: The sooner you begin investing, the more time your money has to grow through compounding. Even small contributions made early can lead to significant wealth over decades.

- Stay Consistent: Regular contributions, regardless of market conditions, help smooth out the effects of volatility and keep your investment plan on track.

- Educate Yourself: Continuously educate yourself about investing and personal finance. Understanding how markets work and staying informed about economic trends can help you make informed decisions.

- Avoid Emotional Investing: Stick to your investment plan and avoid making impulsive decisions based on short-term market fluctuations. Staying disciplined is key to long-term success.

- Consult a Financial Advisor: If you’re unsure about any aspect of your investment strategy, consider consulting a financial advisor. They can provide personalized advice tailored to your specific financial situation and retirement goals.

Conclusion

Building retirement wealth may seem daunting, but by adhering to a simple three-step process, you can create a robust and effective investment strategy. Opening a Roth IRA provides a tax-advantaged vehicle for your savings. Selecting low-cost index funds ensures diversification and cost efficiency, while setting up a recurring investment plan leverages the power of compound interest and dollar-cost averaging. By reinvesting dividends, you maximize the growth potential of your investments.

Remember, the key to successful retirement planning is consistency and patience. Start today, stay committed to your plan, and watch your wealth grow over time. With thoughtful planning and disciplined investing, you can achieve a secure and comfortable retirement, enjoying the fruits of your labor without financial worries.

Legal Disclaimer:

The content shared on “Build Wealth Retire Rich” or “BWRR” is intended solely for informational and educational purposes and should not be construed as financial advice. It does not represent an offer, recommendation, or endorsement of any specific investment product or strategy. BWRR provides general insights and does not aim to offer personalized financial, legal, tax, or other professional advice. The owners of BWRR are not certified financial advisors. For guidance tailored to your unique situation, it is recommended that you consult with an independent financial advisor.

Our Newsletter Can Help You Build Wealth and Retire Rich!

Want actionable tips and expert advice to grow your wealth, save smarter, and retire comfortably? Sign up for the Build Wealth Retire Rich Newsletter to receive weekly updates packed with personal finance strategies and insights—delivered straight to your inbox!

Sign up for our free newsletter!

By submitting your information, you`re giving us permission to email you. You may unsubscribe at any time.